Are you confident in accurately reporting cryptocurrency earnings on your tax returns?

The first 10 Cryptocurrencies you meet

A very brief primer on the ten most (currently) prominent cryptocurrencies & blockchains: BTC, ETH, ADA, USDT, BNB, XRP, UNI, LTC, LINK, and DOGE.

March 10, 2021 · 13 min read

This post is authored by Knifefight (subscribe here).

A very brief primer on the ten most (currently) prominent cryptocurrencies.

1. Bitcoin (BTC)

Market Cap: $914B

The original and still the champion, Bitcoin is an industrial-strength, military grade combat-ready currency. Impossible to counterfeit, seize or censor. The world’s first digitally scarce object, founded and released pseudonymously by creator Satoshi Nakamoto. Bitcoin is a technology for saving that allows ordinary people to store their wealth beyond the reach of seizure or dilution by the state.

For more on Bitcoin you can see our deep dive on owning Bitcoin here or consider Satoshi’s elegant metaphor of Bitcoin as a teleporting metal:

"As a thought experiment, imagine there was a base metal as scarce as gold but with the following properties: - boring grey in colour - not a good conductor of electricity - not particularly strong, but not ductile or easily malleable either - not useful for any practical or ornamental purpose and one special, magical property: - can be transported over a communications channel If it somehow acquired any value at all for whatever reason, then anyone wanting to transfer wealth over a long distance could buy some, transmit it, and have the recipient sell it. Maybe it could get an initial value circularly as you've suggested, by people foreseeing its potential usefulness for exchange. (I would definitely want some)"

Me too, Satoshi. Me too.

2. Ethereum (ETH)

Market Cap: $176B

Ethereum is the leading smart-contract platform in the ecosystem today. Founded in 2015 by Vitalik Buterin, Ethereum’s main value proposition is that it is Turing Complete, which basically means you can run arbitrary code on it. Bitcoin’s codebase is very, very conservative to minimize security risks - one of the ways that manifests is that you can’t do very much with Bitcoin other than store it or send it to someone else. You can do some fancy-footwork with multisig and nLockTime but its pretty limited overall. Ethereum is the opposite - if you can run a program on an ordinary computer, you can run it on the Ethereum Blockchain.

There are other key differences between the two systems as well. Satoshi launched Bitcoin with months of advance notice and no special carve-out for him as the founder. Ethereum launched with a significant (~63%) pre-mine, some of which the developers kept and most they sold to the general public for Bitcoin.

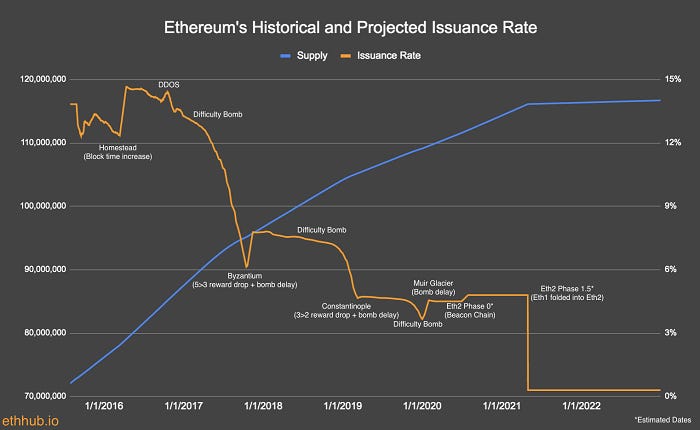

Bitcoin is intended by design to be very difficult to change to protect it from even well meaning desires to meddle with its core promises. Ethereum has had more of an ethos of evolution. One way you can see that is in the supply curve:

An Ethereum advocate would look at this graph and point out that the issuance rate has generally gone down over time and is well under the projected issuance originally set out in the whitepaper. A Bitcoin maximalist would ask, if there is a group of people who you trust to control the interest rate in the economy, why not trust them to verify transactions as well? Then you could skip the blockchain and track things orders of magnitude more cheaply in an ordinary database.

