Bull Market Crypto Tax Saving Strategies

Nov 24, 2020・5 min read

This post explains some of the top crypto tax strategies you can take advantage of during a bull market. The strategies are listed from easiest to most difficult to implement.

Time your crypto sales

The US tax system works on a calendar year basis. Especially near the year-end, you can take advantage of this cut-off period by pushing your current year’s tax liability to the next calendar year.

Say you purchased 1 bitcoin (BTC) at $3,000 in 2020 and now it’s worth $20,000. You might be tempted to sell this during the Nov-Dec time period. If you were to do so, you would have to pay taxes on $17,000 ($20,000 - $3,000) worth of gains when you file your 2020 taxes by April 15, 2021. However, if you were to sell this on January 1, 2021 (or any second after December 31, 2020 midnight), you will have to pay taxes on the gains after 15 months (April 15, 2022). Just by moving the timing of your sale, you can effectively defer your taxes by 15 months!

This strategy is even more effective if your income tax bracket is going to be lower in 2021 due to a change in career, personal life (e.g. taking a year off from work, moving to a state with no income taxes), or retirement.

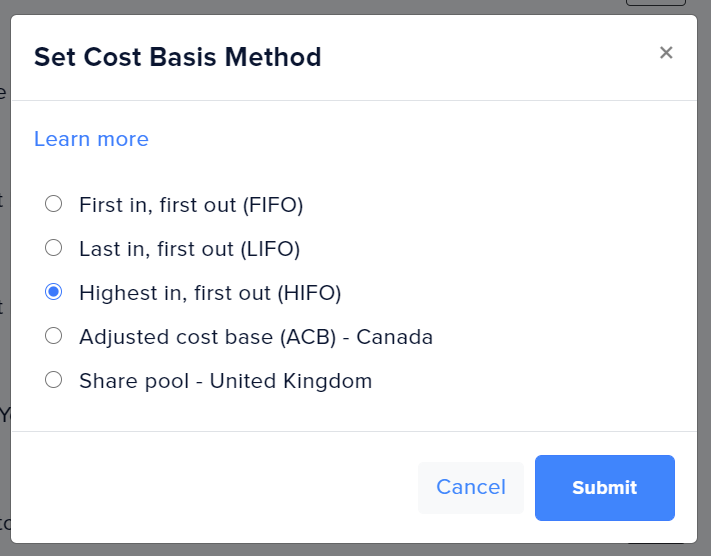

Use HIFO accounting to reduce crypto taxes

Highest-In First-Out (HIFO) accounting enables you to calculate capital gains by disposing of coins for which you paid the highest amount first. By doing so, you can minimize your capital gains and related taxes. In order to use this accounting method for crypto, you need to have detailed records of all of the below items set forth by the IRS:

1) the date and time each unit was acquired

2) your basis and the fair market value of each unit at the time it was acquired

3) the date and time each unit was sold, exchanged, or otherwise disposed of, and

4) the fair market value of each unit when sold, exchanged or disposed of, and the amount of money or the value of property received for each unit.

It's a very time consuming and tedious task for you to keep records of all these items manually. However, if your exchanges and wallets are connected to CoinTracker, we can help you choose HIFO accounting with a click of a button.

Note that, if you can't satisfy the above four criteria, your accounting method defaults to First-in First-out (FIFO) which may not be very advantageous for you.

2025

Crypto Tax

Guide is here

CoinTracker's definitive guide to Bitcoin & crypto taxes provides everything you need to know to file your 2024 crypto taxes accurately.

