Ultimate Australia Crypto Tax Guide (2023 - 2024)

Jul 26, 2022・16 min read

Introduction

Cryptocurrency is complicated, and adding in taxes can be headache-inducing. This guide breaks down everything you need to know to get your Australian cryptocurrency taxes filed with the Australian Taxation Office (ATO).

History of Australian cryptocurrency taxes

On December 17, 2014, ATO guidance on cryptocurrency taxation went into law. Since then, the ATO has published general guidance on cryptocurrencies.

2025

Crypto Tax

Guide is here

CoinTracker's definitive guide to Bitcoin & crypto taxes provides everything you need to know to file your 2024 crypto taxes accurately.

How does the ATO know you owe crypto taxes?

The ATO estimates that there are between 500,000 to 1,000,000 Australians who own cryptocurrency. Beginning in late 2019, the ATO started collecting records from Australian cryptocurrency designated service providers (DSPs) on an ongoing basis to ensure people were tax compliant. DSPs include (but are not limited to) brokerage services, payment facilitators, cryptocurrency exchanges, and bitcoin ATM providers. The ATO aims to collect some or part of the data points listed below from 2014 onward.

The types of information included in these records include:

Digital currency owner details

- Name

- Address

- Australian Business Number

- Date of birth

- Phone numbers (fixed-line and mobile)

- Email address

- Social media accounts (Facebook, Twitter, Telegram, Reddit, etc.)

- Account and transaction details

Account and transaction details

Status of account (open, closed, suspended, lost, etc.)

- Linked bank accounts

- Wallet address associated with the account

- Lost or stolen (crypto)currency amounts linked to accounts

- Unique identifier

- Transaction date

- Transaction time

- Type of (crypto)currency

- Amount (in fiat and cryptocurrency)

- Type of transfer

- Transfer description

- Total account balance

This means that every time you make any cryptocurrency transactions there is an electronic record that is being reported to the ATO by the DSP. When you lodge your tax return, the ATO system tries to match what you reported vs what has been reported to the ATO by the DSP. This matching system is in place to make sure taxpayers are disclosing cryptocurrency activity accurately and paying the right amount of taxes.

ATO crypto tax warning letters

On March 11, 2020, it was reported that the Australian Taxation Office (ATO) had started sending tax notices to 350,000 Australians who had cryptocurrency transactions.

Usually, for cost-benefit reasons, tax authorities focus on taxpayers with large amounts of omitted or underreported taxes. However, currently, in Australia, the ATO seems to be cracking down on taxpayers with even small amounts of crypto transactions given the automated processes they have in place for generating tax letters and scanning for underreported transactions.

This underscores the importance of accurate & complete cryptocurrency tax reporting and that no one is immune from the ATO oversight.

How do cryptocurrency taxes work in Australia?

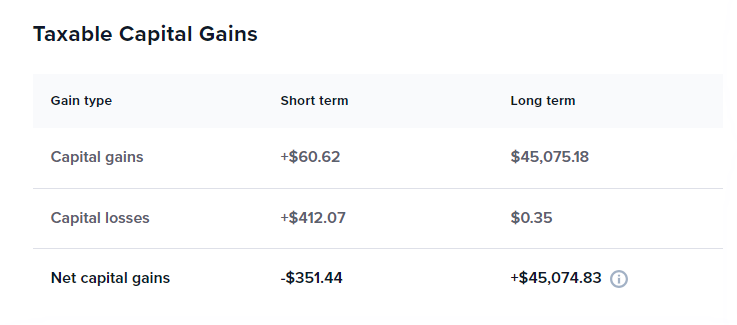

In short, cryptocurrencies are subject to capital gain tax (CGT) and ordinary income tax in Australia, depending on the circumstances of the transaction.

CGT is the tax you pay on the difference between the Australian Dollar (AUD) value of the disposed asset at the time of the disposition minus the AUD value of the disposed asset at the time it was acquired.

If the assets have been held by an individual for more than 12 before selling, you can apply a CGT discount:

- 50% for resident individuals (including partners in partnerships)

- 33.33% for complying super funds and eligible life insurance companies

- 50% discount is removed or reduced on capital gains made after 8 May 2012 for foreign resident individuals

Total taxable capital gain = (capital gains – capital losses) * capital gains discount = (capital proceeds – (cost basis + fees)) * capital gains discount

Note: capital losses are subtracted from capital gains before applying any relevant CGT discounts

If the assets have been held for 12 months or less, then CGT discounts do not apply.