Centralization is a consistent theme of complaints about Ethereum and the things built on top Ethereum. Nodes are notoriously difficult to run so many more users rely on centralized services like Infura. Vitalik is a known founder with large ongoing influence in the community. But there is no denying that a host of very interesting innovations are appearing on top of Ethereum’s decentralized computer. We explored the psychedelic garden of DeFi in greater detail here and we talked about NFTs and the frontier of art here.

3. Cardano (ADA)

Market Cap: $37B

Cardano was founded by one of the early Ethereum developers, Charles Hoskinson, after he left the Ethereum Foundation. Unlike the proof-of-work chains that power Ethereum and Bitcoin, Cardano uses a proprietary approach they call the Ouroborus protocol named after the mythological snake Cardano fans can’t wait to mansplain to you. Ouroborus is a proof-of-stake protocol, meaning that rather than running mining algorithms to secure the blockchain individual node operators are asked to "stake" some of their ADA tokens which they lose if they validate dishonestly.

Cardano advocates claim that Ouroborus is as flexible as Ethereum, as secure as Bitcoin while also being more scalable and with less environmental footprint. I’m skeptical. In general in cryptocurrencies there are trade-offs worth exploring but there is no such thing as a free lunch - anytime someone tells you they have a scalable blockchain but they can’t tell you what they sacrificed to achieve it, they probably sacrificed centralization.

Unfortunately I couldn’t find any good simple explanations of how Ouroborus actually works, although they do have a blizzard of academic style papers for each of the eleven different updates on their "path to decentralization." The Bitcoin whitepaper is eight and a half pages long, including citations - the first Ouroborus paper is 67 pages. The reason this matters by the way is because for a system to truly be decentralized most people need to understand it. If the truth of how it works is enshrouded in an academic veil that only a handful of experts understand, those experts effectively have control of the system. They may as well be a central bank.

It’s hard to know exactly what you’re buying when you’re buying ADA but that’s probably OK because it’s obviously going to keep changing to whatever Charles Hoskinson thinks it should be next.

4. Tether (USDT)

Market Cap: $36B

Tether is a different animal entirely and arguably not even really a cryptocurrency at all. Tether was created by Tether Limited, which is essentially a branch of the exchange Bitfinex, although they worked hard to hide that fact until the Paradise Papers leaked.

Tether works like this: you give your dollars (USD) to Tether Limited and they give you the same number of Tether tokens (USDT) back. Tether promises not to lose your money or steal it or print Tether tokens that nobody paid for. You promise not to do crimes or evade banking laws with your new USDT. Everyone kind of knows you both don’t really mean it. You might be wondering how you turn your USDT back into USD and the answer is you do not. That is not one of the services that Tether offers.

So Tethers are supposed to be worth $1, and in general they roughly are. There are two main use cases for Tether users. First, you can use Tether to play some of the exotic financial games being invented on Ethereum and other smart contract platforms while still keeping your assets denominated in dollars. Secondly and more importantly you can send Tether to places that your bank would otherwise refuse to send dollars, usually a cryptocurrency exchange.

Tether the company is overall pretty shady - they just got done with a multiyear battle with the New York Attorney General over how they handled the reserves for USDT. Many people are periodically worried that Tether represents a systemic threat to the cryptocurrency ecosystem. This is why I’m not.

5. Binance Coin (BNB)

Market Cap: $35B

Binance Coin (BNB) is one of a handful of tokens launched by exchanges that allow users to speculate on the success of the exchange itself while studiously avoiding comparisons to selling equity in the company, which would be highly regulated.

For Binance the model works like this: BNB initially launched with 200M tokens, half sold to the public and half kept by Binance. Every quarter Binance buys a certain amount of BNB off the market proportional to how many trades took place that quarter. Given that Binance makes its money from trading fees, so you might wonder what the difference is between selling tokens and then buying and burning them with your profits and selling shares of stock to the public and then doing stock buybacks with your profit. The answer is they are very different because selling stock has a lot of rules and selling tokens is much easier and more relaxed.

You can also use BNB to pay trading fees on Binance or transaction fees on the Binance Smart Chain (BSC) so Binance has some convenient plausible deniability. Users weren’t trying to invest in the growth of the business - they just wanted $35B worth of discounted trading fees! Users are very frugal.

