Are you confident in accurately reporting cryptocurrency earnings on your tax returns?

Reporting Celsius bankruptcy payments

The tax impact of reporting the Celsius recovery payments will depend on the original cost basis of the asset(s) held with Celsius.

February 28, 2024 · 6 min read

This blog post is intended for informational purposes only. The Celsius bankruptcy case is extremely complex. In many cases, CoinTracker can not support this automatically. We highly encourage individuals to consult with a tax professional to accurately handle this situation.

Celsius filed for bankruptcy protection on July 13, 2022, and many investors have been waiting for a resolution and the ability to recover funds. On November 9, 2023, the bankruptcy court confirmed the reorganization plan, and the plan became effective on January 31, 2024. The plan includes distributions of over $3 billion of cryptocurrency: Bitcoin (BTC),Ethereum (ETH) and fiat to Celsius creditors and the creation of a new Bitcoin mining company called Ionic Digitial Incorporated (Ionic). Celsius creditors will get the shares of the new company, and Hut 8 Corp will manage the mining operations.

The reorganization plan

In the reorganization plan (Docket No. 2358), there are 16 classes of creditors (see page 27). Each class has different rights and treatment for their claims. The assets held in Celsius and their value at the time of the bankruptcy (8:10 PM Eastern Time, on July 13, 2022) filing will determine the scheduled claim value and subsequent distribution calculation. (You can see the crypto values on page 5 of Docket No. 1387) Individuals were given an opportunity to opt out of the class claim settlement (Docket No. 3288).

If you took action and opted out, your claim will be considered a disputed claim and won’t receive a distribution on the effective date. If you didn’t opt out, the scheduled claim is 105% of the scheduled claim.

Here’s an example of general earn claims (class 5) since most of the principles applied to this class will apply to the other classes. Class 5 consists of all taxpayers in the Earn program with claims greater than $5,000.

Eric held 6,000 USDC tokens and 10 AVAX tokens. The petition value (price at the time of the bankruptcy filing) for USDC is $1, and the petition value for AVAX is $18.49. Eric’s scheduled claim value is $6,184.90 ((6,000 x $1) + (10 x $18.49)). His claim value is increased by 5% to $6,494.15 because he didn’t opt out of the class claim settlement.

Recovery waterfall

Now that we know the claim amount, we need to understand what will be distributed to the creditors next. Class 5 (and some other classes) receive a distribution/payout in three different asset classes.

- Liquid crypto (BTC & ETH)

- Common shares in Ionic, a mining company

- Distribution from illiquid asset recovery (it could take several years for this portion).

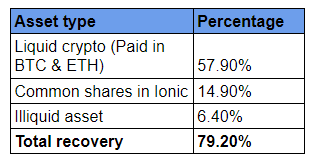

The total recovery amounts to 79.20% of the total claim value.

Here is a breakdown of the total recovery:

The liquid crypto portion of the total claim is paid out in BTC and ETH. These claims are being processed by Venmo and PayPal (for US residents) and Coinbase (for international residents). The amount of BTC and ETH is determined by the effective date price (January 16, 2024, fifteen days before the plan effective date). The effective date price of BTC and ETH are $42,973 and $2,577 respectively.

Example:

Eric has a total claim of $6,494.15, and 57.9% is distributed in BTCand ETH. The USD value of the liquid crypto distribution is $3,760.11 ($6,494.15 x 57.9%). Eric receives 0.0437497 BTC worth $1,880.06 (0.0437497 x $42,973) and 0.72955 ETH worth $1,880.05 (0.72955 x $2,577). The amount of BTC and ETH will vary, but the combined value based on the effective date price should equal the liquid crypto distribution value.

The next distribution is the common shares of Ionic. These shares are maintained by the Odyssey Transfer and Trust Company (the transfer agent). Initially, the shares are restricted and cannot be sold, transferred, or moved to a brokerage account. Once the company’s registration statement is approved, the stock will be listed on the Nasdaq. Once the registration statement becomes effective and the shares are listed, they will be transferable to a brokerage account of your choice. The company is valued at roughly $740M, resulting in a per-share price of $20. You will multiply the claim amount by 14.9%, then divide that amount by 20 to determine the number of shares.

