What to Know About Crypto Airdrop Taxes

Oct 10, 2019・2 min read

In the US, the IRS originally released cryptocurrency guidance in 2014 and followed it up on October 2019 with additional cryptocurrency tax guidance.

Overview

Airdrops are free coins that are sent to your wallet. Coins are generally airdropped to your wallet by ICO issuers or an existing blockchain network (ex:- Spark token airdrop for XRP coin holders) to increase awareness, improve marketing and publicity for the project. Sometimes you may get coins through airdrops, and you may not even know about it (until you check your CoinTracker account!).

2025

Crypto Tax

Guide is here

CoinTracker's definitive guide to Bitcoin & crypto taxes provides everything you need to know to file your 2024 crypto taxes accurately.

Crypto Taxes on Airdrops

The IRS has specified that new coins received through an airdrop are taxed as ordinary income. Therefore, you owe income taxes on new coins you have in your wallet as a result of an airdrop (regardless of whether you intended to own these coins or not). The amount of income is the fair market value of the airdropped coins at the time they are received in the wallet.

Note: this is a pretty bold stance from the IRS and can result in you owing income taxes on your cryptocurrency even if you are just a HODLer, holding coins without proactively making any transactions.

Let’s look at an example. Say Max has 1,000 Ripple (XRP) on Coinbase and he receives 1,000 SPARK tokens airdropped by the Flare network. He needs to report the newly received tokens as taxable ordinary income (not a capital gain). This is true whether or not Max sells the token.

Let’s say the fair market value of the SPARK at the time he receives it is $5. He will have to pay ordinary income taxes on $5,000 ($5*1,000). In addition, the amount Max reports as ordinary income becomes his basis for the new SPARK ($5,000), and he will use it to calculate capital gains/losses if/when he sells his SPARK in the future.

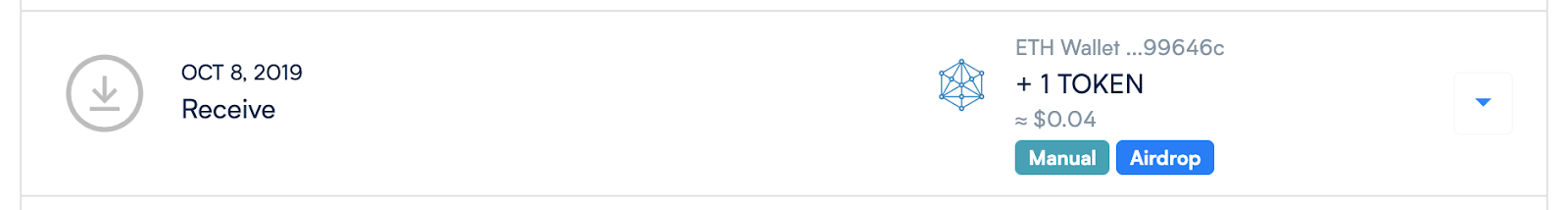

CoinTracker allows you to mark any received coins (from the Transactions page) as an "airdrop" so you can see the amount of ordinary income you have (on the Tax page), in addition to the capital gains which are already tracked separately. This income will be reported as “other income” on your IRS Form 1040 (separate from your IRS Form 8949 where your capital gains are reported from your cryptocurrency disposals).

Get Started With CoinTracker

CoinTracker integrates with 300+ cryptocurrency exchanges, 3,000+ blockchains, and make bitcoin tax calculations and portfolio tracking simple.

If you have any questions or comments about crypto taxes let us know on Twitter @CoinTracker.

Disclaimer: This post is informational only and is not intended as tax advice. For tax advice, please consult a tax professional.