When Should Staking Be Taxed?

Aug 20, 2020・3 min read

Taxes and staking are two topics that have a murky history together due to lack of staking specific guidance issued by the IRS. How staking should be taxed is already a controversial issue (How Staking Tezos May Generate ‘Rental’ Income). When staking income should be taxed is an even more pressing issue because it affects when you pay your taxes on income. A recent letter sent to the IRS by four US congressmen want the IRS to tax staking rewards at the time you sell the rewards of staking, not at the time you receive them.

How Staking Is Taxed Today

As of the date of this posting, the IRS has not issued any staking specific crypto tax guidance. The closest guidance that could be used to infer how staking income should be taxed is the tax guidance on mining income issued on Notice 2014-21.

According to this notice, mining income should be reported on your taxes at the time you receive the rewards. When you sell those mined coins, another taxable event is triggered.

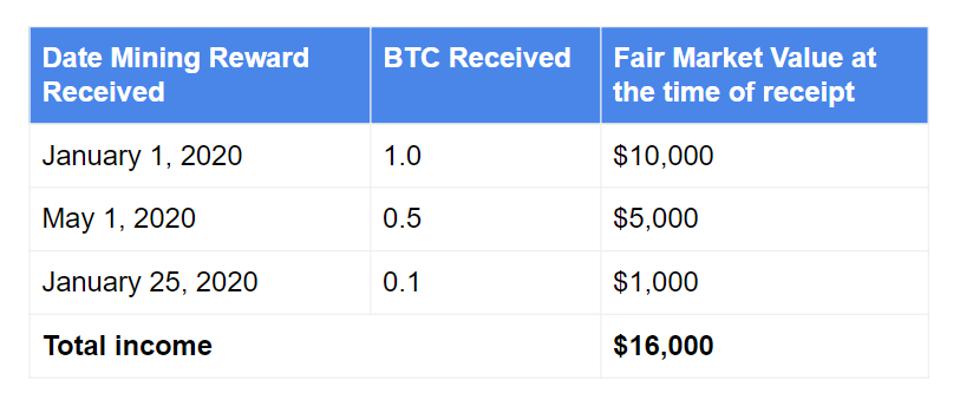

For example, assume David receives the following Bitcoin (BTC) mining rewards on the corresponding days. His total ordinary income from the mining operation for the month of January would be $16,000.

Assume he sells the 1 BTC received on January 1, 2020 for $15,000 in March, 2020. This would also create a capital gain of $5,000 ($15,000 – $10,000). In 2020, his total income subject to taxes would be $21,000 ($16,000 + $5,000).

2025

Crypto Tax

Guide is here

CoinTracker's definitive guide to Bitcoin & crypto taxes provides everything you need to know to file your 2024 crypto taxes accurately.

Why Staking Should Not Be Taxed At The Time Of Receipt

The recent letter signed by four congressmen points out that the above mining specific rules are not applicable in staking scenarios. Staking results in a creation of “new property”. New property is taxed only at the time of sale, not when you discover. As Abraham Sutherland, a lecturer at the University of Virginia, describes on Cryptocurrency Economics and The Taxation of Block Rewards, crops do not generate income until they are sold or exchanged, according to reg. section 1.61-4. According to Reg. section 1.61-3(a) gross income from mined minerals such as gold is only recognized at the time of sale, not at the time of extraction. Applying these fact patterns to staking, it could be argued that staking rewards should only be taxed at the time of sale.

Furthermore, Sutherland also highlights that staking rewards received by the staker are not necessarily income due to the dilution of the entire network. As he reports to Coindesk, “If an individual staker has seen the number of tokens they hold grow by 6%, this does not mean the staker has a 6% gain if, for example, the number of tokens on the network as a whole has increased by 5%.

The letters addressed to the IRS by congressmen will definitely urge the IRS to look more into the specifics of staking taxes. In the absence of specific guidance, the most conservative approach one can take is to report staking rewards as income at the time you receive them similar to previously issued mining tax guidance.

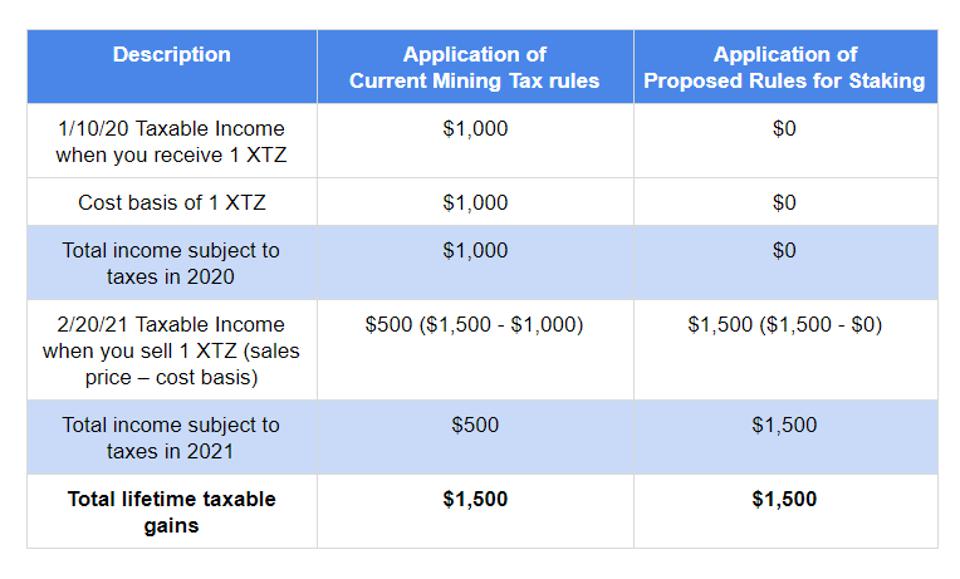

Note that the total amount of income which would be subject to taxes will be the same whether the IRS decides to tax staking rewards at the time of receipt or at the time of sale. The only difference would be in the timing of your tax payment.

For example, assume David receives 1 Tezos (XTZ) on January 10, 2020 for participating in the Tezos network. On this day, 1 XTZ is worth $1,000. On February 20, 2021, he sells this Tezos for $1,500.

In conclusion, it is encouraging to see regulators paying close attention to developments in the crypto space and trying to initiate more favorable tax rules. However, the content of this letter should not be considered tax guidance nor be relied upon when preparing your taxes.

Feedback or questions? Reach out to us on Twitter @CoinTracker

This post was originally published on Forbes by Shehan Chandrasekera on August 7, 2020

Disclaimer: this post is informational only and is not intended as tax advice. For tax advice, please consult a tax professional.