Are you confident in accurately reporting cryptocurrency earnings on your tax returns?

Serving Your First Crypto Tax Client

Whether you're new to cryptocurrency or have owned bitcoin for years, this guide covers everything you need to help your clients file their crypto taxes.

September 8, 2020 · 16 min read

If you have never heard of or used cryptocurrency or bitcoin, undertaking your first crypto client may seem daunting. This guide is designed to demystify this process for you and by the end, you will have all the tools you need to start preparing tax returns for clients with cryptocurrency transactions.

So, why bother with cryptocurrency clients?

Digital asset question on Form 1040

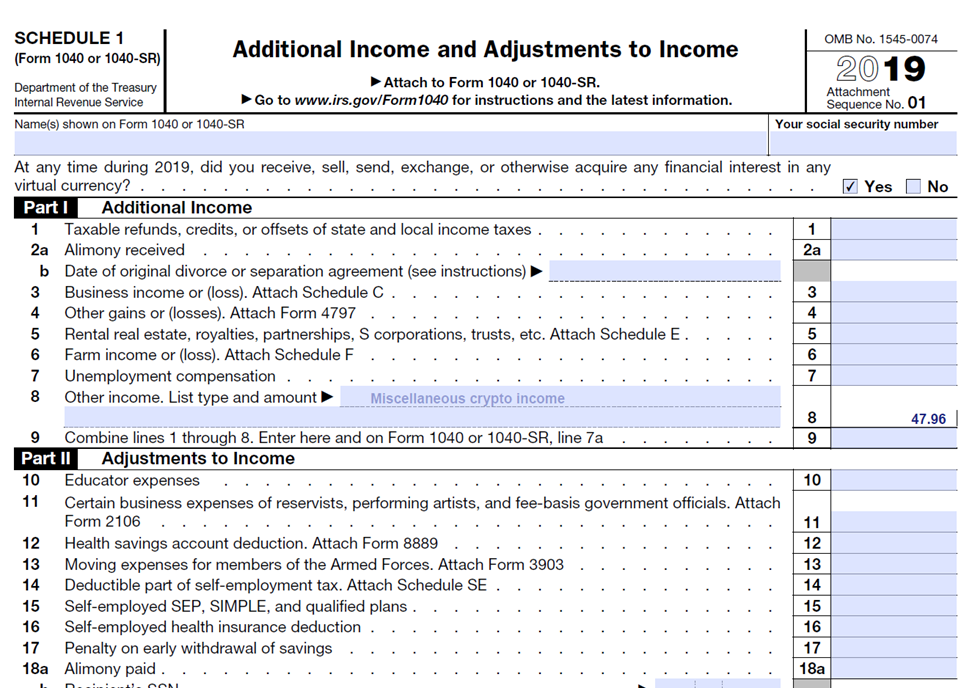

To combat non-compliance and improve voluntary compliance, the IRS introduced the infamous virtual currency question, “At any time during 20XX, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency?”

This question first appeared on 2019 Schedule 1. The IRS later realized that not many people were required to file a Schedule 1 so they did not have to disclose information about their virtual currency transactions to the IRS.

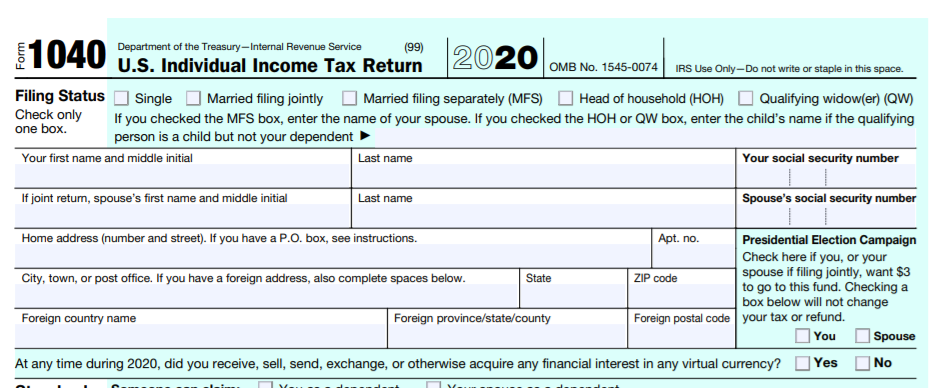

The question was moved from Schedule 1 to the front and center of Form 1040 for the 2020 tax year.

