CoinTracker Simplifies Crypto Taxes for Tax Professionals

Apr 8, 2024・6 min read

At CoinTracker, we like to meet users where they are. We achieve this through partnerships with three key channels. We partner with leading crypto platforms, including Coinbase, Uniswap, OpenSea, and MetaMask. These platforms have large concentrations of crypto users who need support on their taxes. We also partner with tax-prep platforms, including TurboTax and H&R Block, where over 30 million Americans file their taxes every year. So, what is the third segment we focus on, you ask? Tax Professionals.

Are you a tax professional? Get started today with CoinTracker for Tax Professionals.

Why we focus on tax professionals

We know from IRS data that 50% of people file with a tax professional, and from our platform data, that 44% of complex crypto power users do the same. It’s a large market today and we believe it will continue to grow, driven primarily by two things:

- Increased compliance rate: We estimate that only 10-15% of crypto users are tax compliant today. As regulations become clearer we expect this number to increase meaningfully over time, expanding the market organically.

- Continued crypto adoption: Roughly 1 in 5 Americans own crypto. As this number continues to increase, the addressable market moves with it.

It’s a growing market and tax professionals need proper tooling. As such, we’ve doubled down on our mission to deliver the highest quality crypto tax software to this group so they can best serve their clients.

2025

Crypto Tax

Guide is here

CoinTracker's definitive guide to Bitcoin & crypto taxes provides everything you need to know to file your 2024 crypto taxes accurately.

Market observations: what have we learned?

We’ve spoken to 100+ firms in the past eight months. Here’s a quick overview of our observations, the challenges we’ve seen, and the opportunities ahead.

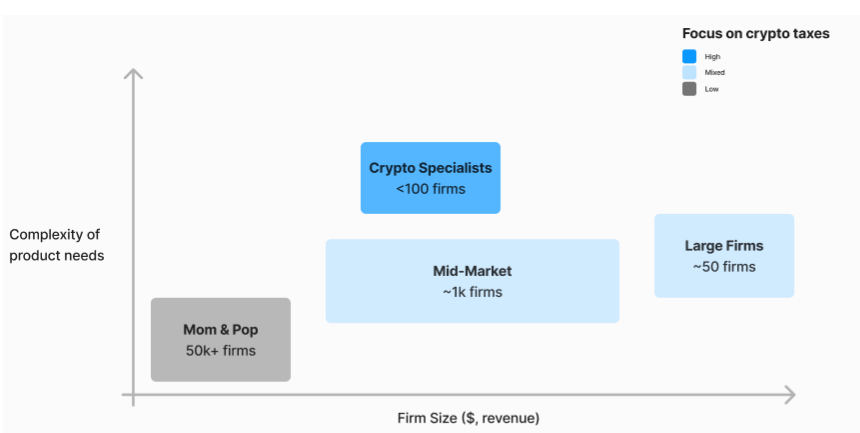

The market is fragmented; addressable users are spread thinly across many firms.

There is a wide range of crypto practice sizes across firms

We’ve worked with firms of all sizes. Here are some quick data points on their crypto practice dynamics:

How do tax professionals service their clients today?

Tax professionals use various methods to manage their clients’ crypto taxes. Here are four of the most common approaches we’ve seen:

- Document dump + Excel model: The client shares a range of PDFs and CSVs, and the tax pro makes sense of it through a proprietary model. This approach is impressive but can be done more efficiently.

- Product agnostic: The firm defers to the software tool the client uses. This is a passive approach; as firms gain more expertise and develop a point-of-view on software, they typically start to consolidate their software stack.

- Use multiple tools: The firm selects software based on the client’s situation. For example, suppose a client has complex DeFi activities, and the tax pro knows that CoinTracker Is the best at handling DeFi transactions. They will choose CoinTracker for the client.

- One tool to win them all: The firm surveys the market and selects one software to use for most or all of its clients.

What pain points do tax pros experience?

Crypto taxes are complicated. Tax pros can find a lot of pain when working with their crypto clients, especially if they aren’t using quality software. Here are the pain points we hear most:

- Low quality tools: Not all software is created equal. Some tools are inconsistent, unreliable, inaccurate, and don’t have the breadth and depth of coverage to support all of a client’s crypto activities.

- Using multiple tools is a headache: Many firms inherited a range of software solutions from clients over a few tax seasons. Now they must train, manage the team, manage clients, and develop mastery across each tool. This approach is inefficient and painful. Increasingly, we see firms looking to consolidate their software stack to simplify.