6. Polkadot (DOT)

Market Cap: $31B

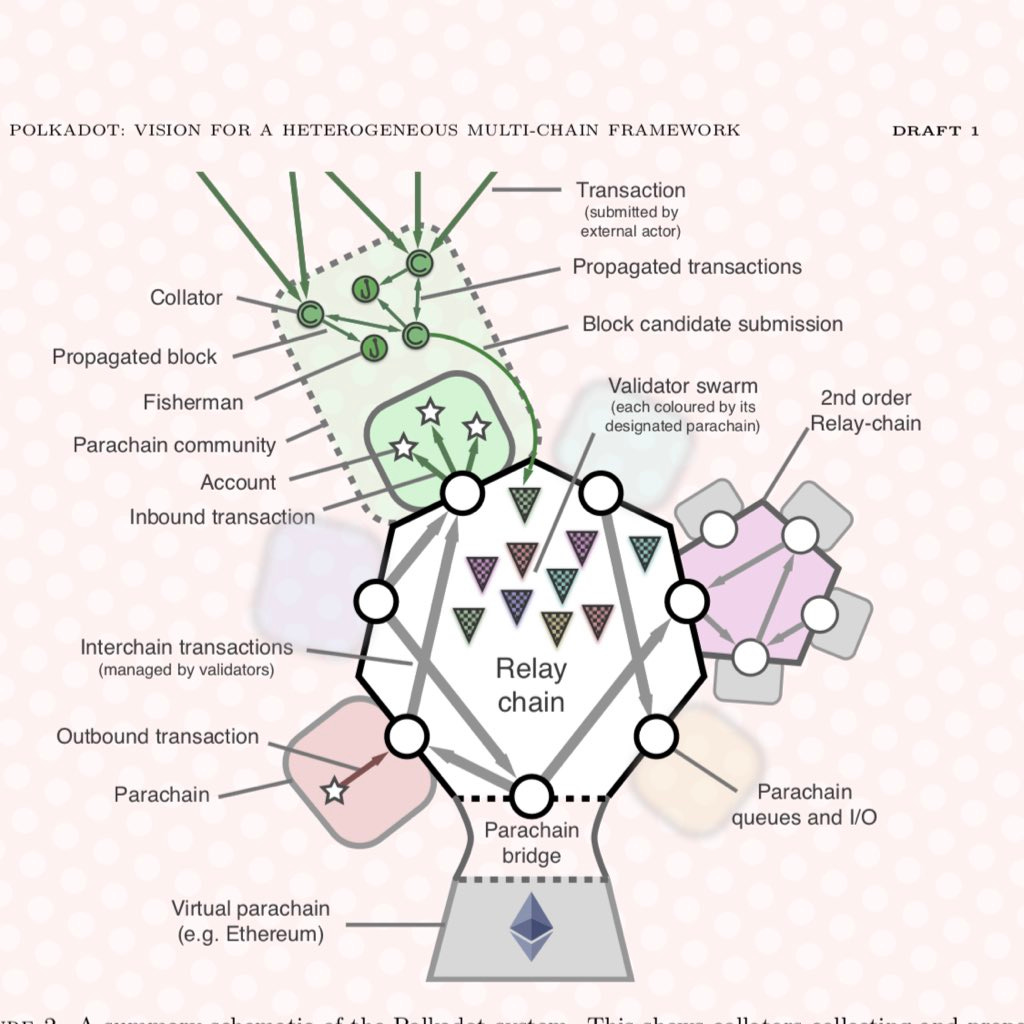

Another one of the early developers on Ethereum, Gavin Wood, founded Polkadot as a kind of meta-blockchain that is meant to bridge different blockchains in a multi-blockchain world. As we talked about in the section in Cardano above, to be decentralized a system has to be understandable to wide swath of the userbase. If only a few experts understand what is happening they will inevitably end up in control of the system because no one else will be able to keep them accountable. Anyway here is a diagram from Page 6 of the 21 page Polkadot whitepaper:

When Satoshi invented Bitcoin he only used one made up term: Bitcoin. Everything about Bitcoin was built with well understood component pieces.