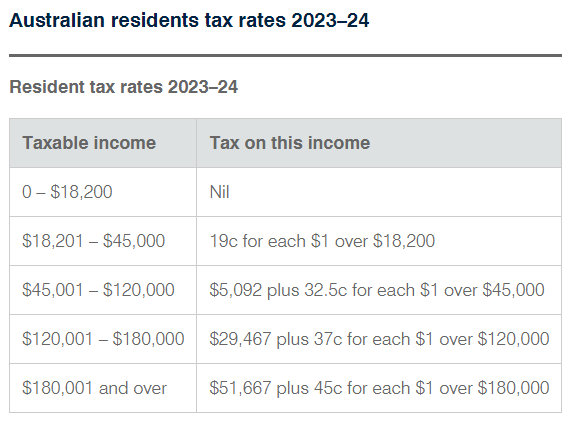

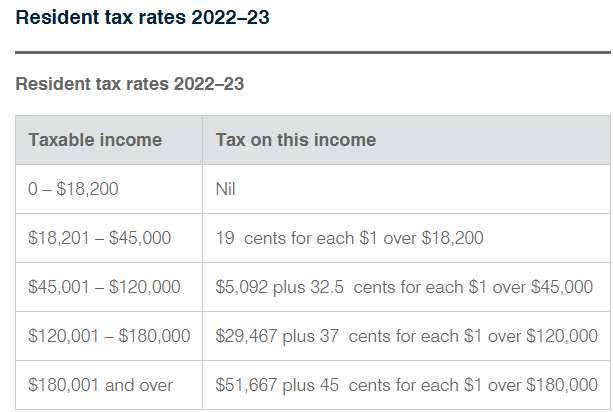

Non-CGT events such as receiving crypto DeFi income are considered ordinary income. Net capital gains and your ordinary income will constitute your total assessable income. Total assessable income will be taxed based on these rates.

Luckily, cryptocurrencies are exempt from goods and service tax (GST) effective July 1, 2017.

Buying cryptocurrency

There are no taxes involved when you buy cryptocurrency using fiat currency (e.g. Australian Dollars).

However, you need to keep track of how much you paid and when you made each purchase for your capital gains calculations down the line.

Selling cryptocurrency

Selling cryptocurrency for fiat currency (e.g. Australian Dollars) triggers capital gains tax.

For example, let’s say Sam bought 1 bitcoin (BTC) for A$5,000 five years ago. 1 BTC is now worth A$12,000. If he were to sell his BTC and cash out, he would have to pay taxes on A$7,000 (A$12,000 – A$5,000) of capital gains.

Trading crypto-to-crypto

Buying one cryptocurrency using another cryptocurrency triggers capital gains tax.

For example, let’s say Sam buys 1,000 ether (ETH) using 1 bitcoin (BTC). Sam purchased 1 BTC five years ago at A$1,000. At the time he purchased 1,000 ether, 1 BTC was worth A$10,000. In this case, Sam has a capital gain of A$9,000 (A$10,000 – A$ 1,000).

Transferring cryptocurrency

Moving your cryptocurrency from one wallet or exchange to another wallet or exchange that you control is non-taxable.

Crypto tax software like CoinTracker can automatically detect transfers between your wallets & exchanges, and make these transactions non-taxable as long as all your wallets are synced to the platform.

Buying goods/services with cryptocurrency

Personal use purchases with cryptocurrency (less than A$10,000) are excluded from taxes.

For example, if you buy goods or services for yourself as an individual (no more than A$10,000), such as a latté at your favourite coffee shop, then no taxes apply to that transaction. If the cost basis of the cryptocurrency used in the transaction exceeds A$10,000, the personal use exemption does not apply and CGT applies as it would normally.

See the “Personal use asset” section below to see if you qualify for personal use asset exemption.