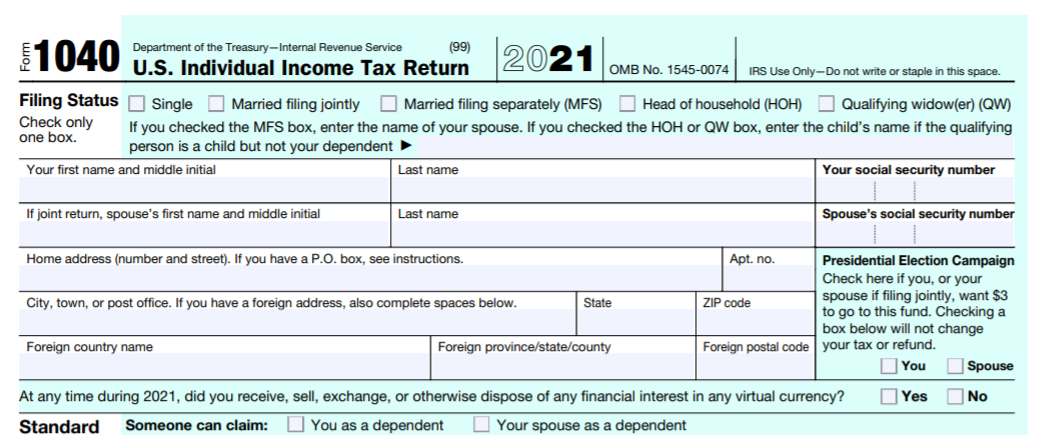

This question continued on the 2021 Form 1040 with a slight tweak to the language.

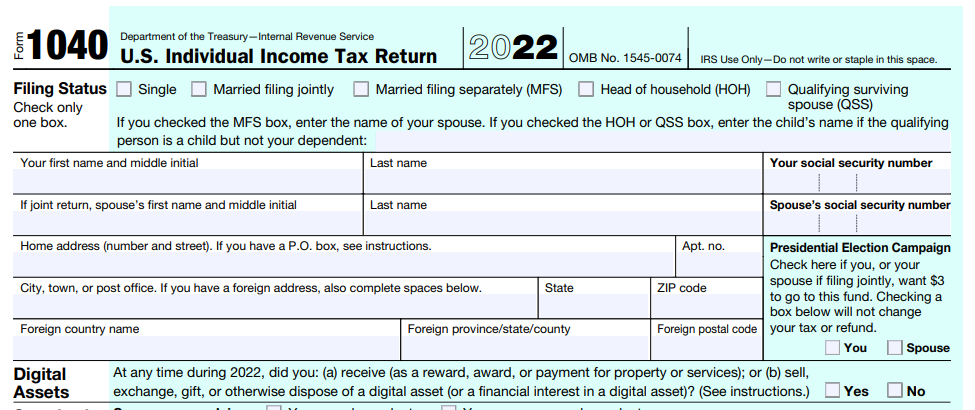

The 2022 Form 1040 also contains the question with some changes to the verbiage.

There are three noteworthy changes in the 2022 version compared to the 2021 version. First, the IRS has broadened the scope of the question by replacing "virtual currency" with "digital assets". Digital assets are any digital representations of value that are recorded on a cryptographically secured distributed ledger or any similar technology. The broader definition clearly includes non-fungible tokens (NFTs) and any asset with "the characteristics of a digital asset".

Second, the "receive" category is further clarified on the question itself. It includes the receipt of rewards, awards, or payment for property or services.

Third, the somewhat ambiguous "financial interest in digital asset" term is clarified in the instructions. "You have a financial interest in a digital asset if you are the owner of record of a digital asset, or have an ownership stake in an account that holds one or more digital assets, including the rights and obligations to acquire a financial interest, or you own a wallet that holds digital assets"

There are three situations where you can safely check "No" for the questions.

1) You just held digital assets in a wallet or exchange during 2022.

2) You only purchased digital assets using USD or fiat currency during 2022.

3) You only transferred digital assets between wallets/exchange accounts you own during 2022.