- Can’t handle complexity: Serving complex clients with multiple wallets, DeFi activity, NFTs, and high transaction volumes is particularly challenging. Not all software can handle this correctly. A robust tool is a must for complex clients and can drive significant time savings.

- Wasted time: Without proper tools, tax pros simply spend too much time reviewing and updating client accounts, much of which can be unbillable. This means less time on higher value activities, like quarterly planning and tax optimization.

What matters most to tax pros?

- Save time: Reducing the manual toil enables tax pros to spend more time with clients on higher value activities, including optimization and planning. They can provide a more comprehensive service to clients.

- Accuracy: Tax pros demand extreme accuracy. This means a breadth and depth of coverage of the crypto ecosystem through high quality integrations, combined with a high quality accounting engine to properly classify transactions and perform tax calculations. Bonus: provide the option to customize accounting methods or treat certain transactions as non-taxable.

- Crypto taxes that just work: Tax pros want a quality solution to recommend to their clients. It needs to be one they trust, have a dead simple user interface, and provide a delightful user experience. Bonus: provide strong customer support, especially during busy season.

How CoinTracker helps Tax Professionals

7,000+ tax professionals use CoinTracker to best serve their clients. We spoke to many of them to get product feedback so we could improve our platform. This feedback helped shape CoinTracker 2.0 and enabled us to ship features that help tax pros save time, offer a more comprehensive service, and stay organized.

Save time

Reduce the manual toil and spend time on higher value activities, like planning and optimization.

- Leading decentralized finance (DeFi) capabilities: CoinTracker supports 23,000+ DeFi smart contracts and the top 90 dApps, so your clients’ use cases are covered. We also auto-detect advanced EVM DeFi activity and automatically classify transactions. Check out our 2024 DeFi guide to learn more.

- Revamped Transactions page: The transactions page is where users view crypto activity, understand tax implications, and dig into the details; it’s the most critical surface within CoinTracker. Our revamped transactions page features a streamlined layout, focused data view, and editing capabilities that enable tax pros to review and reconcile client data quickly.

- NFTs: Non-fungible token (NFT) transactions can be challenging due to each NFT's uniqueness. Clients heavily involved in the NFT market tend to buy and sell multiple NFTs in one transaction. Allocating the cost basis and sale proceeds can take time and effort, but CoinTracker allocates the basis (or proceeds) to each NFT involved in the transactions. For example, if a client spends one ETH to buy 10 NFTs CoinTracker will allocate 1/10 to each NFT.

“CoinTracker has allowed our firm to realize significant time savings and costs on our complicated cryptocurrency clients. We’ve realized time savings of over 75 hours on one client who actively trades NFT’s and has had over 10,000 transactions and hundreds of wallets. Working with the CoinTracker team has been a great experience, Vipul, Chris & Jarrett are always willing to go above and beyond to provide support when required.”

— Michael Boeswald, Manager at Baker Tilly Canada SNT LLP

Offer more comprehensive service

Move up the value-chain with clients and differentiate from competitors.

