Are you confident in accurately reporting cryptocurrency earnings on your tax returns?

A Crypto Tax Loophole Every Crypto Trader Should Know

This post discusses an important crypto tax loophole which could significantly reduce your crypto tax bill.

March 6, 2020 · 2 min read

Tax loopholes are interesting gaps in the IRS code which you can use to reduce your taxes, legally. This post discusses an important crypto tax loophole which could significantly reduce your crypto tax bill.

Cryptocurrency trading has one major tax benefit that traditional stock trading doesn't offer (unless you are a full-time “trader” for tax purposes). Since cryptocurrencies are treated as “property”, wash sales rule which is applicable to stocks are not applicable to crypto. Not having to follow the wash sales rule is extremely beneficial for tax purposes especially during times where your positions have gone down in value.

What Is A Wash Sale?

A wash sale occurs when you sell a security at a loss and then purchase that same security or “substantially identical” securities within 30 days (before or after the sale date). The IRS came up with this rule to discourage equity investors from making artificial losses for tax purposes.

Technically speaking, wash sale rule is governed by the §1091 of the IRS code and applies to “stocks & securities”. This rule is not applicable to cryptocurrencies like bitcoin because they are treated as “property” per IRS Notice 2014-21.

Wash Sales & Crypto

Let’s look at couple of examples to see how wash sale rule interacts with stocks, crypto and capital gains taxes.

Assume Sarah buys $10,000 worth of Company A stocks (1,000 shares at $10 each) on January 10, 2020. On January 15, 2020, Company A stock is trading at a much lower price of $6 per share. If Sarah were to sell her position and buy another 1,000 shares at $6 per share, she would NOT be able to claim the capital loss of $4,000 (($10 - $6) x 1,000) due to the wash sales rule. Therefore, $4,000 capital loss is disallowed under wash sale rule.

In contrast, trading cryptocurrencies which act just like “stocks”, but under the tax treatment of “property”, generate a much better tax benefit. Let’s say instead of buying Company A stocks, on January 10, 2020, Sarah buys 1 BTC at $10,000. On January 15, 2020, this BTC goes down to $7,000. At this point, what she could do is sell the BTC for $7,000, harness $3,000 ($10,000 - $7,000) worth of tax losses and buy back another bitcoin to maintain her position. $3,000 loss would be allowed on your tax return as a capital loss because BTC is not subject to wash sale rules like stocks.

This is a great strategy to implement throughout the year and/or whenever you have positions which have gone down in value. Another advantage here is that losses created from this cryptocurrency tax loophole can also help you offset capital gains arising from other stocks & security transactions, leading to a lower overall tax liability.

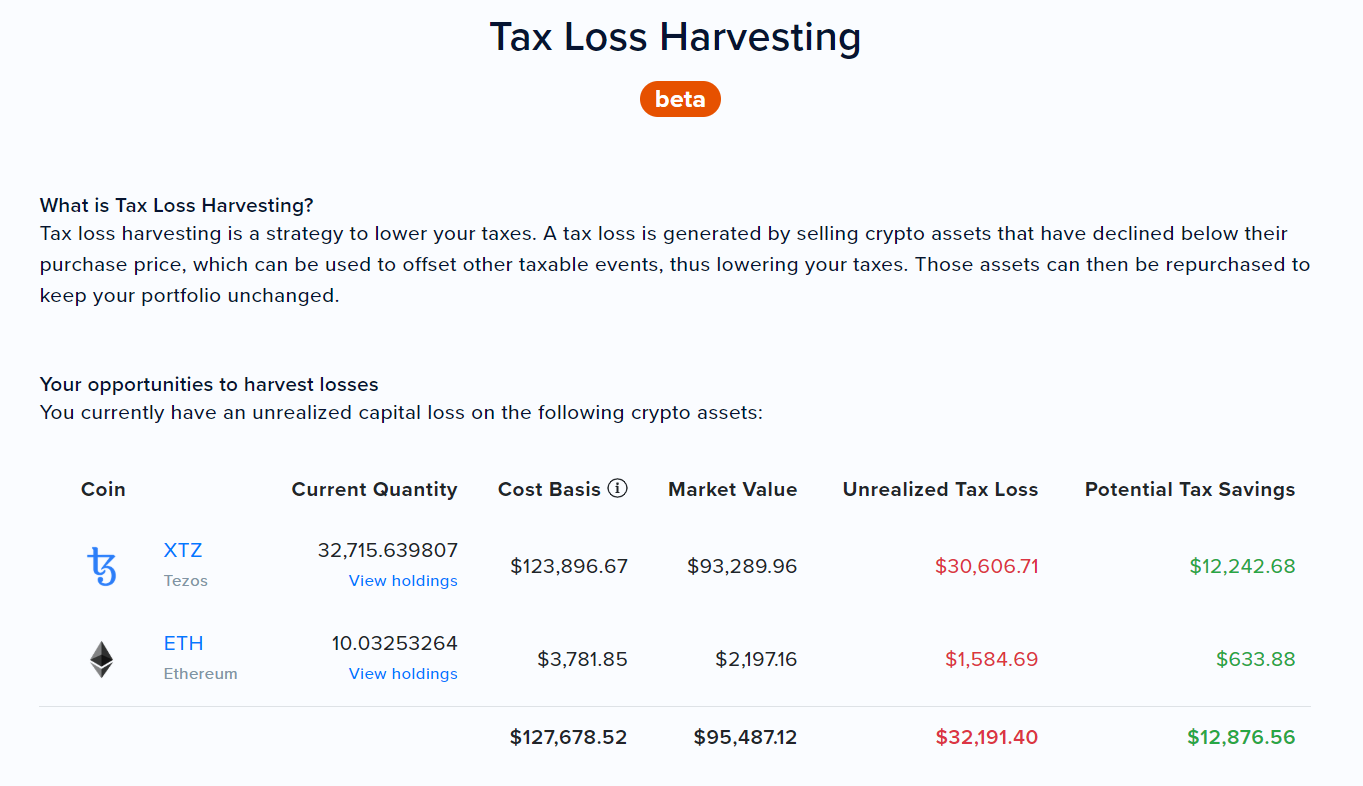

You can use CoinTracker's Tax Loss Harvesting dashboard to automatically harvest your tax losses and take advantage of this loophole.

If you have any questions or comments about crypto taxes let us know on Twitter @CoinTracker.

This post was originally published on Forbes by Shehan Chandrasekera on February 19th, 2020

CoinTracker integrates with 300+ cryptocurrency exchanges, 3,000+ blockchains, and makes bitcoin tax calculations and portfolio tracking simple.

Disclaimer: This post is informational only and is not intended as tax advice. For tax advice, please consult a tax professional.