Polkadot's advocates would tell you that a multichain universe is inevitable but I personally am a bit more inclined to expect one or very few chains, so interoperability may not be as critical as it seems. Blockchains are very expensive, and we probably don't need to run very many to accomplish everything useful they can do. Plus planning on being inter-blockchain blockchain is betting on all the success of all those networks before your opportunity even arises.

7. Ripple (XRP)

Market Cap: $21B

Ripple is the name of both a cryptocurrency (XRP) and a company (Ripple Labs). When Ripple created XRP they kept ~60% of it, and the majority of Ripple’s income comes from selling XRP. Ripple would like very much for you to think of XRP as a naturally occurring commodity they discovered in the wild rather than unregistered securities they created to sell. The SEC does not agree and is currently suing Ripple Labs.

XRP uses a different consensus algorithm than any of the others we’ve described above. The Ripple consensus algorithm is kind of like a high-speed digital hawala. Unlike some of the other algorithms we’ve discussed its actually pretty legible and it does seem to do more or less what it claims to do on a technological level. Unfortunately, the Ripple consensus algorithm does not actually require a token - you can use it with any currency. XRP is a completely redundant element that exists only to be sold by Ripple Labs.

Ripple Labs positions XRP as an inter-banking currency intended for international foreign exchange, but they only actually use it in the smallest of their three products and part of the SEC’s complaint is that they artificially incentivized use of that product by giving their partners kickbacks (in the form of XRP). Ripple then turned around and advertised these partnerships as signs of XRP’s imminent success while continuing to unload tokens.

The only product that uses XRP is built by Ripple, its only users need to be bribed to use it, and Ripple’s main source of income comes from selling it - not using it. Personally that does not instill me with confidence.

8. Uniswap (UNI)

Market Cap: $16B

UNI is the governance token for a decentralized exchange called Uniswap built on top of the Ethereum platform. Uniswap allows its users to "swap" different types of tokens with each other similar to traditional exchanges like Binance or Coinbase but with less centralized control. The UNI token lets its holders vote on the rules that govern Uniswap, like whether to change fees or how to spend funds from the community treasury. UNI is an ERC-20 token, which means that it relies on the Ethereum network rather than operating its own consensus algorithm.

