Introducing CoinTracker 2.0

Jan 16, 2024・6 min read

Background

CoinTracker has been a trusted brand in crypto since we launched in 2017. Since then, we’ve served over 2 million users. However, in 2021 the crypto space experienced significant growth, driven in large part by the rise of DeFi. As we tried to keep up with growth, our product quality fell behind, leading to challenges for our users. Since last tax season, we have been maniacally focused on product quality, and we're so excited to share a wave of major updates launching today.

CoinTracker 2.0 encompasses our most substantial product release in years — and it’s been driven entirely by your feedback. Before jumping into updates, we want to share a summary of the research that grounded our understanding of the CoinTracker user and informed our focus:

- First, you’re not alone — many crypto users struggle with tax confusion. It’s difficult to know what events are taxable and how to apply taxes to your transactions. As a result, it’s not surprising that fewer than one in five users are tax-compliant (according to data confirmed by the IRS).

- People typically have too many wallets and transactions to track on their own, want accurate gain/loss data to track performance, and want peace of mind against tax audits.

- Users’ needs range from the simple to the complex. More than 30% of users are deeply into DeFi, and more than 25% are passionate about NFTs.

- About half of crypto users file through tax software such as TurboTax and H&R Block online, and half via tax prep services such as a personal accountant. There are often gaps when you connect your tax forms to online services, and sometimes your accountant doesn’t know how to address crypto.

- Above all, the #1 thing users care about is minimizing time spent figuring out their crypto taxes with accuracy.

2025

Crypto Tax

Guide is here

CoinTracker's definitive guide to Bitcoin & crypto taxes provides everything you need to know to file your 2024 crypto taxes accurately.

Peace of mind

CoinTracker 2.0 focuses on the three pillars most important to our users: ease of use, accuracy, and year-round value. Taken as a whole, these pillars support our mission to give users peace of mind to freely use crypto. Let’s dive into each of these pillars, highlighting the major updates launching today:

Ease-of-use

Users don't want to spend their Saturday evenings combing through their crypto transactions in preparation for Tax Day; they want things to simply work. To make this happen, we focused on key improvements across the entire user experience:

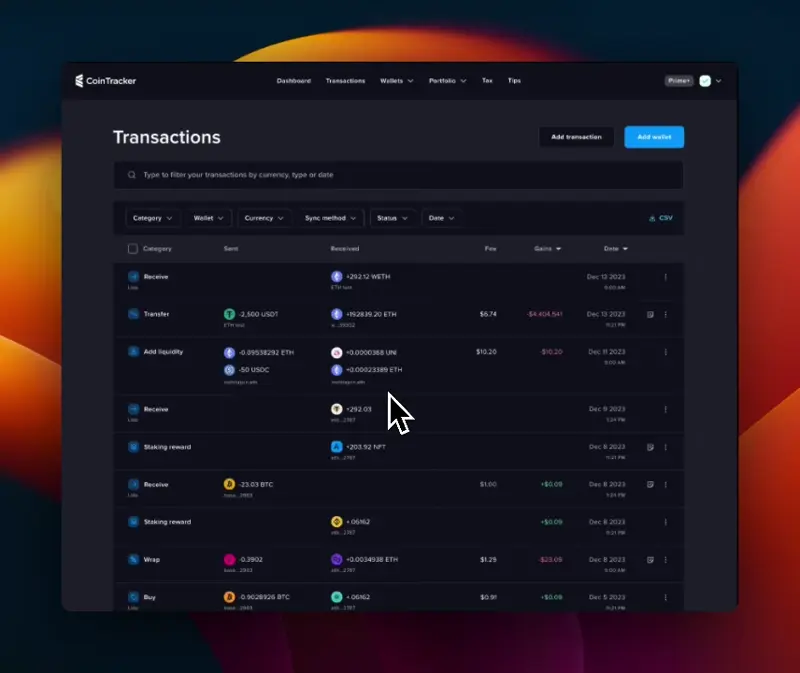

- Transactions page redesign. The transactions page is the most critical and our most popular page. We designed a totally new transactions page after talking to hundreds of users about how they use it. Launching in the coming weeks is a dense spreadsheet-like transactions interface with numerous power features to enable users to better understand their transactions. Our new transactions experience will soon enable you to easily search (powered by AI), filter, review, and bulk edit 100s of transactions at a time in a fast, responsive design.

- Spam resolution. Users are getting bombarded with spam transactions across their crypto accounts — driven in large part by phony airdrops. So we’re giving users the ability to mark those transactions as spam and view them in an inbox-style “Spam” tab. As soon as an asset is marked as spam once, it automatically marks as spam across all wallets & exchanges and removes from transaction count. The next evolution — currently in development — will automatically identify and filter spam tokens from your transactions page.