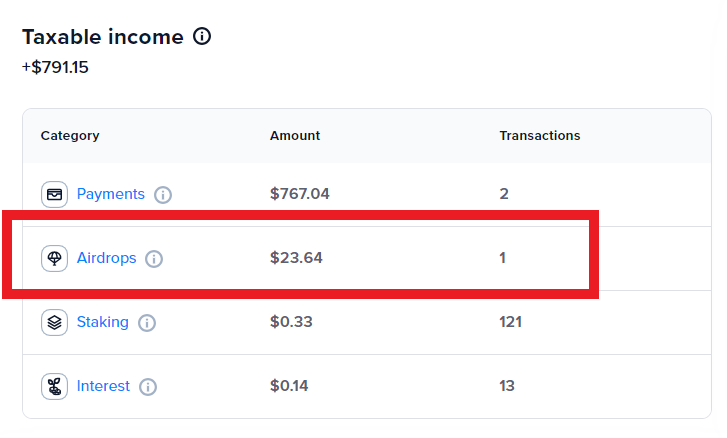

Airdrops

Airdrops trigger income tax.

Some cryptocurrency projects send free coins to users to promote their projects (marketing). If you receive coins through an airdrop, you have to report the value of those coins as ordinary income at the time of the receipt. The amount you report as ordinary income will be the cost basis for those coins going forward.

For example, on January 3, 2022, Sarah receives 1,000 ABC coins from a new crypto project. On this day, 1 ABC coin is worth A$0.10. On January 3, 2022, Sarah has to report A$100 (1,000 x A$ 0.10) of ordinary income.

This amount is reflected under the “Airdrops” line on the Taxable Income card in CoinTracker’s Tax Center.

If the price of 1 ABC goes up to A$0.50 on June 15, 2022, and Sarah were to sell her 1,000 airdropped ABC coins, she would have a capital gain of $400 ((A$ 0.50 - A$ 0.10) x 10).

The capital gain amount is reflected on the “Capital gains” card in the CoinTracker Tax Center.

Forks (aka Chain Splits)

When one blockchain splits into two or more chains, there is a fork (also called "chain split"). The ATO lays out guidance for how these events work depending on the type of chain split:

- If the original chain still exists: the new forked asset has zero basis and you only pay CGT when you dispose of the new asset. The original asset is not impacted. There is no ordinary income.

- If there original chain is abandoned: the new assets all have a zero basis and CGT only applies when you dispose of the new assets. The original coin is treated as a 100% capital loss. There is no ordinary income.

BTC/BCH example

Let's say you receive 1 Bitcoin Cash (BCH) for every Bitcoin you previously held in 2017, you will not recognize any income at the time you receive the BCH. The cost basis of that BCH is zero. In 2022, If you sell that BCH for A$1,000, that will trigger a capital gain of A$1,000 ($1,000 – $0). You can also get a CGT discount on this because you held the BCH for more than 12 months.

Figuring out which cryptocurrency is the new asset from the chain split and which one is a continuation of the original chain depends on examining the "rights and relationships existing in each currency." In the case above, Bitcoin (BTC) was a continuation of the original chain with the same rights and relationships as before, and therefore is the continuing asset. Bitcoin Cash (BCH) is arising from the chain split, and is therefore the new asset with a zero basis.

ETH/ETC example

In the case of the Ethereum split on July 20, 2016, we ended up with two assets: Ether (ETH) and Ether Classic (ETC). Since ETC maintains the rights and relationships of the original chain, that is the continuing asset. ETH on the other hand is the new asset arising from the chain split and therefore takes on zero basis.

BCHABC/BSV example

Let's look at the case of the BCHABC/BSV hard fork. Just before the chain split on November 15, 2018, you acquire 10 Bitcoin Cash (BCH) for $8,300. Then after the split you have 10 BCHABC and 10 Bitcoin Satoshi's Vision (BSV). However since the original blockchain has been abandoned and both projects involve changes to the core consensus rules, you can completely write off the original BCH. This is because miners using the pre-fork software wouldn't be able to find blocks on either the ABC or SV chains.

Therefore an $8,300 capital loss would apply to the original 10 BCH and the new 10 BCHABC and 10 BSV would each have zero basis.

Note: if the forked coin is held by a business instead of an individual, then the coin will continue to be treated as trading stock instead of a capital gain asset. The asset must be brought to account at the end of the income year.

