Are you confident in accurately reporting cryptocurrency earnings on your tax returns?

Automating Cryptocurrency Taxes

The IRS expects that over 150 million tax returns will be filed in 2020. CoinTracker has teamed up with TurboTax to cryptocurrency tax filings simple.

February 5, 2020 · 2 min read

The IRS expects that over 150 million tax returns will be filed in 2020. Most taxpayers require some guidance to prepare their taxes, but not necessarily the guidance of a certified public accountant (CPA). That’s why tens of millions of taxpayers are able to file their taxes through our partners like TurboTax, as well as via other online tax preparation services. In addition, long-established chains of retail tax preparation services located in storefronts across the country have traditionally aided taxpayers in person.

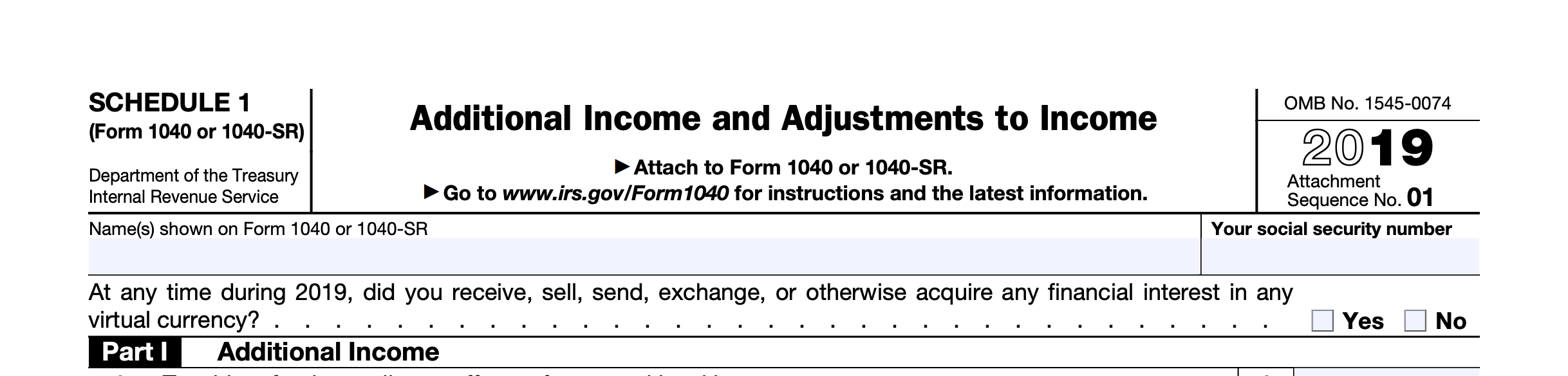

However, changes for tax year 2019 should give customers of those storefront chains pause. For the first time, the IRS is requiring taxpayers to disclose whether they had cryptocurrency holdings via IRS cryptocurrency tax guidance issued in October — just a few months ago. At one of the leading retail chains, preparers are trained via as little as 60 hours of online courses on general taxation rules, certainly not covering the latest developments in new virtual currency tax rules.

This is an important consideration for anyone who owned cryptocurrency in 2019. This new question on Schedule 1 is the key to why:

“At any time during 2019, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency?”

If answered incorrectly, the question exposes taxpayers to the possibility of an unlimited statute of limitations, where the IRS can penalize him or her for incorrectly handling their cryptocurrency, tax-wise. It could put someone with an otherwise straightforward tax prep situation — but who has bought bitcoin or another digital asset (as perhaps, a hobbyist) — in a complicated position. In fact, the IRS has already mailed tax notices to tens of thousands of taxpayers about their suspected cryptocurrency holdings.

However, there’s no reason for taxpayers to despair: cryptocurrency tax help is available to all. For taxpayers with 200 or fewer transactions in the tax year, CoinTracker offers free crypto tax software (more advanced users can take advantage of CoinTracker’s paid offerings). We encourage you to explore both as you brave the new questions the IRS is asking.

CoinTracker helps you calculate your crypto taxes by seamlessly connecting to your exchanges and wallets. Questions or comments? Reach out to us @CoinTracker

Disclaimer: this post is informational only and is not intended as tax advice. For tax advice, please consult a tax professional.