Are you confident in accurately reporting cryptocurrency earnings on your tax returns?

Crypto Taxes on Margin Trading Ultimate Guide

This guide comprehensively covers everything you need to know about cryptocurrency derivatives, what they are useful for, and how they are taxed in the US.

September 5, 2022 · 23 min read

As the cryptocurrency industry continues to evolve, so do the financial products around cryptocurrency. While exchanges originally offered the ability to buy & sell cryptocurrency assets, now many exchanges and decentralized finance (DeFi) platforms offer margin trading and derivatives trading for advanced traders. This guide breaks down what these advanced options are, what they are useful for, and how they are taxed.

Warning: margin trading is for experienced traders. Do not margin trade without first understanding cryptocurrency, regular spot trading, and the tax implications of these transactions.

What are Derivatives?

A derivative is a contract whose value is based on, or derived from, an underlying asset. In the financial world, derivatives are classified as securities, and the underlying assets can range from stocks to bonds to commodities to bitcoin.

Investing in derivatives is different from investing in assets directly. For example, if you purchase one bitcoin (1 BTC) from an exchange you have ownership of that bitcoin. In contrast, if you invest in bitcoin derivatives, you do not own the asset. Instead you own a contract to buy or sell that bitcoin at a set price in the future.

What is their purpose?

There are two primary reasons why someone may want to use a derivative:

- to hedge risk

- to speculate

Derivatives as a Hedge

Let’s look at an example of how a derivative could be used to mitigate risk. Let’s say there is a wheat farmer (selling wheat 🌾🧑🌾) and a cereal manufacturer (buying wheat 🥣). Wheat is a commodity and its price is volatile, changing frequently based on supply and demand. The wheat farmer (seller) wants the price of wheat to be high (📈) so that they can earn more money on their crop sales. On the other hand, the cereal manufacturer (buyer) want the price to be low (📉) so they can have lower costs on their cereal. What if there is a drought or a surplus of the crop causing the prices to swing wildly in one direction or the other? This adds lots of unwanted volatility to both the buyer and sellers businesses.

To hedge, or decrease risk, the seller and buyer can agree today on the price of wheat in the future (say, six months down the line). This is called a forward contract, which is a type of derivative. Because the price of wheat can only go up or down, there is a distinct winner and loser in a zero-sum outcome six months later when the contract executes. At the time of the contract signing however, both sides are using the derivative as an insurance policy to lock in a guaranteed price for the trade.

Derivatives for Speculation

The other most common use case for derivatives is for speculation, or to make a profit (💸). In this use case, the speculator is betting on changes in the underlying assets price (up or down). In this case, the speculator does not have to ever touch the underlying asset itself — they are simply betting on the underlying asset's price. For some users, this is a benefit (e.g. non-tech savvy investor wanting bitcoin exposure without the risk of custodying the asset). However for other use cases, this is a downside (e.g. for individual investor trying to maintain a financial insurance policy against the traditional financial system or trusting third party institutions).

Derivatives can also be used to reduce tax liability, combined with leverage to amplify gains (and losses).

How Are They Priced?

The price of derivative contracts fluctuate with the value of the underlying asset itself.

In the example where a bitcoin future’s settlement date approaches, the holder of the bitcoin forward contract will be looking at the price of bitcoin on the market vs. the agreed upon price of the bitcoin purchase in the contract. If the price of BTC on the market is higher, then the contract will increase in value because the buyer is getting a discount on the pre-agreed lower price. However if the price of BTC on the market is lower, then the contract will decrease in value as the buyer previously agreed to a price that is now overpayment compared to the market value of the bitcoin.

The Different Types

There are multiple types of derivative contracts including Forwards, Futures, Options, Swaps, etc. We’ll focus on some of the most common types of derivatives in the cryptocurrency space below.

Forward Contracts

Forward contracts (or simply “forwards”) are agreements between two parties to buy or sell an asset at a specified price on a specified future date. These are customizable contracts that have flexibility on the terms.

Note that the contract requires the buyer and seller to lock in the trade so they cannot change their mind and reverse the transaction in the future. Also, neither the buyer nor the seller need to hold the underlying asset at the time of the contract — the seller simply needs to ensure that the asset is delivered to the buyer or settle the contract in cash on the date of the contract settlement.

Futures Contracts

Futures contracts (“futures”) are like forwards but standardized and generally settled more frequently on an exchange. Since they are traded on exchanges, they have a higher degree of regulatory scrutiny than Forwards, are typically regulated (by the CFTC in the United States), and therefore have lower counterparty risk than Forwards. On the other hand, they have less flexibility because the terms are standardized.