Source: ATO Guidance

Mining

Mining cryptocurrency is taxable for businesses, not hobbyists.

Income received from cryptocurrency mining is subject to taxes under the ATO rules. The type and amount of tax depend on whether you are a mining hobbyist or a business miner.

Hobbyist miners

Mining cryptocurrency as a hobbyist is nontaxable.

If you are mining cryptocurrency as a hobby, you do not have to report any income at the time you receive the mined coins. You only have to pay taxes when you sell your mined coins in the future. Unlike business miners, hobbyist miners do not get to deduct costs associated with cryptocurrency mining such as equipment costs, subscription fees, and electricity costs.

For example, Sam runs a couple of mining machines in his dorm room. He received 0.01 BTC on January 1, 2022 (worth A$10,000 at the time). On May 15, 2022, he sold this 0.01 BTC for A$2,000.

On January 1, 2022, there is no taxable event for Sam because he is a hobbyist miner. Therefore, the cost basis of his 0.01 BTC in his hands is zero. On May 15, 2022, Sam faces a taxable event when he sells his BTC. He has to report A$2,000 (A$2,000 – A$0) of capital gains.

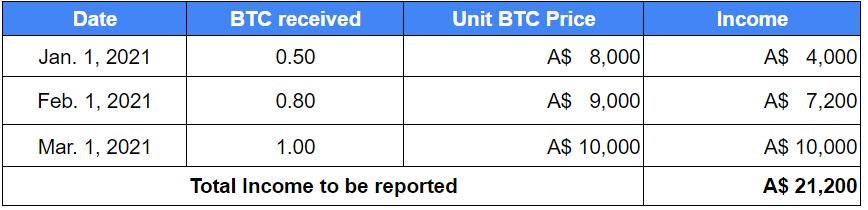

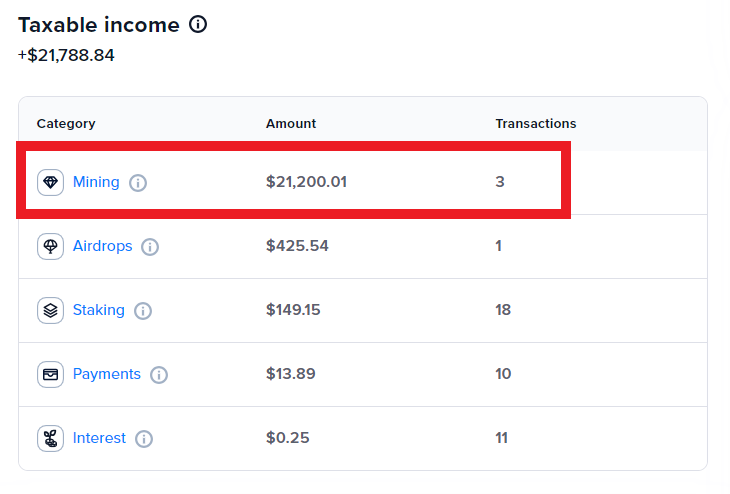

Business miners

Business mining triggers income tax at the time of mining.

If your mining operation qualifies as a business, you have to report the fair market value of the tokens received at the time of receipt. The amount to be reported in AUD is reflected in the “Mining” line on the “Taxable Income” card in CoinTracker’s Tax Center. If you have a mining business, you are eligible to deduct mining-related business expenses like equipment, electricity, etc.

For example, Sarah runs a cryptocurrency mining business and receives mining rewards at the intervals below:

Getting paid in cryptocurrency

Getting paid in cryptocurrency is subject to income tax.

If you get paid in cryptocurrency, you have to include the fair market value of the cryptocurrency as ordinary income.

