Are you confident in accurately reporting cryptocurrency earnings on your tax returns?

Strategies to Reduce Your Crypto Tax Bill

The tax code is full of complexities. We’ve compiled the top crypto tax strategies for reducing your crypto tax bill using the tax code to your advantage.

August 17, 2020 · 5 min read

The savvy cryptocurrency user can use the tax code to their advantage and significantly reduce their crypto tax bill, and in some cases, even reduce other non-crypto taxes as well. Since bitcoin and other cryptocurrencies are taxed as property (IRS Notice 2041-21), every time you sell, trade, or exchange tokens, there is a taxable event if there is a gain on that transaction. We’ve compiled some of the top strategies for eliminating and reducing your bitcoin tax bill on cryptocurrency profits.

0% Long-term Capital Gain Tax Rate

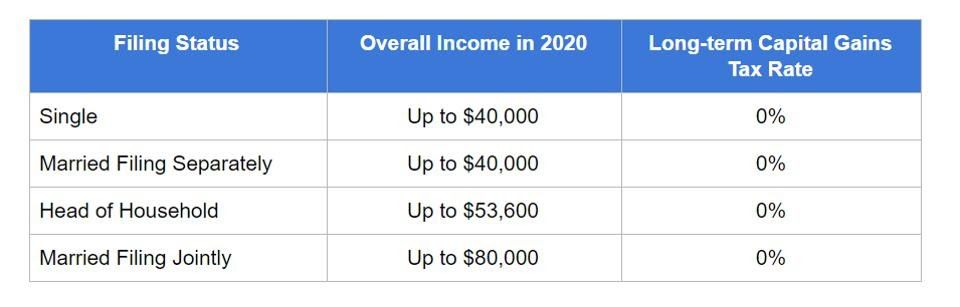

The US tax code has a relatively little known 0% tax rate for long-term capital gains.

Did you know that long-term crypto gains could be subject to 0% tax rate under US tax code?

— Shehan Chandrasekera, CPA 🧗♀️|🇱🇷|🇱🇰 (@TheCryptoCPA) August 3, 2020

The eligibility for this 0% tax rate depends on your filing status, annual income, and cryptocurrency holding period.

Essentially, if you are married and filing jointly, you can make up to $80,000 income (across crypto & non-crypto) and as long as your crypto gains are long term and inside that $80,000, you’ll pay zero capital gains tax on your crypto.

Donate Crypto Assets to a Charity

Crypto assets can be donated to qualified charities to get a tax deduction. When you donate crypto assets which you held for more than 12 months to a charity, you can get a tax deduction equivalent to the fair market value of the asset at the time of the donation. Additionally, you do not have to pay any taxes on the capital gains of the donated property.

For example, let’s say Sam donates 1 bitcoin (BTC) to a qualified charity. He bought this BTC at $1,000 five years ago. At the time of the donation it’s worth $10,000. Here, Sam gets to deduct $10,000 as charitable donation on Schedule A and bypass capital gain taxes on $9,000 ($10,000 - $1,000) of gains. If Sam were to sell his 1 BTC and donate the fiat proceeds to a charity, he would have to pay capital gain taxes on $9,000 profits.

Crypto donations can be subject to a complex set of tax rules, so you may want to consider consulting a tax professional before making a large donation.

HIFO Accounting

The IRS has clarified that you are allowed to specifically identify tax lots in your tax reporting. Essentially, specific identification means that you select which specific “lot” of coins you are selling when you dispose of them. An algorithm that is a subset of specific identification called Highest In, First Out (HIFO) automatically selects your coins at the highest cost basis and disposes of them first, thereby minimizing your capital gains.

In order to use HIFO, you need to have the following information according to IRS rules (Q39):

- The date and time each unit was acquired,

- Your basis and the fair market value of each unit at the time it was acquired,

- The date and time each unit was sold, exchanged, or otherwise disposed of, and

- The fair market value of each unit when sold, exchanged, or disposed of, and the amount of money or the value of property received for each unit.

This can be a game changer for deferring your capital gains. Using this legal technique, we've seen users go from owing six figure tax bills to getting refunds. While this is extremely tedious to figure out by hand, software like CoinTracker can automate the calculations for you in a click of a button.

Tax Loss Harvesting

A technique called Tax Loss Harvesting allows you to sell an asset at a loss and then re-purchase it at a lower price. This allows you to capture realized capital losses today and defer capital gains to the indefinite future.

The tax code actually prohibits tax loss harvesting (within 30 days of buying or selling an asset) for “stocks and securities” through wash sale rules. Cryptocurrencies like bitcoin are actually subject to a loophole however because they are property — not stocks nor securities (note: the SEC has classified some longer tail cryptocurrencies as securities so this technique would not apply to those).

This allows you to sell your loss positions just to harvest losses for tax purposes and quickly get back into the same position without having to wait 30 days. These harvested losses can be used to offset your crypto and other capital gains.

Self-Directed IRA (SDIRA)

The Self-Directed IRA (SDIRA) is a powerful tool to defer taxes until retirement. Although SDIRAs cannot completely bypass taxes, they can compound crypto profits in your portfolio today while deferring taxes to the future. Avoiding taxes on trades today means that you get to compound profits tax deferred, which would have gone out to the government if you traded in a non-SDIRA account. On top of this if you withdraw SDIRA funds at retirement when you are subject to a lower tax rate, you get tax savings from there as well.

Note: one downside to an SDIRA is that you cannot self custody these assets so you have to find a custodian that you trust.

Qualified Opportunity Funds

Sophisticated high-net worth taxpayers with sizable unrealized cryptocurrency gains can take advantage of Opportunity Zones (OZs). The federal government has created a set of tax incentives for investing into economically distressed areas. Tax savings come in three forms: tax deferral, tax reduction, and tax elimination. In order to take advantage of these tax breaks, you can roll over your long-term crypto profits into a Qualified Opportunity Fund (QOF). The QOF fund invests that money into the economically distressed areas designated by the government. If you hold your investment in the QOF for at least five years, 10% of your initial crypto tax gain is tax free. If you hold your investment in the QOF for at least seven years, an additional 5% of your initial crypto tax gain will be tax free.

Finally, if you hold your investment in the QOF for 10 years, you can completely avoid capital gains taxes on the appreciation of QOF stocks in addition to the tax savings triggered at year five and seven. This ability to completely eliminate taxes on the appreciation of QOF stock is one of the biggest tax saving opportunities in the tax code.

If you have any questions or comments about crypto taxes let us know on Twitter @CoinTracker.

CoinTracker integrates with 300+ cryptocurrency exchanges, 3,000+ blockchains, and makes bitcoin tax calculations and portfolio tracking simple.

Disclaimer: This post is informational only and is not intended as tax advice. For tax advice, please consult a tax professional.