Perpetual Futures

A perpetual futures contract is specific to the cryptocurrency space and not commonly used in the traditional financial industry. As the name suggests, a perpetual contract does not have an expiration date like a regular futures contract — holders can keep perpetual contracts indefinitely. Perpetual contracts generally settle at least one per day — often three plus times per day — but in perpetuity. Because they are settled so frequently, unlike conventional futures, perpetual contracts are often traded at a price that is equal or very similar to spot markets.

Options

Options grants the holder the right — but not the obligation — to buy or sell an asset at a specific price. The investor pays a premium to lock in this price and this is the cost of the option contact. The key difference between options and futures is that, with an option, the buyer is not obliged to exercise their agreement to buy or sell — it’s an option to do so.

A cryptocurrency call option gives the holder the choice to buy a cryptocurrency at a specific price you agreed upon today. So, if the price goes up in the future, the investor gets to buy the crypto asset at a lower price because they locked in the purchase price on the option contract. If the price goes down, then the investor doesn’t have to exercise the option and they only lose the money they already spent to buy the option.

A crypto put option is the reverse — it gives an investor the choice to sell a cryptocurrency at a specific price in the future.

What is Margin Trading?

Margin trading refers to the use of borrowed funds (debt) to trade. When trading on margin, crypto investors can leverage their buying power by trading a multiple of value of what they own, and also access derivatives.

How Does Margin Trading Work?

With margin trading, an investor is borrowing money, often from an exchange or Decentralized Finance (DeFi) platform. To get started, an investor makes an initial deposit into the margin account (initial margin). Unlike regular (spot) trading, the margin account allows the investor to trade with leverage.

For example, let’s take a look at George. He has one bitcoin (1 BTC) and wants to buy ether (ETH). Without margin, George could deposit his 1 BTC on an exchange and buy only 1 BTC worth of ETH. With a margin account however, George can deposit 1 BTC and select a level of leverage, say 5X. The 1 BTC would be held by the exchange as collateral, and the exchange would give George 5 BTC worth of “nominal money” to trade with on the exchange. The nominal money can only be used to trade on the exchange within the margin account but not withdrawn from the exchange. Now George’s buying power is 5X (5 BTC) what it was without margin.

If George goes all in on ETH and the price of ETH increases by 10%, George makes 0.5 BTC profit (5 BTC*10% = 0.5 BTC) instead of what he would have made without margin (1 BTC*10% = 0.1 BTC). This however cuts both ways — if the price of ETH drops 10%, George loses 0.5 BTC instead of 0.1 BTC.

In the crypto world, the amount of leverage on a margin account can vary from small amounts (e.g. 1.1X leverage) to huge amounts (100X leverage). For the skilled trader, leveraged derivatives allow for significant amplification of profits in a short period of time; however these financial contracts can also lead to hasty financial ruin.

Maintaining Margin

To protect themselves from losses, exchanges have the right to liquidate investors’ collateral if the investor becomes undercollateralized. This means that if your notional investment experiences a sufficient loss, the exchange will sell your initial margin (collateral) to cover the losses.

As an example, let’s say that George’s exchange requires that his collateral maintains at least 20% of the value of the assets in his notional account. At 3X leverage, the lowest George’s ETH contract can afford to go down to is 0.6 BTC (3 BTC * 20%). Remember George’s initial margin collateral was 1 BTC, so if he suffers more than 0.4 BTC of losses based on the contract’s fair market value, the exchange will send George a “margin call.” When George gets a margin call, he either needs to add more BTC as collateral on top of his initial margin, or the exchange will partially (or fully) liquidate his initial margin to regain the 20% collateral threshold (or recoup the losses).

Capital Gains on Liquidations

Counterintuitive: in some cases, liquidation of collateral after a margin call from suffering a derivative loss can actually result in a taxable gain! To understand this, remember that the collateral deposited is cryptocurrency, which the IRS taxes as property and is subject to capital gains and losses. Therefore if the initial margin bitcoin that George deposited in the exchange had appreciated since he acquired it, and then was liquidated, it would be subject to capital gains just as if he had sold it for USD. He would also be able to claim the loss from the contract settling at a lower value than when he bought it, however the capital gain on the initial margin could be larger than that loss (most software providers do not correctly handle this so be extra cautious about margin liquidation calculations with cryptocurrency tax software providers).

For example, imagine an exchange liquidates George’s 1 BTC he initially deposited to the margin account because of poor performance. At the time the exchange sold this BTC, the price of BTC was $10,000. George initially purchased this BTC a few years ago at $4,000. In this case, George would have a taxable gain of $6,000 ($10,000 – $4,000) and would have to pay taxes on it, even though he suffered losses on the derivative contract (those losses would be claimed separately).