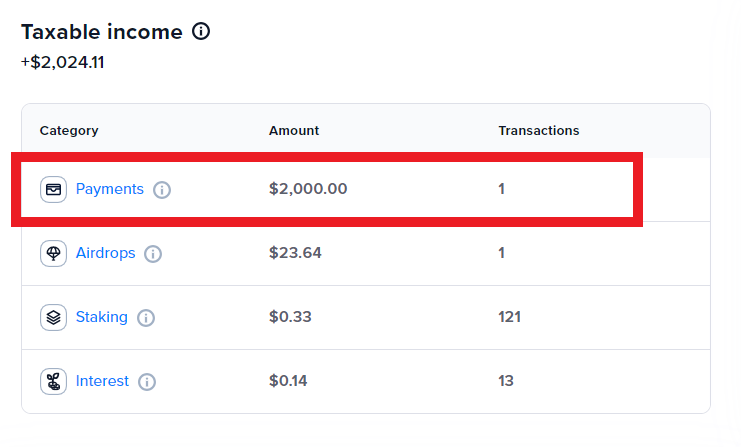

For example, Sam works for a startup and received 1 BTC on August 15, 2021, as compensation. At the time of the receipt, 1 BTC was valued at A$2,000. Sam has to report A$2,000 of income when he files his 2021/2022 income tax report. Sam can mark his income receipt as “payment” on the CoinTracker transaction page. This will automatically calculate the 1 BTC to the AUD fair market value at the time of the receipt and aggregate the amounts across all payments on the “Payments” line of the “Taxable Income” card on the CoinTracker Tax Center.

Initial Coin Offerings (ICOs) and Initial Exchange Offerings (IEOs)

ICOs and IEOs are probably subject to capital gains tax when disposed of/traded/sold.

The ATO has not issued any guidance specific to ICO and IEO taxation. Based on the general guidance, it’s likely intended that any time you are involved with selling or exchanging a token — ICO or otherwise — that creates a taxable event.

If you have a complicated situation, you can reach out to CoinTracker support or the ATO directly to initiate an early engagement discussion.

Stablecoins

Stablecoins are subject to capital gains tax when disposed of/traded/sold.

The ATO has not released any specific tax guidance for stablecoins. That means, in the eyes of the ATO, a stablecoin is taxed the same as other cryptocurrencies like bitcoin. Since most stablecoins aren’t 100% tied 1:1 with fiat currency (e.g. USD, AUD, etc.) any slight difference between the purchase price and selling price is subject to capital gains tax. In some situations, this will be zero, and in others, it can add up to significant sums.

Staking

Staking rewards are subject to income taxes.

Staking is similar to earning interest in your bank account. Just as you pay income taxes on the interest you earn in your bank, you’re subject to income tax on staking rewards from staking cryptocurrencies like Dash, NEO, and Tezos. You can leave these coins in your wallet and/or exchange that supports staking, and receive periodic payouts based on the amount of funds you stake.

According to ATO, the value of the tokens received is treated as ordinary income at the time they are received. Other consensus mechanisms that reward existing token holders for their role in maintaining the network have the same tax outcomes. This includes rewards derived through Proof-of-Authority and Proof-of-Credit mechanisms by Validators, Agent Nodes, Guardian Nodes, Premium Stakers and other entities performing comparable roles.

Token holders who participate in “proxy staking” or who vote their tokens in delegated consensus mechanisms, and receive a reward by doing so, also derive ordinary income equal to the money value of the tokens they receive.

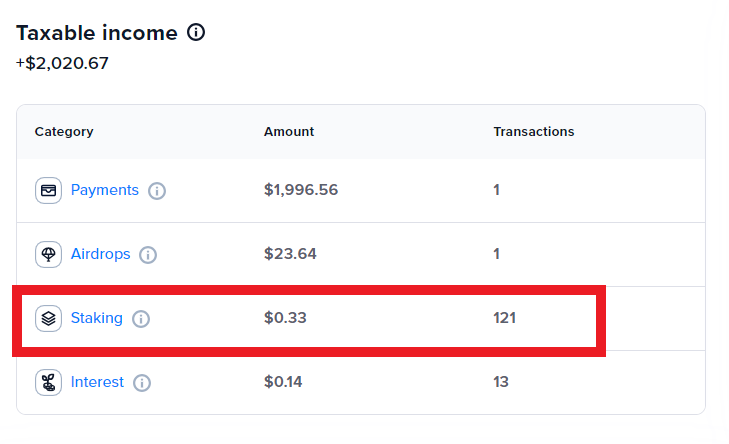

Once you connect your exchanges and wallets to CoinTracker, it can detect staking rewards and aggregate the amount under the “Staking” line on the “Taxable Income” card.

Gifts

Cryptocurrency gifts are subject to capital gains tax.