Practice tip: If your client deals with virtual currency even in some remote capacity during the filing year, you will most likely have to check “Yes” for this question.

How cryptocurrencies are taxed

Cryptocurrencies like bitcoin are treated as “property” per IRS Notice 2014-21. Therefore, all the general tax rules applicable to property also apply to cryptocurrency. Note: cryptocurrencies are not treated as currency for tax purposes.

Practice tip: think of cryptocurrency similar to a unit of stock. The amount you pay to obtain it establishes the cost basis. When you sell it, that creates sales proceeds. The difference between these two is a gain or loss.

The easiest way to understand crypto tax implications is by focusing on the different types of clientele you will come across in this space.

Types of clients

Investors

Investors are the most common type of client you will come across in the cryptocurrency space. Investors buy and sell cryptocurrencies for speculative purposes. They buy crypto as a personal investment, not for business purposes.

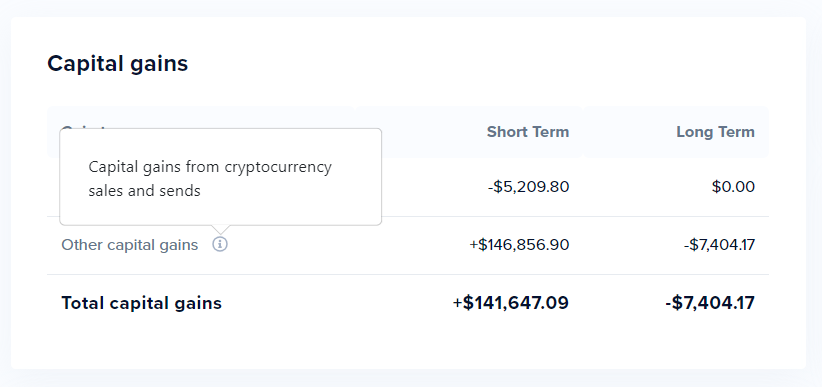

Gains and losses arising from these transactions are capital gains or losses, similar to stock transactions. This means net short-term gains on cryptocurrency trading transactions will be taxed as ordinary income; net short-term losses will offset ordinary income up to the $3,000 limit on capital losses. Net long-term gains will generally be taxed at the preferential long-term capital gains tax rates, and long-term losses can be offset against ordinary income, again, subject to the $3,000 limitation.

Example 1: On Jan. 1, 2018, one bitcoin (BTC) was purchased for $5,000. On July 25, 2018, it was sold for $8,000. The gain of $3,000 ($8,000 – $5,000) is short-term and will be taxed at the taxpayer's ordinary income tax rate.

Example 2: On Jan. 1, 2018, one bitcoin (BTC) was purchased for $5,000. On July 25, 2020, it was sold for $10,000. The gain of $5,000 ($10,000 – $5,000) is long-term and will be taxed at preferential rates.

One cryptocurrency can be converted/exchanged for another cryptocurrency. This is a taxable event. When one cryptocurrency is converted into another type of cryptocurrency or token, gains or losses must be recognized in U.S. dollars. This means investors can owe a tax liability without real currency to pay with (same as with stocks).

Example 3: On Jan. 1, 2020, one bitcoin (BTC) was purchased for $5,000. On July 25, 2020, it was traded for another cryptocurrency: Ether (ETH). 1 BTC = 100 units of ETH. 1 ETH = $200. This will trigger a gain of $15,000 [(100 × $200) - $5,000].

Example 4: it is common that tokens appreciate in value before they are traded. Follow the fact pattern below:

10/01/2020 – Bob purchases 1 BTC for $5,000. This is the original cost basis.

10/20/2020 – market booms so 1 BTC is now worth $10,000 (100% gain on initial investment)

10/20/2020 – ETH falls in price so Bob sees a great buying opportunity. He purchases 20 ETH using the 1 BTC previously purchased. 1 ETH = $200

Calculation

Value of 20 ETH purchased = $4,000 (20 * $200)

BTC spent to buy 20 ETH = 0.4 ($4,000 / $10,000)

Cost basis of the BTC Sold = $2,000 (0.4 * $5,000)

Proceeds of the BTC Sold = $4,000 (0.4 * $10,000)

Taxable gain = $2,000 ($4,000 – $2,000)

BTC remaining on hand = 0.6 BTC (1 BTC – 0.4 BTC)

Cost basis of the BTC on hand = $3,000 (0.6 * $5,000)

Cost basis of ETH on hand = $4,000

Practice tip: in many cases, a large portion of your clients’ annual cryptocurrency capital gains may come from crypto-to-crypto trades. Knowing these amounts throughout the year can help you better understand your client's tax bill and come up with estimated tax payments.