To prevent this situation George could only deposit initial margin that has a high cost basis (which is at an unrealized loss), or avoid margin trading all together. It's also wise to always protect downside by using stop-loss orders — trades that automatically settle a position at a certain price to prevent further losses.

Margin Interest and Fees

When an investor borrows funds (margin) to trade cryptocurrency, they typically have to pay a fee called “margin interest” for the right to borrow those funds. For tax purposes, margin interest is referred to as an investment interest expense. Investment interest expenses are subject to special tax rules and are deductible only up to your net investment income amount.

For example, say during 2020 Karen generated $3,000 worth of net investment income. She also incurred $4,000 worth of margin interest fees (investment interest expenses) in the process of generating these gains. When she files her 2020 tax return, she can only deduct $3,000 worth of investment interest expense. The remaining $1,000 will be carried forward to future years. Karen can deduct this $1,000 when she has additional net investment income in future years.

Since special rules are applicable to investment interest expenses, it is important to track these separately. The amount you can deduct on each year is calculated on IRS Form 4952. Once calculated, this amount will flow to Schedule A, Line 9 (for casual investors) or Schedule C (for traders). Make sure to itemize these expenses to take advantage of their benefit 📝

Going Short and Long

When you have high conviction of the price of an asset in the future, you can go “long” or “short” on that asset. In simple terms, going “long” is betting that the value of the asset will increase and going “short” is betting that the value of the asset will decrease.

The simplest way to go long on cryptocurrency is to buy it. For example, if you think the price of bitcoin will increase in the future, you can simply buy and hold bitcoin. If you are a more sophisticated investor and have high conviction that the price is likely to increase, then you can open a margin account and go long bitcoin with leverage, thereby increasing your return multiple if the price of bitcoin increases.

Shorting a cryptocurrency however requires using margin. To open a short position, you buy a derivative contract obligating you to sell the underlying cryptocurrency asset at a specific price on the expiration date, irrespective of the future spot value of the underlying asset. Therefore you are betting that the price of the crypto asset on expiration of the contract (in the future) is going to be lower than it is today (at the date of the contract).

With all of these contracts, if they are cash settled, then you don’t actually need to ever buy or sell the underlying cryptocurrency asset — your margin account will automatically adjust the PnL to match the gain or loss based on the contract settlement terms between the settlement price and the futures contract price. If the contract is property settled however, then you will actually be buying/sending or receiving the underlying asset to settle the contract.

Taxation of Derivatives and Margin Trading

Unfortunately, the IRS has not published any general principles governing the taxation of derivative contracts in the US. Instead what we have is a complex set of tax rules and regulations that have evolved in piecemeal fashion over time. Due to their complexity, these rules are often exploited to make financial bets relatively risk-free by delaying, minimizing, or even avoiding taxes. Tax rules applicable to derivatives are complex and riddled with loopholes. To complicate matters further, none of these rules are clearly laid out in the cryptocurrency space, leaving significant grey area in how cryptocurrency derivatives are taxed.

The Complexity of Derivatives

Existing tax rules provide differential treatment for derivative transactions based on many factors, including:

- Character of tax attribute (ordinary vs. capital)

- Timing of recognition (short-term versus long-term)

- Type of derivative instrument (forward, future, option, swap)

- Location of trade (exchange-traded or over-the-counter)

- Conclusion of the contract (terminated, exercised, or lapsed)

- Type of settlement (cash vs. physical delivery)

- Intended use of the instrument (hedge vs. speculation)

- Nature of the taxpayer (dealer, trader, or investor; corporation or individual)

- Source of the transaction (US or foreign)

- etc.

Furthermore, taxpayers must consider numerous anti-abuse rules (e.g. straddle and wash sales rules) when they engage in certain derivative transactions. Moreover, these tax rules prescribe federal tax treatment of derivative instruments without regard to their treatment under accounting rules 🤷🏽♂️

You get it. It’s complicated. Onward 👇🏾

Cryptocurrency Derivatives

Crypto derivatives have an added layer of complexity to this already complex subject for three reasons:

- The IRS taxes cryptocurrency as property

- Crypto platforms have created novel derivatives which do not resemble any traditional financial derivatives

- There is literally zero IRS guidance on cryptocurrency derivatives

Nonetheless, we do our best to navigate this grey area and deduce logical options for reporting taxes on cryptocurrency derivatives. If you traded cryptocurrency derivatives, we strongly recommend consulting a qualified tax professional to understand how the tax rules apply to your specific situation 👩🏫

Regulated Section 1256 Contracts

If a derivative contract classifies for Section 1256 of the IRS tax code, it is subject to unique preferential tax treatment. To qualify, a derivative contract needs to meet certain criteria such as being regulated by the Commodity Futures Trading Commission (CFTC). Currently, there are only a few cryptocurrency exchanges that meet this criteria to offer Section 1256 futures (e.g. Bakkt, CME, Erisx, LedgerX). Other exchanges are offering non-regulated derivatives which likely do not qualify for Section 1256.