When you gift cryptocurrency, the ATO treats it as a disposition event that triggers CGT.

For example, Sarah gifts 1 BTC to her mother. Sarah purchased her bitcoin five years ago at A$1,000. At the time of the gift, 1 BTC is worth A$5,000. Therefore Sarah has to report $4,000 of capital gains (A$5,000 – A$1,000). Sarah’s mom does not have any taxable event at the time she receives the gift. Her cost basis on the 1 BTC will be zero.

Donations

Cryptocurrency donations to registered charities are non-taxable.

If you donate your cryptocurrency to a registered charity, it is not considered a taxable event. Additionally, you can claim the amount (calculated as a fair price for the cryptocurrency at the time it’s donated) as a deduction on your tax return.

Margin trading and DeFi

The ATO has not released any specific guidance on margin trading or DeFi. In the absence of these guidance, the best way to be compliant is to analyse your specific transactions and see if there is a disposition of your token/change in ownership and/or a receipt of income. Disposition of your token likely creates a CGT event and receiving income from a platform would result in ordinary income.

Lending cryptocurrency to a platform

Lending fiat currency is not a taxable event. However, the ATO views lending cryptocurrency as a taxable event because crypto assets are not fungible. For example, if you were to lend 1 BTC (purchased for A$10,000) and receive 8,000 DAI (worth A$11,000), the ATO sees it as a disposition of your original 1 BTC. This would result in you realizing a A$1,000 (A$11,000 - A$10,000) capital gain.

In general, the lending scenario and related tax rules would apply to any occasion where you lock cryptocurrency you own and take control of another asset.

Receiving DeFi interest & rewards

If you receive periodic rewards in the form of a cryptocurrency or a token (similar to interest income) from DeFi platforms, you have to report the fair market value of the tokens at the time of receipt. This will be ordinary income.

Derivatives: futures, contracts, options

When you trade crypto derivatives such as futures, contracts and options, you do not actually own the underlying asset. You own the right or obligation to buy or sell the underlying crypto asset. To learn more in-depth about how cryptocurrency derivatives work, refer to CoinTracker's Guide to Cryptocurrency Taxes on Margin Trading.

When you invest in these derivatives, your ultimate profit and loss is shown on the exchanges as “PnL”. If the PnL is positive you made a profit from your bet. If the PnL is negative you lost money from your bet.

There is no guidance from the ATO on how this PnL should be taxed. However, the most conservative way to treat PnL amount is to report ordinary income at the time your derivative contract closes and PnL is posted.

Record-keeping requirements

The ATO requires you to keep detailed records of cryptocurrency transactions for five years after you “prepared or obtained the records”, or “completed the transactions or acts those records relate to”, whichever is later.

Meeting this record keeping requirement manually can be very burdensome for taxpayers. If you use CoinTracker for your tax calculations, the app will automatically save your transaction records under your account for your future reference and to meet ATO record-keeping requirements.

Cryptocurrency tax rate

If you are a cryptocurrency investor, your tax rate will be determined by your overall assessable income, based on Australia’s sliding scale of individual tax rates. Assessable income is calculated by:

Assessable Income = Income + Capital Gains – Deductions

How to minimize cryptocurrency taxes

Sell long-term crypto assets for a discount

The ATO allows you to reduce your capital gains by 50% (33.33% for complying super funds and eligible life insurance companies) when you sell cryptocurrencies that you held for more than 12 months.

For example, let's say Sam bought 1 bitcoin for A$1,000 in 2015. He holds it for 18 months and sells it for A$11,000, making a profit of A$10,000. He has no capital losses coming from other assets. After applying the 50% CGT discount, he will only have to pay taxes on A$5,000 (A$10,000 x 50%) of capital gains instead of on A$10,000.

Personal use assets

The ATO does not tax capital gains arising from personal use assets. Cryptocurrency is considered a personal use asset if it is kept or used mainly to purchase items for personal use or consumption. Cryptocurrency is not a personal use asset if it is kept or used mainly as an investment, in a profit-making scheme, or in the course of carrying on a business.

Although there are no set conditions for you to prove your personal use case for cryptocurrencies you hold, the following are some good practices to follow to make a compelling case for personal consumption:

- Have separate wallets for personal use cryptocurrency and investment cryptocurrency.