In the cryptocurrency space, unlike with traditional brokerage, exchanges do not provide taxpayers with 1099-B forms. This is also in part because cryptocurrency users commonly move assets between exchanges, or even into self-custody (e.g. on a laptop, phone, USB drive, etc.). Therefore it is the taxpayer's responsibility to track the basis and sales price for each transaction. These gains and losses are recorded on the IRS Form 8949 (Sales and Other Dispositions of Capital Assets). This is a cumbersome task that CoinTracker automates.

Tax Lot ID Method

The tax lot ID method dictates which units of cryptocurrency are being sold for gain and loss calculation purposes. According to the IRS virtual currency FAQs (A40), specific identification can be used as long as you have detailed records of ALL four items below:

- the date and time each unit was acquired

- your basis and the fair market value of each unit at the time it was acquired

- the date and time each unit was sold, exchanged, or otherwise disposed of, and

- the fair market value of each unit when sold, exchanged, or disposed of, and the amount of money or the value of property received for each unit.

If any of the above items are missing from your records, you can not use specific identification. Instead, you are required to use the default first-in-first-out (FIFO) method.

Practice tip: highest-in-first-out (HIFO) is a subset of specific identification that results in the lowest capital gains by always disposing of units with the highest basis first. In order to use this method, you must keep detailed records of the four criteria mentioned above. This is extremely difficult to do by hand. Luckily, CoinTracker keeps all the records necessary to support the specific identification method so your client can optimize taxes with a click of a button.

Wash sale rule

Since cryptocurrencies are treated as “property” by the IRS, they generally do not fall under §1091 of the tax code which applies to “stocks and securities.” The SEC has also said that prominent cryptocurrencies such as bitcoin and ether are not securities; therefore wash sales rules would not apply to them (note: long tail cryptocurrencies that are ruled to be securities may be an exception to this rule). Therefore, cryptocurrencies can be sold and bought back to harvest losses for tax purposes without having to wait for 30 days. Cryptocurrencies offer a more aggressive tax loss harvesting opportunity compared to stocks.

Practice tip: One caveat to keep in mind is that continuous tax loss harvesting while bypassing the 30-day window is neither explicitly permitted nor denied under the current guidance related to cryptocurrency. Abusive practices may be subject to substance over form argument resulting in disallowance of losses.

Miners

Mining is the process by which cryptocurrencies like bitcoin are first entered into circulation. Mining typically requires powerful computers running 24/7 solving mathematical problems. When these computers successfully solve problems, the owner of the mining machines gets rewarded in cryptocurrency.

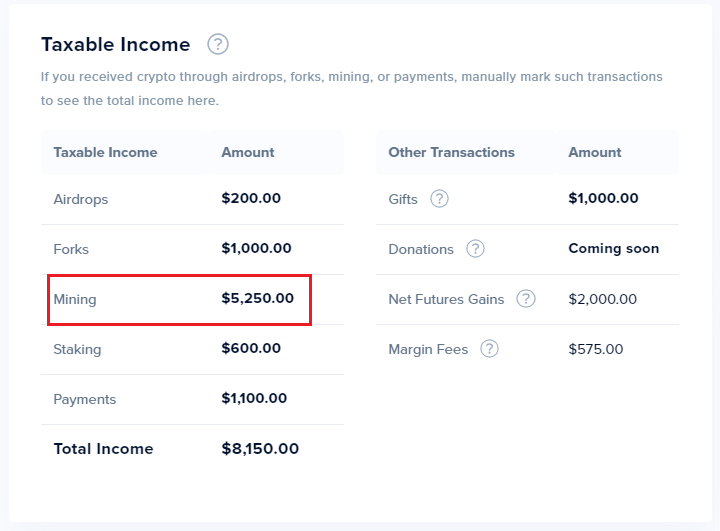

Cryptocurrency mining income is treated as ordinary income. When mining, the fair market values of the coins at the time they are mined become the users’ ordinary income. You can get this amount from the “Taxable Income” line item on the CoinTracker Tax Center.