So why should you care about Section 1256 contracts? Because they can save you a lot of money on taxes if you are trading frequently 💸

Unlike unregulated derivatives, Section 1256 contracts are taxed at a hybrid 60/40 tax rate: 60% long-term capital gains rate and 40% short-term capital gains rate on the total gain amount. This is irrespective of the holding period of the derivative (e.g. even if you are day trading). Compare that to 100% short-term capital gains rate (higher) for normal cryptocurrency trading for coins that you have held for less than a year. Note: the hybrid rate is actually higher than 100% long term capital gains for normal cryptocurrency trading for HODLers who are keeping their coins for more than one year.

In addition, open Section 1256 contracts are required to mark-to-market at the end of the year. This allows the investor to write off unrealized losses on their tax return if they are in the red (or report unrealized gains as income for tax purposes, if they are in the green). Because of this rule, investors generally close Section 1256 contracts at year end. Furthermore, there is no “trade-by-trade” accounting in Section 1256 futures, so no wash sale rules apply and losses can be carried back three years on futures-based investments. 1256 contract information is reported on IRS Form 6781.

Note: Section 1256 rules are applicable regardless of whether you are a casual investor or a trader (without section 475(f) election for commodities — see below). These do not apply if you are a trader with section 475(f) election for commodities.

Tax Treatment for Casual Investors

For a casual investor in crypto forwards and futures — generally — a taxable event occurs when you either close or settle the position. Most exchanges report the net profit and loss (PnL) arising from each contract on the dashboard.

Assuming the PnL does not arise from Section 1256 contracts, these will be taxed similar to the underlying assets they represent. For example, a bitcoin future/forward is a capital asset and therefore results in capital gains and losses. These are taxed at the short term capital gain rate (ordinary income tax rate) if the contract is held for a year or less, and the lower long term capital gain rate if the contract is held for more than a year. The gains and losses would be reported on IRS Schedule D and IRS Form 8949.

Tax Treatment for Traders

Without Section 475(f) election

For tax purposes, a trader is someone who trades on a full time basis. The IRS outlines some criteria to see if you qualify as a “trader.” Note that the IRS definition of a “trader” for tax purposes is different from the colloquial meaning of the term.

For traders, crypto futures PnL will also result in capital gain or losses. This will be reported on Schedule D and IRS Form 8949. Unlike casual investors, traders can write-off trading related business expenses (e.g. internet fees, rent, subscriptions, etc.) on IRS Schedule C to offset trading income.

With Section 475(f) election

If you qualify as a trader, the default tax treatment described above may not be beneficial for you. For example, if you have a $100,000 loss on your day trading activities in a given year, you can only deduct $3,000 worth of net losses because by default traders’ gains and losses are capital in nature. Therefore, almost all the traders file a 475(f) election with the IRS. This allows the trader to treat trading capital gains and losses as ordinary income and losses instead. This allows deduction of unlimited losses in the tax year. However the downside to this election is that if you make long term gains (on assets held over 12 months), those will now be subject to higher ordinary income rates than preferential long term capital gain rates.

A section 475(f) election can be very beneficial for traders. However, it is currently applicable only if you deal with securities and commodities. Since cryptocurrencies are taxed as property per IRS Notice 2014-21, the applicability of this election for crypto traders is a grey area. AICPA has advocated the IRS to make this election applicable to crypto traders and others have asked for more clarity on this issue.

If a trader chooses to make this election, their crypto derivative PnL (along with any other crypto gain or loss) will be treated as either ordinary income or losses. Trading gains and losses will be reported on IRS Form 4797 and Schedule C can be used to report your business related expenses. These traders are also required to mark-to-market their holdings at the end of each year and report unrealized gains/losses as realized gains/losses on their tax return. This will also require these traders to adjust the cost basis of their crypto asset based on the marked up/down values.