- Improved “Add Wallets” flow. Users can now add all EVM wallets in one click, syncing wallets across Ethereum, Base, Polygon, and other L2 chains. We also have WalletConnect support for a seamless wallet integration experience via a simple QR code.

- Seamless, faster, more responsive experience. With CoinTracker 2.0, users should expect a snappier overall experience. We migrated our front end to a single-page application. This has enabled numerous user experience improvements, including dark mode and 4x faster navigation.

- Automatic sync with TurboTax and H&R Block. Finally, users can complete their filing with auto-sync to TurboTax and H&R Block and invite their tax professionals to collaborate. CoinTracker is the exclusive partner to H&R Block and TurboTax and the only solution with API import.

Accuracy

Users expressed that their dream is for CoinTracker to automatically reflect whatever they are doing within the crypto ecosystem — whether they’re operating on exchanges or wallets, interacting with DeFi protocols, or buying and selling NFTs. With CoinTracker 2.0, this dream is a reality. Just add your wallet. No manual editing, no errors, no problems.

- Reimagined foundations. We’ve overhauled our technology stack from first principles — improving our data ingestion, transaction classification, and accounting/tax engine — to enable complete, reliable crypto support not just for today but for the next set of DeFi applications coming over the next 10 years. We’ve rebuilt our cryptocurrency ingestion pipelines from 500+ exchanges & wallets and 10,000+ cryptocurrencies. On top of that backbone, we built a new system — our transactions model — that allows us to classify every transaction with a deep level of context and understanding.

- Tax optimization. To help users save taxes, we’ve launched two new features. Now, users can mark certain DeFi transactions, such as wrapping, staking deposits & withdrawals, and entering & exiting liquidity pools, as non-taxable. Users can also select the cost basis calculation method (e.g., highest-in-first-out accounting) they want to use by year to maximize their tax savings.

- Native staking support. More than 50% of our users are staking crypto. We’ve added support for native staking across the highest volume chains, including ETH and SOL, and across top dApps (including Rocket Pool and Lido).

- Industry-leading DeFi support. CoinTracker 2.0 supports 23,000+ smart contracts and the top 85 dApps. It accurately accounts for gas fees, wrapping/unwrapping, staking, lending, and liquidity pools, and has ERC-1155 and ERC-721 token support. It detects the most advanced EVM DeFi activity and automatically tags those transactions. Users can also set rules to treat wrapping, staking, liquidity, and lending as non-taxable.

- Complete Coinbase support. Coinbase has been a close and trusted partner of CoinTracker for over three years. CoinTracker 2.0 has complete coverage for Coinbase, including Coinbase Prime, Base, Coinbase staked ETH, and cbETH. We will continue to quickly support every new trading feature that Coinbase launches. Our strong technical partnership with the Coinbase team enables us to build support before features launch to the public so our users can track from day one.

Year-round value

Finally, we are bringing more year-round value to our users. Taxes in crypto are different from traditional taxes because each transaction type is different. You can maximize your crypto earnings if you are on top of your taxes throughout the year. We’ve thus combined our tax and portfolio tracking into one product to give you real peace of mind.

