Guide to Non-Fungible Token (NFT) Taxes - 2024 Edition

Sep 8, 2021・5 min read

What are NFTs?

Non-fungible tokens (NFTs) are units of data stored on a digital ledger called a blockchain. Unlike fungible assets (e.g. USD, bitcoin, ether) where any unit can be swapped out for another without changing the value of the asset — NFTs are unique and therefore not interchangeable.

In plain terms, NFTs are unique digital assets. They can be used to represent digital files such as photos, videos, audio, etc.

Recently, there has been a surge in NFTs in the form of digital art created and offered for sale in limited quantities. Similar to dynamics with regular physical art, supply and demand forces price NFTs.

For example, Bored Ape Yacht Club is a popular collection of thousands of digital ape avatars with different facial features and characteristics.

You can buy and sell NFTs in digital marketplaces like OpenSea, SuperRare, Niftygateway, and others.

NFT Tax Overview

The IRS has released limited tax guidance on NFTs. Notice 2023-27 esstially says the tax treatment of NFTs depends on the underlying asset that it represents (look-through analysis). This is important to know because if we extrapolate from the existing US tax code (IRS 408(m)(2)(A)), “any work of art” is considered a “collectible”. Therefore, it is reasonable to assume that most art-based NFTs should be classified as collectibles for tax purposes. This classification subjects NFTs to capital gain taxes similar to other common cryptocurrencies (e.g. BTC, ETH, etc.).

The specific tax implications of a given NFT depends on:

- The taxpayer’s role (NFT creator or investor) and;

- To what extent (i.e. as a hobby or a trade or business) the taxpayer interacts with NFTs

NFT Creator Taxes

People who mint (read: create) NFTs are called creators, and they are the ones who list their NFTs for sale on marketplaces like OpenSea and SuperRare.

There are two types of creators. Hobbyist creators mint NFTs for fun. Professional creators are full-time artists who mint and sell NFTs as a trade or business.

Minting an NFT

Paying gas fees to mint an NFT is a taxable event.

For example, Sam, a hobbyist NFT creator, spent 0.1 ETH to mint a crypto punk NFT. He originally purchased this 0.1 ETH for $100. At the time he minted the NFT, 0.1 ETH was worth $300. Therefore, this minting transaction would generate a $200 ($300 - $100) capital gain for Sam. Sam’s cost basis on the NFT minted is $300.

Note: if Sam was a professional creator who frequently mints NFTs in the course of his business instead of being a hobbyist, the $200 would be treated as ordinary income. The NFT’s cost basis would be $300.

Selling an NFT

NFT creators are taxed at the time they sell NFTs into any cryptocurrency or exchange one NFT with another.

Say Sam sold his crypto punk NFT for 10 ETH (worth $30,000) after holding it for less than 12 months. Here, Sam would have a $29,700 ($30,000 - $300) short-term capital gain. This will be subject to his ordinary income tax rate.

If Sam were to sell his punk after holding it for a year or more, the $29,700 gain would be subject to the more favorable long-term capital gains rate (either 0%, 15%, or 28%).

Note: if Sam were a professional creator, he would report an ordinary income of $29,700 ($30,000 - $300) on his taxes. Sam can also deduct business-related expenses, such as internet fees, utilities, etc., on Schedule C (or the applicable business return) to offset his gains. Schedule C (or the applicable business return) to offset his gains.

Earning NFT Royalties

Earning royalties on a recurring basis is also a taxable event.

Say Sam received 1 ETH in royalties. 1 ETH is valued at $4,000 at the time he receives royalties. Sam would report $4,000 of ordinary income.

2025

Crypto Tax

Guide is here

CoinTracker's definitive guide to Bitcoin & crypto taxes provides everything you need to know to file your 2024 crypto taxes accurately.

Investor NFT Taxes

Investors are individuals who buy and sell NFTs for speculative purposes. Most people fall into this category. For NFT investors, taxes work similarly to the way they work for crypto trading.

Purchasing an NFT

Purchasing an NFT using a cryptocurrency like ether is a taxable event.

Say Erin purchased an NFT valued at $1,000 (1 ETH) in January 2024. To make the purchase, she used 1 ETH purchased at $200 several years ago. When she purchases the NFT in January, she incurs a long-term capital gain of $800 ($1,000 - $200). This is considered long-term because she held the ETH for more than 12 months before disposing of it to purchase the NFT.

In general, any gas fees paid to purchase an NFT will also be included in the cost basis.

Long-term capital gains on cryptocurrency are taxed at long-term capital gains rates. The cost basis of the NFT purchased would be $1,000.