Exchange Specific Guides

BitMEX Margin Trading

BitMEX is an exchange that offers unregulated cryptocurrency derivative contracts using cryptocurrency collateral. BitMEX calculates your realized profits and losses (PnL) on every settled contract and displays them on the exchange dashboard. CoinTracker converts these realized PnL cryptocurrency amounts (as defined and calculated by BitMEX) into your CoinTracker base currency at the time of contract settlement and displays them in CoinTracker.

Sync your account

The first step to track your BitMEX positions is to add your BitMEX account to CoinTracker.

Interpreting your transactions

After you sync your BitMEX account with CoinTracker, you will see a summary of your transactions on the wallets page. Note that the list of cryptocurrencies displayed includes those in the notional trades of your derivative contracts (not just the cryptocurrencies that are actually in your wallet).

If you drill into the transactions of any particular cryptocurrency within your BitMEX wallet, you'll see the leveraged notional positions involving that cryptocurrency on the transactions page. For example, if you bought 10 contracts of the ETHUSD perpetual contract, you will see a transaction row like the one below:

Do not be alarmed by the numbers if they seem large — this transaction is merely the trading pair that your derivative contract (in this example the ETHUSD perpetual contract) is indexed on. The actual BTC value of your contract is a fraction of the nominal dollar value of the trade, determined by using the multiplier for the contract. These trades are marked as "Margin" positions and are ignored for cost basis and capital gains calculations for your CoinTracker account.

Because all notional positions, gains, and losses on BitMEX are posted in bitcoin, the realized profit and loss figures will be displayed in CoinTracker under your BitMEX bitcoin wallet. Realized profit and loss (PnL) figures will be tagged with either "Trading Gain" or "Trading Loss" along with a chip displaying the amount gained or lost. Note that any unrealized gains will not be displayed on this page even if you are able to see them on your BitMEX account. The figures shown for realized PnL entries are net of all fees charged by BitMEX:

How BitMEX Taxes Work

These PnL entries are the only figures that will matter for tax calculations from BitMEX. If you make a trading gain, then the cost basis of the quantity gained will be 0. If you make a trading loss, it will be as if you spent the BTC and normal capital gains or losses will apply. Counterintuitively, this can mean that you can incur a capital gain even at a trading loss, if the bitcoin you are losing is at an unrealized capital gain compared to when you acquired it.

Example

Nic buys 1 BTC for $1,000. He buys 5,000 contracts of ETHUSD on BitMEX for 1 BTC (assume no leverage for simplicity). If the price of ETH declines 50% relative to the USD, Nic will realize a loss of 0.5 BTC when he settles the contract. If the price of BTC is $2,000 when the contract is settled, Nic will incur ($2,000 - $1,000) * 0.5 = $500 in capital gains, even though he made a trading loss, because of the appreciation in the price of BTC.

Let’s say Nic now has one bitcoin (1 XBT) of realized profit on Contract A on January 1, 2020 and 2 XBT realized profit on February 1, 2020 on Contract B. The USD price of 1 XBT is $1,000 (on January 1, 2020) and $1,500 (on February 1, 2020). In this case, CoinTracker will show net futures gain of $4,000 ($1,000 + (2*$1,500)) on the tax page:

The amount recognized as income on the above step will be the cost basis for those bitcoin going forward. Continuing the example, if Nic were to sell 1 XBT received from settling the Contract A for $5,000 on July 1, 2020, that would trigger a short-term capital gain of $4,000 ($5,000 – $1,000).

The way you file BitMEX taxes depends on a variety of factors. For example if Nic is a casual investor, this would be included on his Form 8949 and Schedule D tax reports just like any other bitcoin sale. If he’s a trader or makes certain elections, different tax treatment may apply. We recommend consulting a tax professional if you are not sure how to deal with this (or fill out this form and we will connect you with a tax professional).