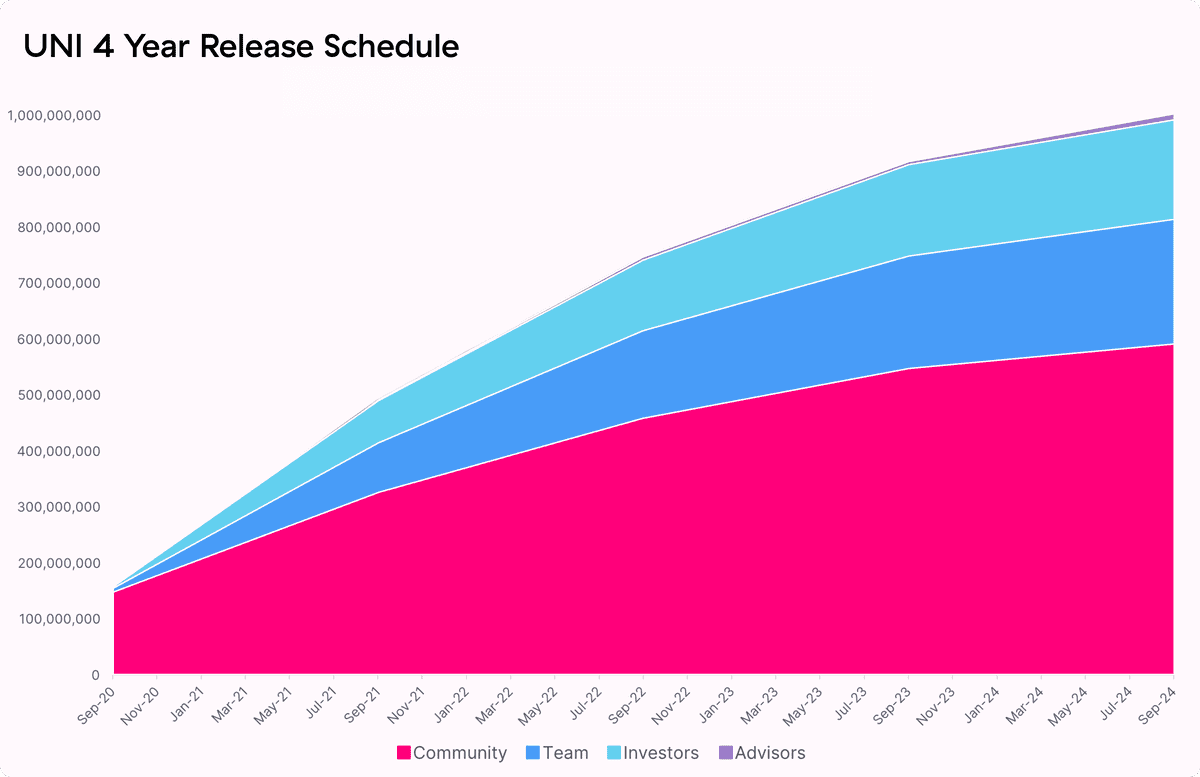

Governance tokens function somewhat like owning stock in a company - in fact Uniswap’s introduction page for UNI includes a vesting schedule for developers very similar to the equity vesting schedule for a tech startup.

UNI was distributed retroactively to users who had been active on the Uniswap exchange before the token drop and new tokens are distributed via a process known as liquidity mining, which you can learn more about here. In addition to voting rights the UNI holders have the option to collect a 0.05% fee on every transaction on the platform, though it hasn’t been exercised yet. At this point Uniswap’s daily volume is typically ~$1B - comparable to Bitfinex or Kraken - so that would be ~$0.5M/day in fees if activated.

Advocates of UNI argue that a multi-token world is inevitable and a trustless way to exchange those tokens will inevitably be valuable. Being entirely open-sourced, though, Uniswap faces stiff competition from clones of itself - most notably SushiSwap (also on Ethereum) and PancakeSwap (built on Ethereum clone BSC). Uniswap has the first mover advantage and the network effect but it is not clear what the long term competitive equilibrium will look like, even in a multi-token world.

9. Litecoin (LTC)

Market Cap: $12B

Litecoin is not the oldest altcoin (that would be Namecoin, in 2011) but Litecoin is the oldest altcoin still in widespread use. Litecoin uses the same proof-of-work structure as Bitcoin but replaced the mining encryption that Bitcoin uses (SHA-256) with a different encryption scheme (Scrypt), which was intended to prevent the design of dedicated litecoin mining rigs. (Narrator: It did not.)

Litecoin presented itself as "the silver to Bitcoin’s gold" and more or less is just a copy of Bitcoin with a few parameters tweaked to fit this narrative: there are 4x as many total Litecoin as there are Bitcoin and blocks happen 4x as frequently. More frequent blocks was intended to give the impression of being "faster" but since security doesn’t come from the blocks themselves but from the amount of hashpower needed to create them that’s a bit like turning a dollar into four quarters and calling it a raise.

Litecoin’s original premise is widely dismissed these days, but it does continue to have an interesting value proposition as a kind of "real money" testnet for Bitcoin, since it is similar enough for a lot of Bitcoin technology to deploy to either network and Litecoin is generally smaller and faster moving. The original founder of Litecoin, Charlie Lee has sold all of his Litecoin holdings and is no longer an active developer.

10. Chainlink (LINK)

Market Cap: $11B

Chainlink is also a smart contract platform, akin to Ethereum, Polkadot and Cardano. The Chainlink pitch focuses specifically on connecting smart contracts to the "real world." Blockchains are very useful for keeping track of things that only exist on blockchains like bitcoin, ether or ERC-20 tokens. But they don’t know anything outside the universe of their blockchain like the Dow Jones Industrial Average or the price of silver.

A lot of financial contracts have clauses that depend on these kinds of external signals, so Chainlink is intended to support that by enabling oracles - i.e. third parties who provide data signals to be used by smart contracts on the Chainlink platform. In theory the oracles should be paid for accurately reporting data and punished for inaccurately reporting data, similar to mining in proof-of-work (which Chainlink also uses). Chainlink advocates describe the feeds as crypto-economically secure.

