Are you confident in accurately reporting cryptocurrency earnings on your tax returns?

Three Cryptocurrency Bills Before the US Congress in 2019

As the US Congress examines cryptocurrency issues more closely, we analyzed three bills that aim to resolve some of the murky legal issues surrounding digital money.

July 16, 2019 · 5 min read

In April, a bipartisan group of 20 lawmakers asked the IRS agency to update its cryptocurrency tax guidance. In the coming weeks, the IRS is expected to provide further clarity on three issues: acceptable methods for calculating cost basis, acceptable methods of cost basis assignment, and the tax treatment of forks.

While the IRS mulls this, Congress has also begun to examine cryptocurrency issues more closely, and three bills have been proposed to resolve some of the murky legal issues surrounding digital money:

The Token Taxonomy Act - H.R. 2144

The Token Taxonomy Act was introduced April 9th, 2019 by Rep. Warren Davidson (R) and Darren Soto (D), and would exclude cryptocurrency from being classified as a security by amending the Securities Act of 1933 and the Securities Act of 1934. Additionally, it would allow cryptocurrency users to have a “de minimus exemption,” to make small purchases with cryptocurrency without being taxed on the capital gains.

"It is time for the United States to step up and lead in blockchain technology...This is an important step to promoting innovation and maximizing the potential of virtual currencies for the U.S. economy, all while protecting customers and the financial well-being of investors.”

- Rep. Darren Soto

Analysis: This legislation would create a separate definition for "digital tokens" and exclude these "digital tokens" from securities regulations. While ambitious, there may still be some ambiguity in how the bill defines "digital tokens." According to the bill, a "Digital Token" has 4 key properties:

(A) It is created:

(i) in response to the verification or collection of proposed transactions;

(ii) pursuant to rules for the digital unit’s creation and supply that cannot be altered by any single person or persons under common control; or

(iii) as an initial allocation of digital units that will otherwise be created in accordance with clause (i) or (ii);

(B) it has a transaction history that

(i) is recorded in a distributed, digital ledger or digital data structure in which consensus is achieved through a mathematically verifiable process; and

(ii) after consensus is reached, resists modification or tampering by any single person or group of persons under common control;

(C) it is capable of being transferred between persons without an intermediate custodian; and

(D) that is not a representation of a financial interest in a company or partnership, including an ownership interest or revenue share.

While on first glance this definition may appear broad, several elements seem to be designed to limit the definition specifically to decentralized projects like Bitcoin rather than centralized/permissioned projects (i.e. Facebook's Libra initiative). Specifically, Section B requires that the token "resists modification or tampering by any single person or group of persons under common control." While the bill may find support among some in the cryptocurrency community, this may cause it to run afoul of the organizations pushing centralized/permissioned initiatives and alternative efforts to create "security tokens" that explicitly comply with existing security regulations.

The Blockchain Regulatory Certainty Act - H.R. 528

The Blockchain Regulatory Certainty Act was introduced January 14th, 2019 by Rep. Tom Emmer (R), and would exempt blockchain developers and providers of blockchain services from certain licensing and registration requirements applied to money transmitters, money services businesses, and other financial brokers.

"The United States should prioritize accelerating the development of blockchain technology and create an environment that enables the American private sector to lead on innovation and further growth. These technologies hold untold promise for our economy and for all Americans.”

- Rep. Tom Emmer

Analysis: This bill would exclude blockchain companies and developers from a host of requirements that apply to traditional money services, transmitters, and financial brokers. While the bill's proponents argue that the legislation is necessary to alleviate the regulatory burden on blockchain companies in the US and spur innovation, it would be a stark contrast to recent efforts by US regulators. On July 15th, Treasury Secretary Steven Mnuchin made clear his belief that money services regulations should apply to the cryptocurrency industry:

"The rules governing money service providers apply to physical and electronic transactions alike. As money service businesses, cryptocurrency money transmitters are subject to compliance examinations, just like every other U.S. bank. To be clear, FINCEN will hold any entity that transacts in bitcoin, Libra, or any other cryptocurrency to its highest standards"

-Secretary Steven Mnuchin

Given the eagerness by federal and state regulators to apply these existing regulations to cryptocurrency businesses, it seems unlikely that this bill will be able to reach a critical mass of support – and even if it somehow passed Congress the recent comments by the White House suggest it would face a Presidential veto.

The Safe Harbor for Taxpayers with Forked Assets - H.R. 3650

The Safe Harbor for Taxpayers with Forked Assets was first introduced by Rep. Tom Emmer on September 28th, 2018 and reintroduced in July 9th, 2019. It has been referred to the House Ways and Means Committee for further consideration.

This bill establishes a safe harbor period to prohibit penalties and additional taxes from applying to a taxpayer who receives a forked convertible virtual currency until the Internal Revenue Service issues regulations or guidance, or legislation is enacted, that addresses specified issues related to the tax treatment of forked convertible virtual currency.

"Taxpayers can only comply with the law when the law is clear. This bill will provide a safe harbor for taxpayers with "forked" digital assets. Further it will restrict fines against individuals that attempt to report these assets until the IRS provides any type of guidance regarding the appropriate means of reporting them."

- Rep. Tom Emmer

Analysis: In contrast to the broader scope of the other two blockchain bills, this proposal focuses on a more narrow issue – the tax classification of cryptocurrency received due to a protocol fork. The tax treatment of forked assets has been a source of confusion for cryptocurrency users since the first major hard fork of Ethereum in 2016 and the controversial Bitcoin hard fork into 2017 which spawned Bitcoin Cash. Since then, forking has only grown more popular, and similar confusion exists over the practice of "airdropping" new cryptocurrencies to users of a more popular token.

As it currently stands, there is no authoritative guidance from the IRS, but it seems likely that this issue will be addressed when the IRS officially updates its guidance. If the IRS fails to clear up this ambiguity, this bill may prove to be a viable alternative for lawmakers looking to clarify one of the most prominent areas of confusion.

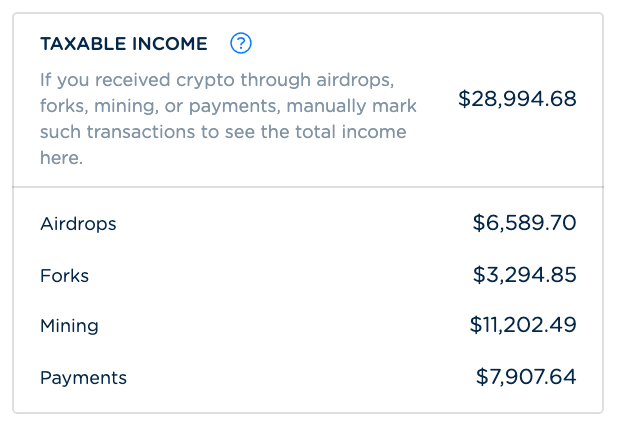

In the meantime, you can keep tabs on your forked and airdropped assets in CoinTracker under the "Taxable Income" tab of your tax report.

Want to track your cryptocurrency portfolio, generate tax reports, and stay up to speed on the latest rules and regulations? Create a CoinTracker account for free today.

CoinTracker helps you calculate your crypto taxes by seamlessly connecting to your exchanges and wallets. Questions or comments? Reach out to us @CoinTracker.

Disclaimer: this post is informational only and is not intended as tax advice. For tax advice, please consult a tax professional.