CoinTracker for Accountants: How to use CoinTracker to Calculate Cryptocurrency Capital Gains/Losses for Clients

Sep 11, 2019・2 min read

Crypto tax gain & loss reconciliation can be very time consuming task for accountants. Read our post on why you should consider becoming a crypto tax accountant. At CoinTracker, our main objective is to make crypto tax accountants’ life easier. If you are an accountant, you can interact with CoinTracker in two ways: get invited by your client or invite clients to your admin account. Both methods have their own distinct pros and cons. We are here to help either way.

Get Invited by Your Client

How it Works?

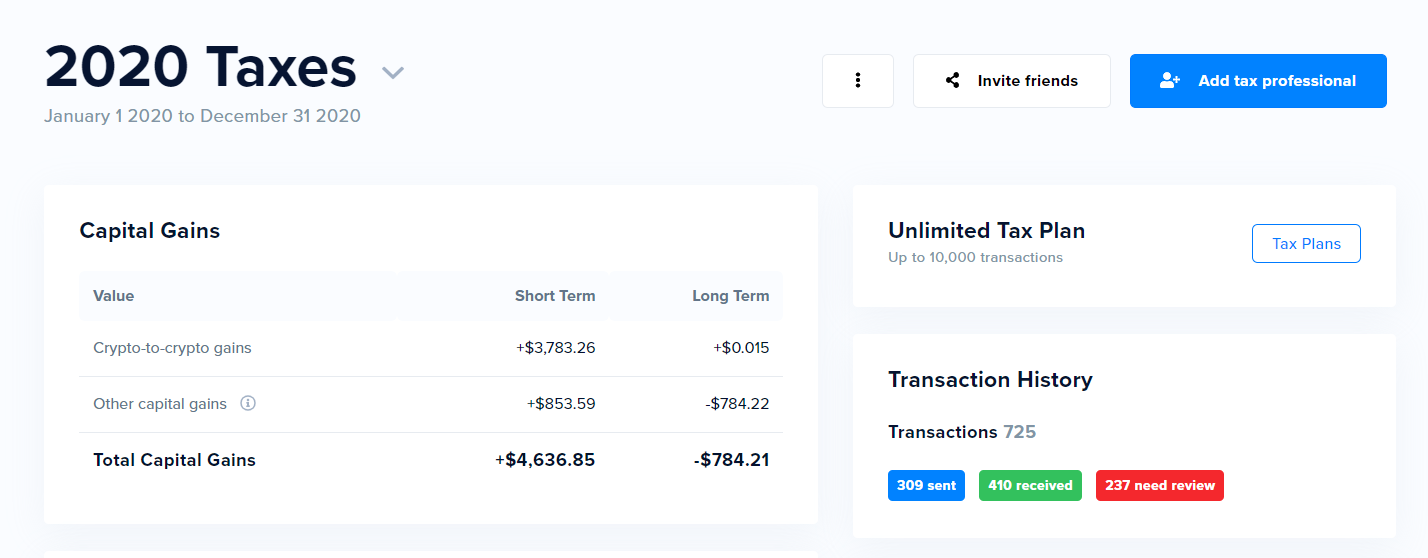

- Direct your crypto client to purchase a tax plan

- Have your client connect all the exchanges, wallets and other platforms to CoinTracker

- Have your client share access with you

Pros

- Since the client connects crypto accounts to CoinTracker, all you have to do is download the reports and include them on the tax return. Easy!

- Read only access reduces your professional liability; you can only download the tax reports

- Don’t have to worry about invoicing the client for CoinTracker tax plans; client will pay CoinTracker when they sign up for an account

- If there are any issues with the account, the client typically resolves them with CoinTracker via customer support. This will save your time

Cons

- High-profile clients may want you to handle this step on behalf of them (see section below)

- Non-tech savvy clients may not want to pick this route and will expect you to connect the crypto accounts and generate reports on behalf of them

Invite Clients to Your Admin Account

How It Works?

- Setup a CoinTracker Admin account to enjoy bulk discounts and customized perks depending on your needs

- Manage your crypto clients through the admin account

Pros

- More control over your client’s tax engagement

- Bulk purchase discount & special pricing for accountants

- Ability to markup the prices when you invoice the client

- Priority support

- Can charge a premium from the client for providing end-to-end service

Cons

- Higher professional liability since you connect client accounts and reconcile transactions on behalf of the client

CoinTracker helps you calculate your crypto taxes by seamlessly connecting to your exchanges and wallets. Questions or comments? Reach out to us @CoinTracker.

Disclaimer: this post is informational only and is not intended as tax advice. For tax advice, please consult a tax professional.