Where and how you report your client’s mining income depends on the nature of the activity conducted by your client.

Mining activity that rises to the level of trade or business

If you have a client who is involved in mining bitcoin or other cryptocurrency, and that activity rises to the level of trade or business, related income and expenses go on Schedule C. As with any business activity, mining activity related expenses can be deducted under §162. Net income generated from the mining business would also be subject to self-employment taxes.

Practice tip: in many cases, cryptocurrency mining activity that is considered to be a trade or business will be conducted in a legally formed business entity. This would lead to filling Form 1120, 1120S or 1065 as applicable.

Mining activity that does not rise to the level of trade or business (mining as hobbyist)

If the mining activity does not rise to the level of trade or business, it would be considered a hobby. In this case, mining income will be reported on Schedule 1 as “other income.” Mining related expenses will not be allowed as a deduction because it is not a trade or business.

Traders

Traders are individuals who carry out a substantial amount of trading continuously throughout the year with regularity. Being a “Trader” enables you to bypass the default limit on capital loss deduction ($3,000 maximum a year) arising from cryptocurrency and activate a very powerful tax saving election called section §475(f). Investors are not eligible for this election.

Practice tip: it is extremely difficult for a taxpayer to qualify as a “trader” for tax purposes. Your client may colloquially call themselves a “trader” but this will not grant him/her the “trader” status for tax purposes in the eyes of the IRS. Being a “trader” for tax purposes is based on the facts and circumstances of each case.

Traders making Section §475(f) Election

The application of this tax election to ALL crypto assets traded by a qualified trader is still unclear.

This is because the way the law is written, it is currently applicable only if you deal with “securities” and “commodities.” Since the Commodities Exchange Act has deemed the cryptocurrencies like bitcoin are commodities it seems likely that this election should be allowed, though AICPA has advocated the IRS to clarify.

Once you successfully make this election, you will;

- Report gains and losses on Form 4797 as ordinary income (as opposed to Form 8949 as capital gains/losses)

- Not be subject to wash sale rules

- Not be subject to self-employment taxes

- Implement mark-to-market accounting (recognize unrealized gain/loss at year end)

- Bypass the $3,000 annual capital loss deduction limit that investors are subject to

- Deduct §162 business expenses on Schedule C

Traders not making Section §475(f) Election

Being a trader gives you the option (not required) to make the §475(f) election. If the election is made, gains and losses arising from cryptocurrencies will be reported and taxed similarly to an investor. Use Form 8949 and Schedule D.

Practice tip: the conservative approach for crypto traders is to not make the §475(f) election given the ambiguity of current tax guidance related to virtual currency.

Dealers

Dealers purchase, hold, and sell cryptocurrencies to their customers in the ordinary course of their trade or business. Dealers are required to report using mark-to-market accounting. Dealers’ main source of income is commissions and spreads they make at market making. §162 expenses can be deducted from business income.

Taxation for specialized types of crypto transactions

Forks

A “fork” occurs when the software for a blockchain is changed.

If the software update is backward-compatible, meaning that nodes running the new software can still communicate with the old software, then that is considered a soft fork. Soft forks have no tax implications.

However, if your client’s assets go through a hard fork, where the new software is backward incompatible, then a hard fork has occurred. In the case of a hard fork, there are two (or more) blockchains arising from the original one. This means the client receives a new cryptocurrency in addition to the ones s/he originally had. The newly received cryptocurrencies are taxed as ordinary income at the time of receipt. This would be reported on Schedule 1 as “other income.”

For example, the bitcoin network went through a hard fork in 2017. Consequently, everyone who owned one bitcoin (BTC) received one Bitcoin cash (BCH), another type of cryptocurrency, free.

Airdrops

Some cryptocurrency projects send free coins to users to promote their projects (marketing). While the IRS guidance on marketing airdrops is in a bit of a grey area, if your client receives coins through an airdrop, the conservative approach is to report the value of those coins as ordinary income at the time of the receipt. The amount you report as ordinary income will be the cost basis for those coins going forward. The fair market value of the airdropped coins will be shown on the CoinTracker “Taxable Income” card.