Kraken Margin Trading

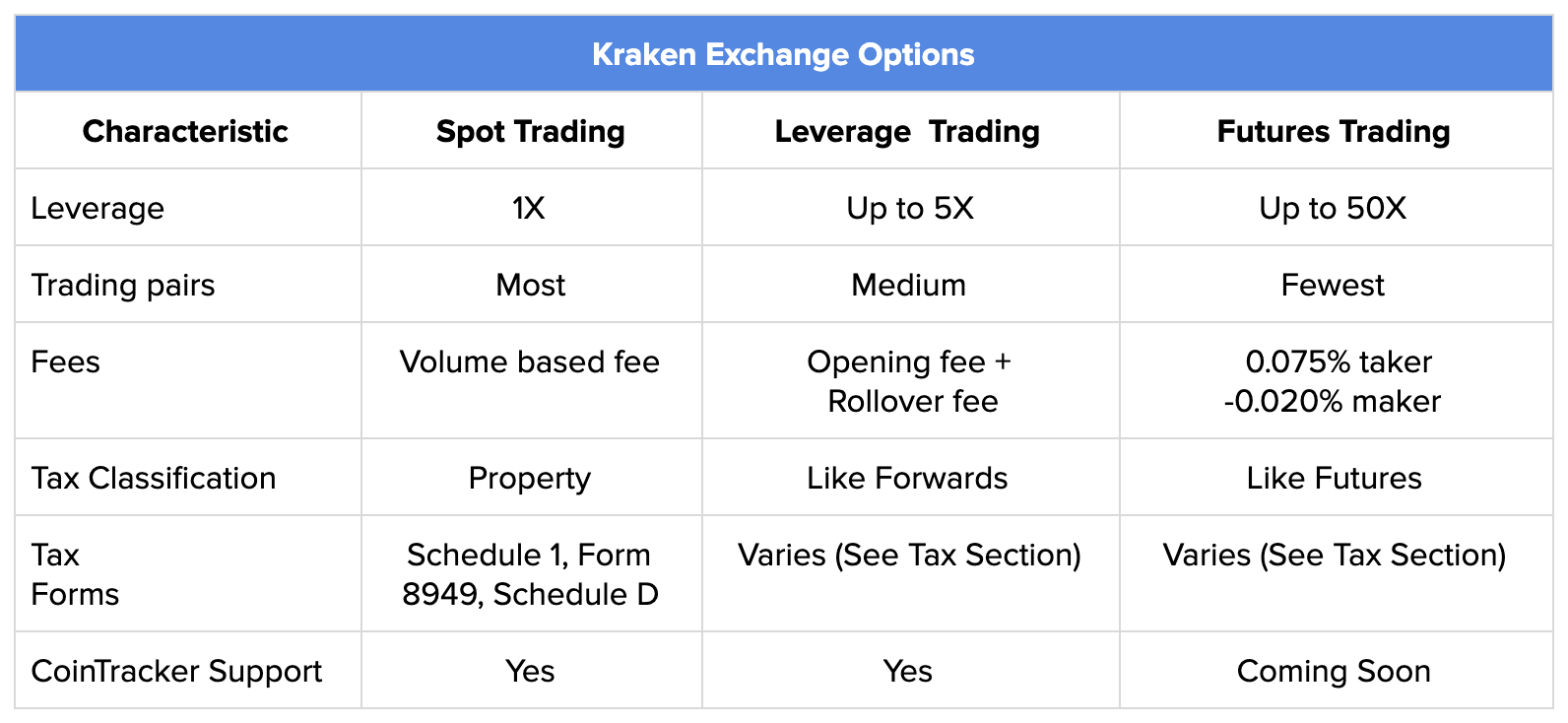

Kraken offers a spot exchange with margin trading options and a Futures exchange.

Spot Exchange

When using Kraken as a spot exchange, there is no leverage. This means if you deposit one BTC or $1,000 to the exchange, you have the buying power of one BTC or $1,000, respectively. After you make a spot trade, you directly own the asset, and you can withdraw it from the exchange at any time. These are regular cryptocurrency trades and taxed as property in the US per IRS guidelines.

Margin Trading

Kraken also allows you to open a margin account to trade with leverage. Enabling margin trading allows an investor to amplify gains (and losses) for their cryptocurrency trades and is required to create short positions (bet against the value of a cryptocurrency).

Within a Kraken margin account, an investor can deposit collateral, select a leverage amount, and gain access to margin pairs. The amount of leverage available depends on the margin pair and typically ranges from 2X to 5X.