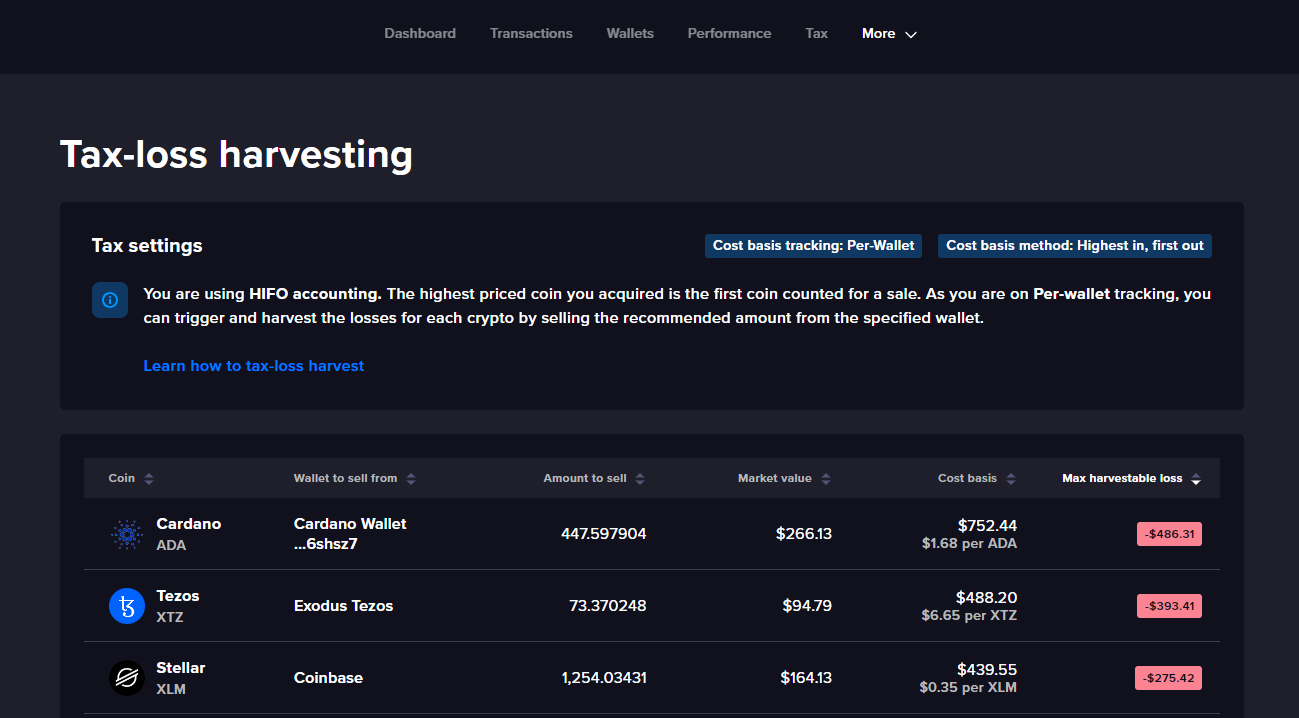

- Tax-loss-harvesting: With CoinTracker’s tax loss harvesting dashboard it is simple to identify tax loss opportunities, the amount to sell and the wallet to sell from.

- Changing accounting methods: Ultra plan subscribers are able to select an accounting method (FIFO, LIFO, HIFO) by tax year. This provides opportunities for tax savings and tax optimization for clients that feel stuck with the method they chose when first starting their crypto journey.

- Planning: View current year to date activity to help clients prepare estimates. The performance page helps provide a high level view of their current holdings and the unrealized gains and losses to help clients make informed financial decisions.

“One of the coolest features on CoinTracker is the ability to seamlessly toggle between HIFO, LIFO, and FIFO reporting methods. This flexibility ensures that we can choose the most tax efficient method for each client maximizing their tax savings while staying compliant with regulations.”

— Jonathan Bander, Partner at Experity CPA

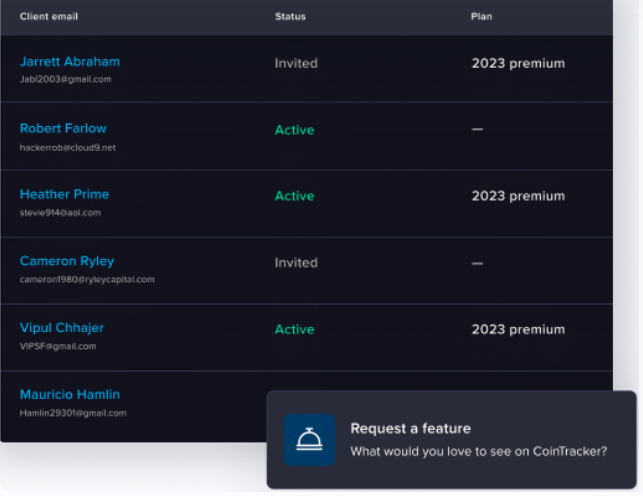

Stay organized

Sleek dashboard to manage your team, clients and workflows.

- Organize your crypto practice: view all clients and Tax Pros in one place and manage staff assignments with custom permissions

- Manage billing with ease: purchase plans on behalf of clients and streamline through bulk plan options

- Request features, we’ll listen: easily request features from the dashboard—we take feedback seriously

“CoinTracker’s sleek dashboard makes managing clients and our team an absolute breeze. It's like having all the tools we need right at our fingertips, making life easier and more efficient for everyone involved.”

— Jonathan Bander, Partner at Experity CPA

Ready to elevate your practice with professional tools?

If you're a tax professional looking to streamline your crypto tax process and save time, CoinTracker is here to help. It’s quick and easy to get started. Visit CoinTracker for Tax Professionals to learn more and connect with our team.