Back to Eric's example:

Eric’s total claim was $6,494.15. The cash value of the shares is $967.63 ($6,494.15 x 14.9%). Since the shares are worth $20 each, Eric receives 48 shares ($967.63 ÷ 20). (They aren’t issuing partial shares.)

The final distribution will come from illiquid assets recoveries. This portion could take up to five years because it depends on recoveries from ongoing litigations and other wind-down activities. They expect to be able to recover enough to pay 6.4% of the total claim from these recoveries.

Eric receives $415.63 ($6,494.15 x 6.4%), representing the recovery from illiquid assets.

How to report the recovery on taxes

For those who waited for the bankruptcy court to decide on the recovery plan, the tax impact will depend on the original cost basis of the asset(s) you had with Celsius. Most Celsius users will not receive in-kind (the same) assets they originally had. Even if you did receive in-kind assets, the treatment would be the same. In essence, the recovery asset gets the cost basis and holding period of the original assets held in the platform.

Depending on the cost basis and the market value of what you received, you could have an unrealized capital loss or a realized capital gain.

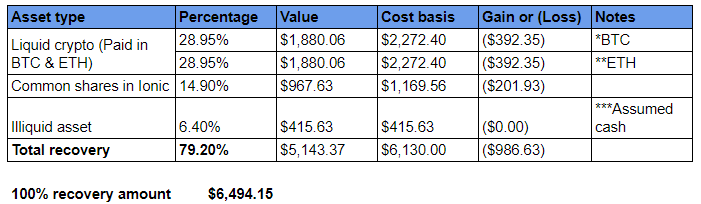

Loss scenario (common)

For example, Eric’s cost basis of his 6,000 USDC is $6,000, and the cost basis of his 10 AVAX is $130. The total cost basis of $6,130 ($6,000 + $130) is allocated proportionally (based on the fair market value) to the 0.0737497 BTC, 0.72955 ETH, the stock he receives, and the illiquid asset payout.

The value of what he receives ($5,143.37) is less than his original cost basis ($6,130), which results in an unrealized loss. Since these new assets have a higher cost basis he will realize less capital gains in the future. Each portion of the loss would be deductible only when he sells that asset.

For example, if Eric sells his ETH when he receives it, he would trigger a capital loss of $392.35 ($1,880.06 - $2,272.40).

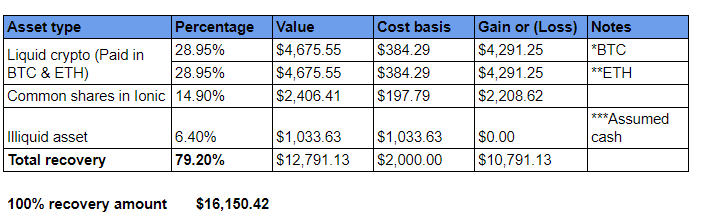

Gain scenario (rare, but possible)

While a loss is the most likely outcome from the recovery payments, there could be a situation where you have a taxable capital gain.

For example, Ellen deposited 0.5 BTC and 5 ETH with a combined cost basis of $2,000. Ellen receives 0.1088 BTC ($4,675.55) and 1.814 ETH ($4,675.55). Even though Ellen receives less BTC and ETH, she still has a capital gain of $10,791.13 to report on Form 8949 because the recovery amount ($12,791.13) is higher than the cost basis of the original assets held ($2,000).

How to enter in CoinTracker

Due to the complexity of the Celsius case, we cannot advise how to enter these recovery transactions into CoinTracker. We recommend speaking with a tax professional regarding your situation.

If you have reached a decision with your tax professional how you would like to record the transactions in CoinTracker but are having issues, please contact our support team.

CoinTracker integrates with 300+ cryptocurrency exchanges, 8,000+ cryptocurrencies and makes crypto tax calculations and portfolio tracking simple.

Disclaimer: This post is informational only and is not intended as tax advice. For tax advice, please consult a tax professional.