- Transact more frequently from your personal use wallet to avoid being a hodler/investor (the longer a cryptocurrency is held, the less likely it is that it will be a personal use asset – even if you ultimately use it to purchase items for personal use or consumption).

- Keep detailed receipts and records of everything you purchase with your personal use cryptocurrency.

- Do not exchange cryptocurrency for fiat currency to then buy products and services. This would disqualify it as a personal use asset.

- Purchase products or services for personal consumption directly from the vendor without using a payment gateway or other bill payment intermediary.

Deduct crypto tax software and tax adviser fees

The ATO allows you to deduct crypto tax software costs associated with completion and lodgement of your tax return along with the fee you paid to a recognized tax adviser. You can enter this amount on D10 - Cost of Managing tax affairs.

What if I lost my cryptocurrency?

If you lose access to your cryptocurrency, then you may be eligible to claim a capital loss. To claim the loss, you will need to be able to provide the following types of evidence:

- when you acquired and lost the private key

- the wallet address that the private key relates to

- the cost you incurred to acquire the lost or stolen cryptocurrency

- the amount of cryptocurrency in the wallet at the time of loss of private key

- that the wallet was controlled by you (for example, transactions linked to your identity)

- that you own the hardware which stores the wallet

- transactions to the wallet from a digital currency exchange for which you hold a verified account or is linked to your identity

Tax deadline

The Australian tax year runs from July 1 – June 30 the following year. If you are completing your tax return for July 1, 2023 – June 30, 2024, it needs to be filed by October 31, 2024. If you are completing your tax return for July 1, 2022 – June 30, 2023, it needs to be filed by October 31, 2023.

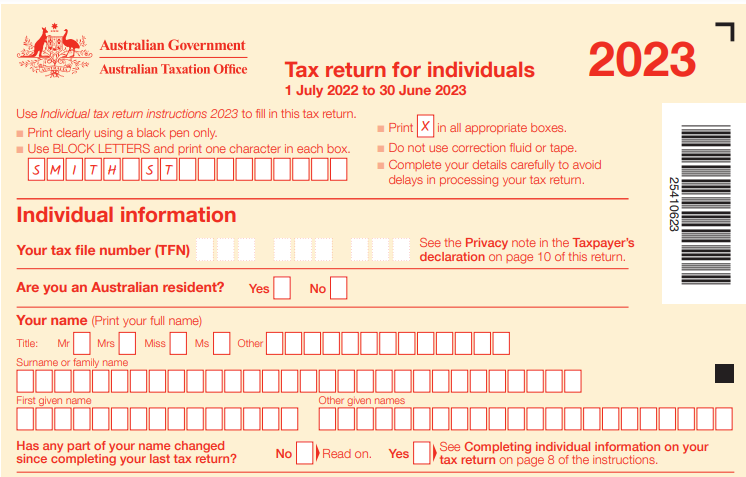

How to file crypto taxes

Once you have your reconciled cryptocurrency calculations, you can file your taxes via paper by filling out and mailing out your tax form to the ATO or through myTax, the online tax lodging service associated with the ATO. Lodging online with myTax is the quick, easy, safe, and secure way for you to prepare and lodge your tax return. This will help you get faster refunds as well.

How does CoinTracker work?

CoinTracker automatically syncs your transactions and balances across all the top cryptocurrency exchanges and wallets, to provide you with a fully reconciled transaction history. This works across 3,000+ coins and provides historical and current pricing, cost basis calculation, return calculations, performance charting, and more. Also, CoinTracker applies ATO tax rules to calculate your capital gains and income from cryptocurrency in each taxable year.

CoinTracker has partnered with major exchanges like CoinJar, Coinbase, Swyftx to make your crypto tax calculation seamless.

How can I file my taxes with CoinTracker?

After purchasing a CoinTracker tax plan, you can generate a Capital Gains CSV report so that you can file yourself or send the necessary tax documentation to your accountant.

CoinTracker helps you calculate your crypto taxes by seamlessly connecting to your exchanges and wallets. Questions or comments? Reach out to us @CoinTracker.

Disclaimer: this post is informational only and is not intended as tax advice. For tax advice, please consult a tax professional.