Are you confident in accurately reporting cryptocurrency earnings on your tax returns?

Stablecoins Are Booming, But What Are The Tax Consequences?

May 14, 2020 · 2 min read

This post was originally posted on Forbes by Shehan Chandrasekera on April 23rd, 2020

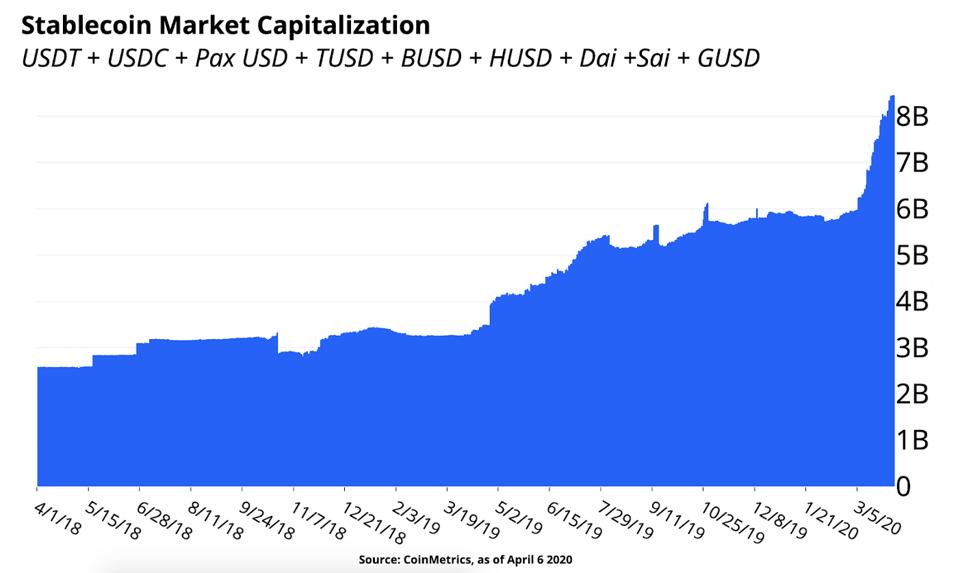

Under the radar, stablecoins have experienced hypergrowth over the past few years. Coinbase reports that the total stablecoin market capitalization has risen to an all-time-high of over $9 billion. On-chain value transfers of USD Coin (USDC) have recently reached all-time-highs of nearly $400 million per day. On top of this, one of the most hyped stablecoin projects, Libra, seems to be moving forward with its updated whitepaper v2. If Libra succeeds, stablecoins backed by several fiat currencies will be released to the circulation with potentially immediate mass global adoption.

Stablecoin Market Capitalization

COINMETRICS, AS OF APRIL 6 2020What are Stablecoins?

As the name suggests, stablecoins are designed to have a fixed price not affected by market forces. This is often achieved by tying each unit of a stablecoin to a fiat currency or an underlying asset. For example, stablecoins like USDC and GUSD are pegged to US dollars. Stablecoins like Dai are backed by a basket of cryptocurrencies.

Stablecoins are extremely important to the crypto ecosystem because they allow holding digital value shielded from the volatility of other cryptocurrencies like bitcoin, as well as transfer of stable value between exchanges. By combining price stability with other beneficial characteristics of cryptocurrencies (high security, low transaction fees, and programmability), stablecoins appear to be driving the next wave of growth for the crypto industry and its verticals.

Stablecoin Taxes

From a tax perspective, there are no distinct rules applicable to stablecoins; stablecoins are treated as “property” under IRS Notice 2014-21, similar to any other cryptocurrency like bitcoin and ether.

Although stablecoins are praised for maintaining steady prices, the concept is not perfect yet. In practice, it's extremely difficult to achieve a perfect 1:1 ratio between stablecoin and the underlying fiat currency, leading to some unfavorable tax outcomes under “property” tax treatment. For example, let’s say you receive 1,000 USDC at $1.00 each. You then spend 1,000 USDC to buy bitcoin. At the time you spend the 1,000 USDC, the value of 1 USDC is $1.02. This would result in $2 (1,000*($1.02 - $1.00)) of capital gains under current tax rules. While stablecoins are meant to be completely pegged to fiat, these slight fluctuations in price from one exchange to the next can result in unintended taxes.

Further, this tax treatment also puts an unnecessary burden on stablecoin users to track cost basis and figure out fair market value each time they dispose of coins leading to unintended bottlenecks. Consequently, it is reasonable to think that stablecoins should be exempted from taxation because they do not work as a speculative asset, and the unintended minor gains/losses are immaterial.

Recently, the controversial topic of stablecoin taxes was brought up at the IRS Virtual Currency Summit held in Washington DC in March, 2020. While some argue that taxing stablecoins doesn’t make sense because they aren’t speculative assets, unfortunately, until more specific guidance is issued to address stablecoins, they are subject to generic “property” taxation and will result in capital gains taxes.

Feedback or questions? Reach out to us on Twitter @CoinTracker

Disclaimer: this post is informational only and is not intended as tax advice. For tax advice, please consult a tax professional.