Donations

Since cryptocurrencies are treated as property, all general rules applicable to property donations are applied to cryptocurrency donations. The amount of the deduction reported on Schedule A is based on the holding period of the asset.

If a taxpayer holds the crypto asset for more than 12 months, the deduction is the fair market value at the time of the donation. If a taxpayer holds a crypto asset for 12 months or less, the deduction is the lesser of fair market value or cost basis.

Buying and selling items with cryptocurrency

Each time a taxpayer buys goods or services in exchange for virtual currency, there is a taxable capital gain or loss event that needs to be reported on the taxes.

Practice tip: ask your clients whether they used virtual currency to purchase any goods or services. Many taxpayers do not know that spending virtual currency like bitcoin is a taxable event.

Getting paid in cryptocurrency

Cryptocurrency received as compensation should be included in gross income and taxed as ordinary income.

Practice tip: if your client is getting paid in cryptocurrencies check whether these wages are included in a W-2 and/or 1099. Unsophisticated employers may not include amounts paid in virtual currencies in any tax form however, the taxpayer is still required to report that income.

Staking

Staking is similar to having an interest bearing bank savings account. DASH, NEO, and XTZ are some cryptocurrencies you can stake. When you stake (deposit) these coins in a supported contract or platform, you receive periodic payouts based on the amount of funds you stake.

The IRS has not issued any staking specific tax guidance so far. There are some debates related to when staking income should be taxed and how it should be taxed.

Practice tip: until staking specific tax guidance is issued by the IRS, the most conservative approach is to report them at the time of receipt on Schedule 1 as other income (similar to mining income). The aggregated fair market value of staking rewards is reflected on the CoinTracker dashboard.

Cryptocurrency derivatives

The IRS has not published any general principles governing the taxation of derivative contracts in the US. Instead what we have is a complex set of tax rules and regulations that have evolved in piecemeal fashion over time. Due to their complexity, these rules are often exploited to make financial bets relatively risk-free by delaying, minimizing, or even avoiding taxes. Tax rules applicable to derivatives are complex and riddled with loopholes. To complicate matters further, none of these rules are clearly laid out in the cryptocurrency space, leaving a significant grey area in how cryptocurrency derivatives are taxed.

Existing tax rules provide differential treatment for derivative transactions based on many factors, including:

- Character of tax attribute (ordinary vs. capital)

- Timing of recognition (short-term versus long-term)

- Type of derivative instrument (forward, future, option, swap)

- Location of trade (exchange-traded or over-the-counter)

- Conclusion of the contract (terminated, exercised, or lapsed)

- Type of settlement (cash vs. physical delivery)

- Intended use of the instrument (hedge vs. speculation)

- Nature of the taxpayer (dealer, trader, or investor; corporation or individual)

- Source of the transaction (US or foreign)

- etc.

Refer to the cryptocurrency margin tax guide to get an in-depth understanding of cryptocurrency derivatives and how they are taxed.

Practice tip: given the lack of tax guidance related to cryptocurrency derivatives and the influx of new instruments such as perpetual futures which are not present in the traditional finance world, a practical approach to figure out gains/losses belonging to your client is to convert the profit or loss (PnL) which is reported on the exchange into USD, at the time the contracts closes. In general, PnL represents a gain or loss which is capital in nature (as opposed to ordinary). Note that there could be exceptions to this rule.

Scams, theft, and loss

The passage of the Tax Cuts and Jobs Act (TCJA) in 2017 greatly limited the deductibility of personal losses. That said, some cryptocurrency-related personal losses may be deductible as long as they incur in a "transaction entered into for a profit".

Practice tip: refer to our comprehensive cryptocurrency tax write-off guide

Information reporting requirements

FBAR & Form 114

According to FinCEN, virtual currency held in offshore exchanges are not subject to FBAR reporting (GAO report, Page 31).

However, this rule may change soon based on FinCen Notice 2020-2 issued in January 2021.

FATCA & Form 8938

The IRS has not clearly mentioned anywhere whether virtual currency held in foreign jurisdictions are subject to FATCA reporting. If your clients meet the reporting threshold, the most conservative approach is to report the amounts on respective forms and schedules.