Unfortunately that doesn’t seem to actually be the case:

Chainlink oracles are *not* cryptoeconomically secured.

— Eric Wall 🟧 (@ercwl) March 2, 2021

That’s the whole problem with Chainlink. This tweet is bollocks.

If you need evidence of this statement, look up the XAG-USD incident from February 2020 when false data was reported. The cryptoeconomical penalty? None. 0. https://t.co/Dtrwe2rCLU

The issue in question was a human-error incident in which an oracle mistakenly quoted the price of silver (~$18) as the price of gold (~$1600) for a period of about six hours. There were ultimately no economic consequences for the oracle in question. That’s not necessarily morally troubling, since it seems to have been a genuine good-faith error. But the problem if the system doesn’t punish mistakes it is not "crypto-economically" enforcing accuracy.

Without economic incentives to enforce reliability in the oracles you are forced to trust the oracles, which means your platform is not trustless and the blockchain running it is just very expensive theater.

Honorable Mention: Dogecoin (DOGE)

Market Cap: $6.6B, currently #15 on coinmarketcap.com

Dogecoin was founded in 2013 as a joke making fun of the first generation of altcoins. Its main value proposition was having an absurdly large number of tokens, which meant the value of each individual token was absurdly small. Thus DOGE made good play money, where you could send someone 10,000 of something for less than a nickel. A community formed around the silliness - giving each other meaningless tips, organizing charity drives, making quality memes:

The DOGE community is extremely friendly and fun - what they are not, sadly, is very fiscally responsible. A bug in the original code means that the supply of DOGE is not fixed (as intended) but will keep growing forever. Scams have been pretty common in the space because DOGE users are often both trusting and careless with their money. Both founders have since left the project in part out of concerns that it was enabling things it was meant to satirize.

Still, DOGE is having another moment in the sun. Price hit an all time high this year behind support from celebrities ranging from Mia Khalifa to Mark Cuban to Gene Simmons to Elon Musk. This is all in good fun and I do enjoy the joke but I also want to caution people not to rely on Dogecoin as a serious endeavor because it is not. There is only one developer and the network itself is in extremely poor health.

1/ It's time to have a conversation about #Dogecoin.

— Lucas Nuzzi (@LucasNuzzi) February 12, 2021

If you're invested in $DOGE after @elonmusk's much endorsement (such wow), there are a couple of things that you should probably know👇

How to think about a cryptocurrency generally

It is tempting to think of new cryptocurrencies as a chance to either (a) get in early on the next Bitcoin or (b) hedge their crypto portfolio against something overtaking Bitcoin. But I generally think those lead you to bad outcomes for a couple of reasons.

First, different cryptocurrencies don’t get you the benefits of diversification because the entire cryptomarket moves together much more than individual cryptocurrencies move relative to each other. The broader world is still waking up to the idea that cryptocurrencies are a thing at all, let alone forming different opinions about different crypto technologies. So owning a portfolio of cryptocurrencies is like owning a portfolio of gold mining companies - there are different tickers but they are so correlated they don’t buy you much in the way of portfolio diversification.

Second, the vast majority of cryptocurrencies (literally thousands) have a brief spike in value at launch and then trend inexorably to zero. In practice they have functionally been cash grabs for founders and little else. Diversifying your portfolio into the long tail of crypto-assets is like selling your cows so you can diversify into magic beans. Don’t expect it to be a winning strategy.

Third, there will not be a next Bitcoin. That’s not to say there won’t be new opportunities to make money in the crypto space - there definitely will. But whatever they are, they won’t look like Bitcoin. They will be completely different things like liquidity mining or NFTs. Anything that pitches itself as "Bitcoin only better" is probably better at solving the problem of convincing you to give the founders money than solving any actual problem in the real world.

CoinTracker integrates with 300+ cryptocurrency exchanges, 3,000+ blockchains, and makes bitcoin tax calculations and portfolio tracking simple.

Disclaimer: This post is informational only and is not intended as tax nor investment advice. For tax or investment advice, please consult a tax or financial advisor.