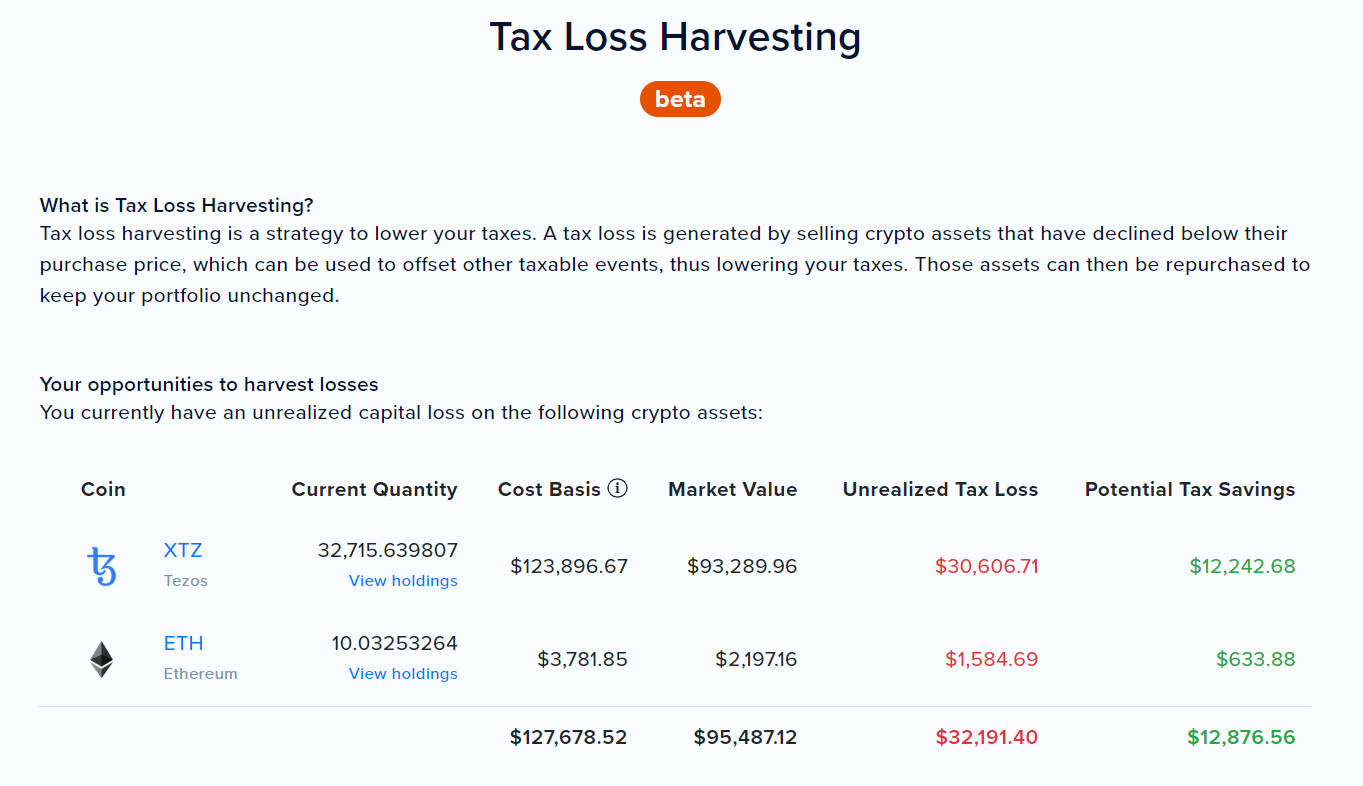

Harvest tax losses to offset crypto gains

Tax loss harvesting enables you to sell your losing positions to claim losses for tax purposes. Although the top 10 cryptocurrencies are nearing their all-time high during the 2020 bull market, you can use this strategy on holdings where your cost basis is higher than the market value. For example, if you have any coin that you bought at a higher price than its current price, this could be a strategy to consider.

If you have connected all your wallets and exchanges to CoinTracker, the Tax Loss Harvesting dashboard will show your holdings where you can harvest losses. When you harvest losses, that will help you reduce your capital gains from both crypto and non-crypto positions such as stocks and securities.

Donate crypto to bypass capital gains taxes and reduce other taxable income

Donating crypto to charities is one of the handful of tax strategies allowed in the tax code that gives you two benefits at once. By donating cryptocurrency to charities:

- You get to bypass the capital gains taxes on appreciated cryptocurrency holdings and,

- You get a deduction on Schedule A which will reduce your both crypto and non-crypto taxable income

Say, for example, you purchased 1 BTC a few years ago for $2,000 and it’s now worth $20,000. When you directly donate this coin to a charity, you can avoid capital gains taxes on $18,000 ($20,000 - $2,000) and claim $20,000 as a deduction on Schedule A which will reduce your income coming from a W-2, stocks, businesses and other sources.

Note that in order to get the full advantage of charitable deductions, you must itemize on your tax returns. If you don’t itemize, you get to bypass the capital gains taxes on crypto, but you won’t be able to get the benefit of the deduction.

Gift crypto to family members

Gifting cryptocurrency to your loved ones allows you to share your wealth without triggering a taxable event.

Each year, you can gift up to $15,000 worth of crypto to your spouse, children, or any person of your choice without triggering a taxable event for any parties involved.

If the amount of the gift is more than $15,000, don’t worry. There won’t be any taxes you have to pay immediately as long as it is below the lifetime gift tax exclusion of $11.58 million. However, if you gift someone more than $15,000, you will have to file IRS Form 709 to report information about the gift.

Move to a state with no state taxes on cryptocurrency

If you live in a state with no income tax (Alaska, Florida, Nevada, South Dakota, Texas, Washington, Wyoming), you’re already taking advantage of this strategy. Otherwise, your crypto capital gains are subject to both federal income taxes and state income taxes.

For example, if you live in California and make more than $500,000, your crypto short-term capital gains are subject to 37% federal income tax rate and 12.3% California state income tax.

Note that this does not mean 37 cents and 12.3 cents of every dollar you make goes to the federal government and California government, respectively. The tax rates are applied to taxable income after reducing your total income by various deductions, exemptions, and credits. Nevertheless, moving to a state with no income tax and selling your crypto assets while you are in that state will completely shield your gains from state-level income taxation.

If you have any questions or comments about crypto taxes let us know on Twitter @CoinTracker.

CoinTracker integrates with 300+ cryptocurrency exchanges, 3,000+ blockchains, and makes bitcoin tax calculations and portfolio tracking simple.

Disclaimer: This post is informational only and is not intended as tax advice. For tax advice, please consult a tax professional.