Form 1099s & W-2

Payments to contractors and employees in virtual currencies are subject to regular information reporting regimes.

Crypto Tax Notices

Four types of tax notices (Letter 6173, Letter 6174, Letter 6174-A & CP2000) can be seen in the cryptocurrency world. Letter 6173 and CP2000 are action letters so you need to pay immediate attention if your client receives one. Refer to how to deal with letter 6173 and how to deal with CP2000 to successfully address these letters.

Tax Planning Strategies

- Cryptocurrencies are taxed as capital assets so they are eligible for 0% long-term capital gains tax rate

- Donate appreciated crypto assets to qualified charities to bypass capital gain taxes and get a deduction on Schedule A.

- Use CoinTracker and change the tax lot ID method to highest-in-first-out (HIFO). This will result in the least amount of gains.

- Each quarter, evaluate your clients' cryptocurrency positions and sell losing positions to harvest losses for tax purposes.

- Advise your clients about regulated cryptocurrency futures which have more favorable 60/40 tax treatment under §1256.

- Trade cryptocurrency in a self-directed IRA.

- Roll over unrealized cryptocurrency gains into opportunity zone.

Cheat sheet for accountants

- The functionality of crypto is similar to stocks traded on a brokerage. The difference for crypto is that the wash sale rule does NOT apply.

- No 1099-Bs in this space (Even if you see a 1099-B it will show "missing cost basis").

- Cryptocurrency is treated as “property” for tax purposes (2014-21, 46 Q&As, 2019-24) and the result is capital gains & losses (Form 8949, Schedule D).

- Taxpayers need to reconcile gains/losses (easier with an automated tool like CoinTracker).

How to Use CoinTracker

What CoinTracker does

CoinTracker is a data aggregation tool that connects with your client’s cryptocurrency exchanges, wallets, blockchain, etc. and produces a gain/loss report for tax purposes. Without a tool like CoinTracker, it is virtually impossible to reconcile all the virtual currency transactions and produce IRS-compliant gain and loss reports.

Workflow

Using CoinTracker with your client is an easy process:

- Set up a CoinTracker account for your firm here.

- Invite your tax pros to the firm-level CoinTracker account.

- Invite your clients and have them connect read-only access to crypto exchanges, wallets, and blockchains. If your client has any issues or needs help with this process, our customer service team is available to help.

- View/edit transactions and download the tax reports (form 8949, Schedule D & Schedule 1).

FAQs

1. My client needs to file back taxes. Do they need a CoinTracker tax plan for each year they are filing for?

Yes. Your client will need a tax plan for each year they are filing their cryptocurrency taxes (pricing).

2. How should my client sign up for CoinTracker?

There are two ways you can use CoinTracker to help your clients. The first way is that you can signup for a CoinTracker tax professional account for free and invite your client to your firm-level CoinTracker account. Your annual cost per client is a flat $200 fee.

Alternatively, if your client already has a CoinTracker account with a Premium tax plan, they can invite you as a tax professional using the blue “Add tax professional” button in their tax center. If you follow the instructions on their invite, you’ll be able to get access to the same tax reports this way instead.

3. Does my client need a separate CoinTracker account for each cryptocurrency exchange or wallet they have?

No. CoinTracker automatically reconciles cryptocurrency transactions across wallets and exchanges in one simple account.

4. How do you ensure that the CoinTracker tax reports are accepted by the IRS in case of an audit?

Over the years, CoinTracker has helped hundreds of users successfully defend IRS tax audits with our software and tax reports.

5. How does pricing work for Accountants?

Tax professionals pay a flat $200 annual fee per client. This amount is charged when you add a client to your firm-level CoinTracker account.

6. Can I invite multiple accountants to one CoinTracker account?

Yes, this can be managed on your firm dashboard.

7. What happens if a client jumps from having 100 transactions to 1,000 in the middle of the year?

CoinTracker charges a flat $200 fee per client served by you, irrespective of the transaction count.

8. I have more questions. How can I contact you??

Email us at cpa@cointracker.io.

CoinTracker integrates with 300+ cryptocurrency exchanges, 3,000+ blockchains, and makes bitcoin tax calculations and portfolio tracking simple.

Disclaimer: This post is informational only and is not intended as tax advice. For tax advice, please consult a tax professional.