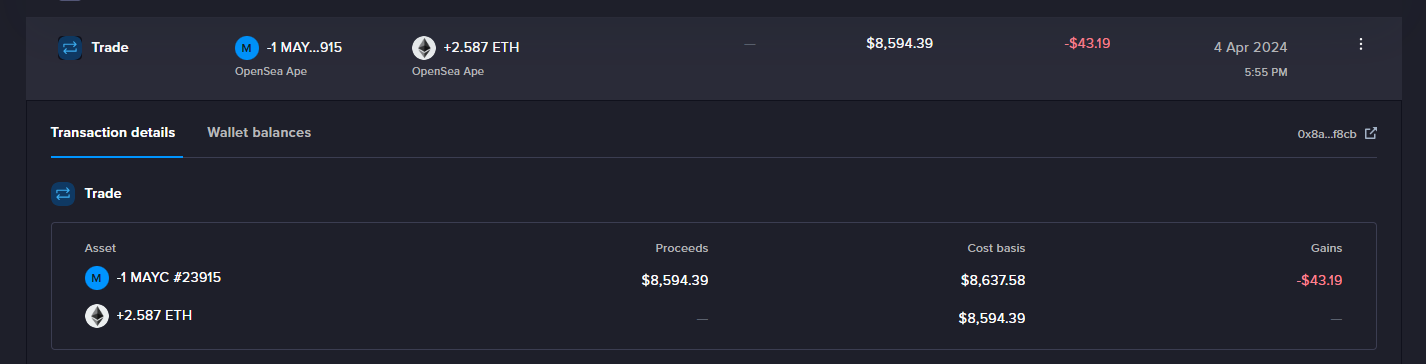

Selling an NFT

Selling an NFT (for cryptocurrency, for another NFT, fiat, or any other good/service), triggers a taxable event subject to capital gains tax.

If Erin were to sell this NFT in April 2024 for $10,000, she would have a short-term capital gain of $9,000 ($10,000 - $1,000). In this case, the gain is short-term because she held on to the NFT for less than 12 months before selling. Short-term gains are taxed at ordinary income tax rates.

You can use CoinTracker to track the cost basis of NFTs and calculate gains when they are sold.

Additional Taxes for High-Income Earners

Since most NFTs fall under the IRS definition of “collectibles” high-income earners may face an additional tax on long-term NFT capital gains. Single filers with over $518,900 ($492,300 for 2023) of taxable income & married filers with over $583,750 ($553,850 for 2023) of taxable income would fall into this category.

These high-income earners are subject to a higher 28% tax rate on collectible gains instead of the more favorable 20% long-term capital gains tax rate on regular cryptocurrency and stocks. Taxpayers who are below these income thresholds won’t see a difference in tax rates between NFT gains and regular cryptocurrency gains.

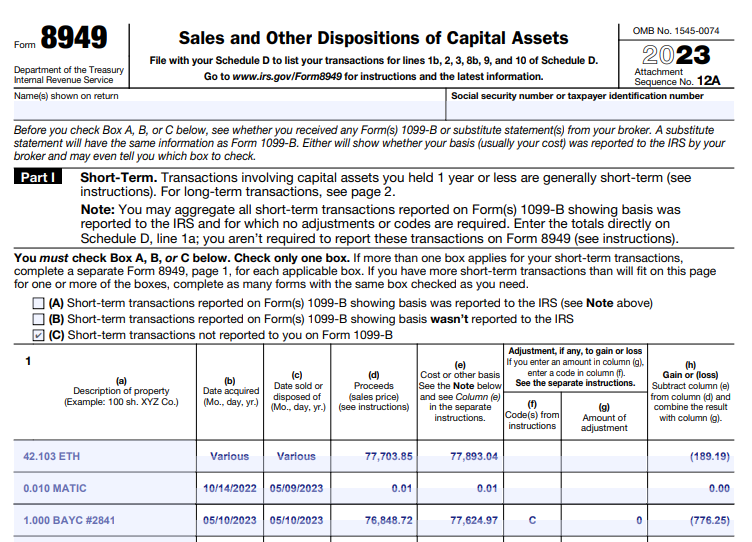

How to Report NFT Transactions on Your Taxes

Hobbyist NFT Creators and Investors

Hobbyist creators and investors can use IRS Form 8949 and Schedule D to report NFT minting gains/losses and NFT trades. Make sure to enter code “C” in column (f) to indicate that you sold an NFT which is treated as a collectible.

Professional NFT Creators

Professionals can use Schedule C or the applicable business tax form (Form 1065, Form 1120, or Form 1120-S) to report their NFT income and business expenses.

Common Misconceptions

TCJA

The Tax Cuts & Jobs Act (TCJA) was enacted on January 1, 2018. The provisions introduced in this bill have no direct impact on NFT-related taxes.

Utility NFTs

Not all NFTs represent artwork such as digital graphics, music, etc. For example, a domain name can be represented by an NFT. Depending on the type of utility provided and the facts and circumstances of each case, utility NFTs could have different tax treatments like collectibles, inventory, or property.

If you have any questions or comments about crypto taxes, let us know on X @CoinTracker.

CoinTracker integrates with 300+ cryptocurrency exchanges, 8,000+ cryptocurrencies and makes crypto tax calculations and portfolio tracking simple.

Disclaimer: This post is informational only and is not intended as tax advice. For tax advice, please consult a tax professional.