Kraken Futures

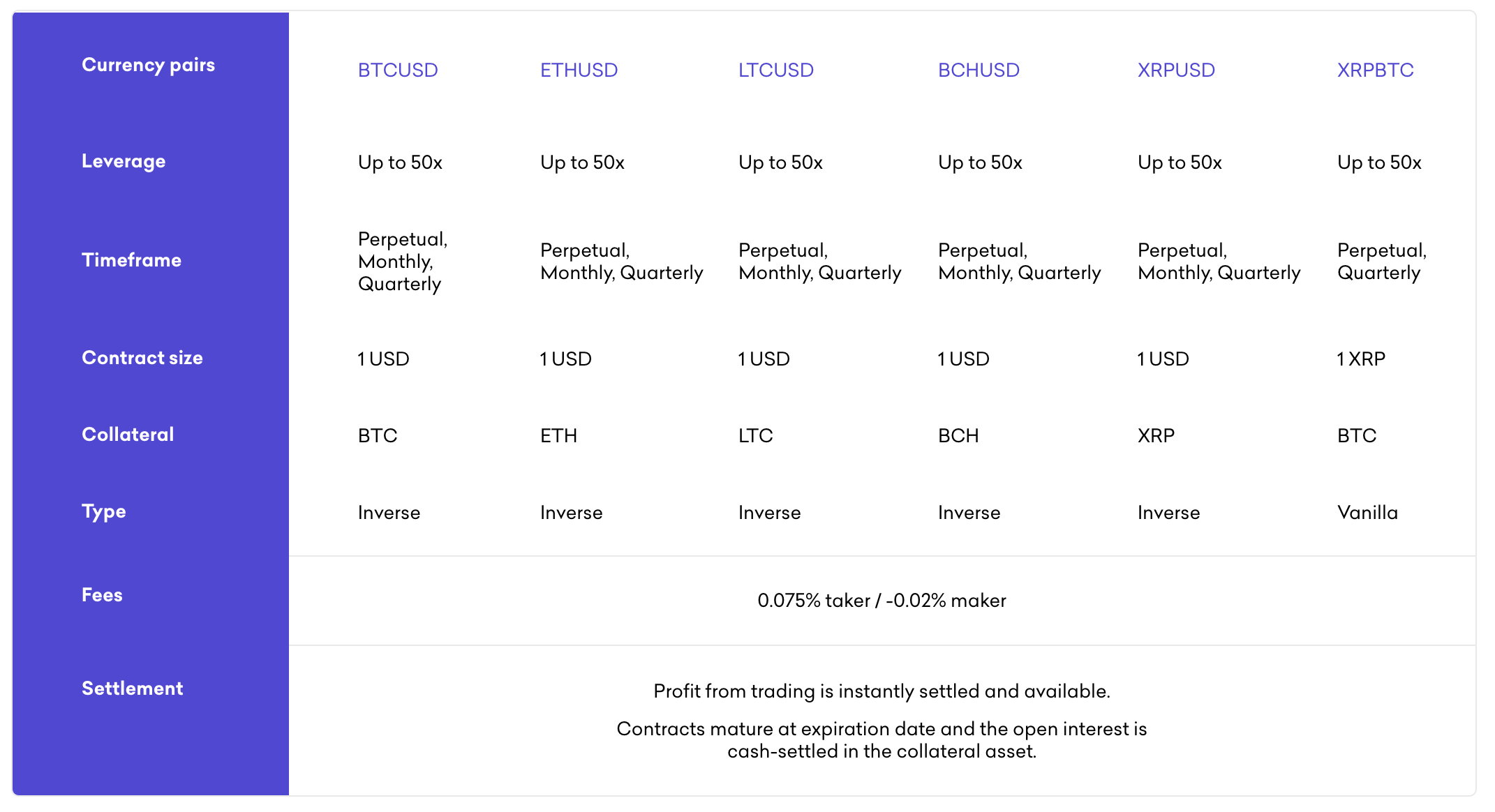

Kraken has also opened a derivatives exchange for futures contracts with up to 50X leverage. A margin account is required to open short positions for derivatives. An investor can deposit collateral (see choices below), set the leverage (up to 50X) and get access to future contracts.

Here is a quick side by side comparison of Kraken spot margin and futures trading.