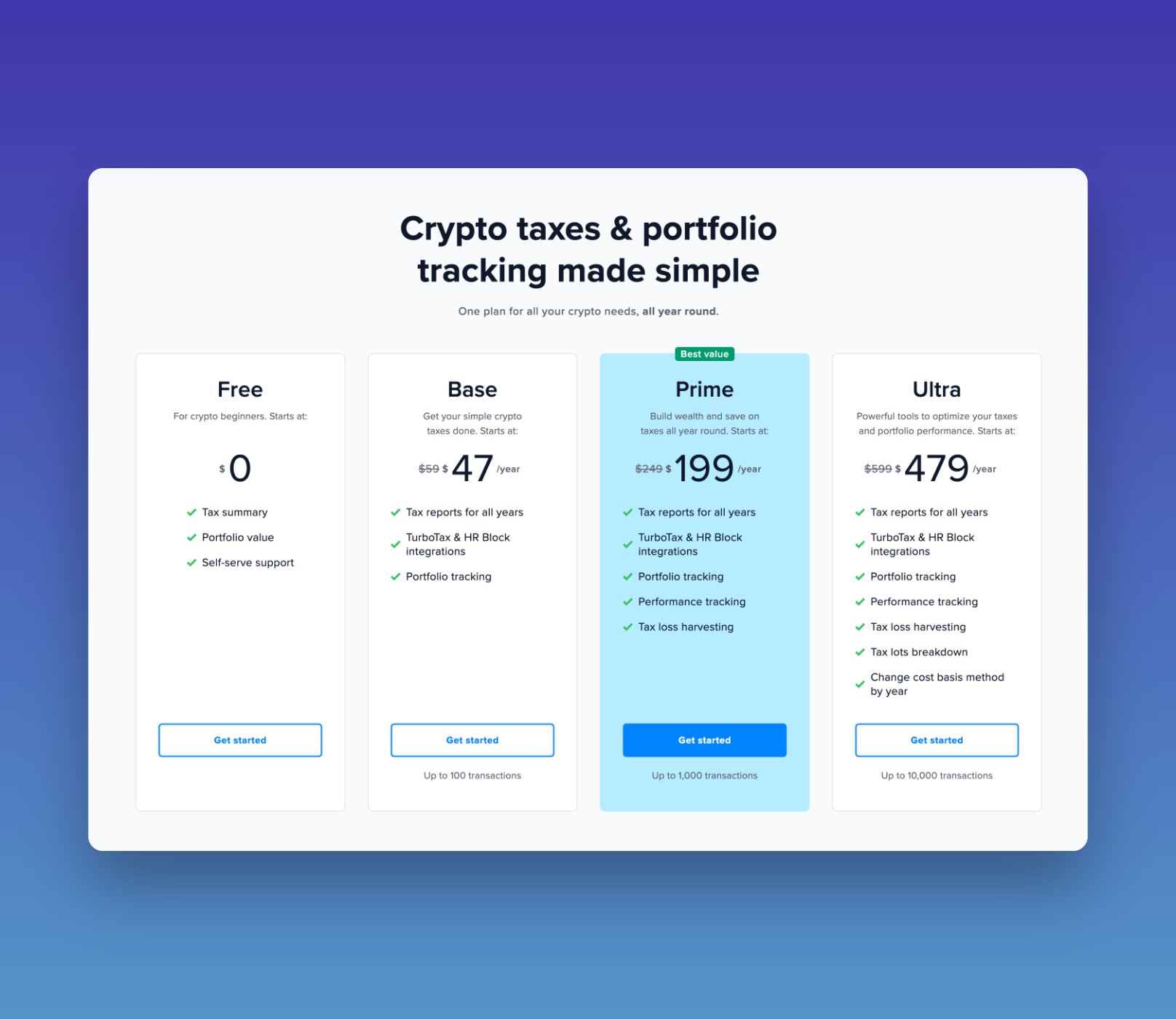

- More value for less. We consistently heard from users that our pricing was confusing. Our revamped pricing is now much simpler — with one annual price covering all CoinTracker offerings, including tax calculation, portfolio tracking, and tax reports for all years. We're also excluding staking transactions up to $25 in the Base plan, ignoring spam transaction counts, and only counting transactions from the previous calendar year. Prime and Ultra plans incorporate unlimited staking transactions.

- Tax-loss harvesting and lot-level intelligence. With CoinTracker 2.0, advanced tax-loss harvesting is now available, allowing users to strategically manage losses at the lot level, much like traditional brokerage services. Over time, we intend to make this feature even more powerful. CoinTracker users harvested an average of $7k in 2022. And with our new pricing, tax-loss harvesting is 80% cheaper. Ultra users can also view their crypto portfolio at the lot level to see exactly the performance, holding period, and performance of every crypto lot.

- Mobile UX & performance insights. We now empower you to understand your performance over time for individual crypto holdings and view realized and unrealized returns at the portfolio level. Both features are available on both desktop & mobile. Lastly, you can now add wallets to your CoinTracker account via mobile.

Thank you

As important as this launch is, it’s merely the beginning.

The fundamental changes we’ve made over the last year have set the foundation for a much more robust set of tools that we are building now and will build in the future. We will continue to improve our core tax product, ensure it remains best-in-class, and aim to address every critical use case — including a faster and more reliable backend, new chain integrations, new transaction types, and easier workflows.

Thank you for being the driving force behind CoinTracker’s evolution, and please don’t stop giving us feedback. We are so excited for you to experience an entirely refreshed version of CoinTracker today and for us to build together into the future we all envision.

CoinTracker delivers integrations for 500+ exchanges, wallets, and NFTs, and 23,000+ DeFi smart contracts. Generate accurate reports and file in minutes with the only solution that integrates directly with TurboTax, H&R Block, or your own CPA.