How Kraken Trades are Taxed

Spot Trades

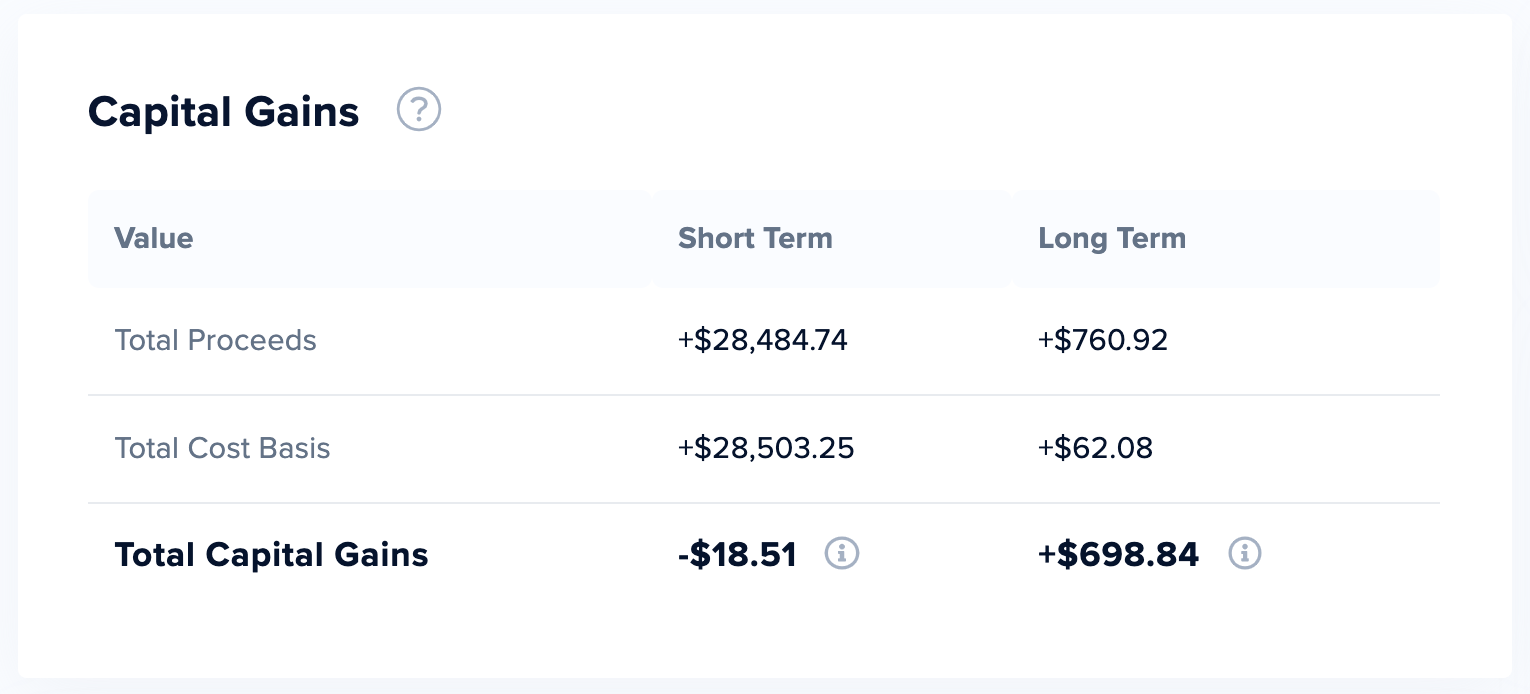

On CoinTracker, gains and losses coming from spot trades are reflected on the “Capital Gains” section of the Tax page. These numbers will also be on the downloadable tax reports such as Schedule D and Form 8949.

Leverage and Futures Trades

CoinTracker calculates the Profit and Loss (PnL) on each futures contract is converted into USD (if they are not shown in USD) at the time they are settled. Then, these amounts are aggregated in “Net Futures Gains” line on the “Taxable Income” card.

Second, CoinTracker tracks margin fees on a separate line item so your accountant has the information needed to follow the tax rules:

The tax rates will depend on various factors such as whether you are a casual investor or a trader with certain tax elections.

Binance Margin Trading

Leverage Tokens

Binance Leverage Tokens (BLT) allow investors to participate in sophisticated derivatives like perpetual futures without worrying about technicalities and complex rules.

BLTs essentially work like any other token on an exchange. They are tradable assets in the Binance spot market that give investors leveraged exposure to the underlying assets they represent. Each leveraged token represents a basket of perpetual contract positions.

The price of the tokens track the notional value of the basket of perpetual contract positions they represent and change in multiples based on the level of leverage they represent. Unlike traditional leveraged trading on margin, BLTs allow investors to access leveraged positions without a margin account, collateral, or liquidation risk.

On CoinTracker, gains and losses from BLTs are reflected in the “Capital Gains” section of the Tax page. These numbers will also be on the downloadable tax reports such as Schedule D and Form 8949.

Futures Contracts

Binance also supports futures contracts. Binance shows the net profit and loss (PnL) from these contracts. A taxable event occurs every time an investor closes or settles a futures position. CoinTracker calculates the fair market values of each of these settlements and aggregates them under the “Net Futures Gains” line in the “Taxable Income” card on the tax page.

Perpetual Futures

On top of regular futures, Binance also supports perpetual futures. This product is best suited for long-term investors and miners who prefer to hold positions for a long time and do not want their positions to automatically expire. Binance's fund system automatically settles perpetual futures every eight hours, indefinitely until the position is closed by the user (or they are liquidated).

Since there is no direct tax guidance on the implications of perpetual cryptocurrency futures, CoinTracker tracks the contracts as if there is a settlement at each funding event. These are captured from the PnL and reflected under the “Net Futures Gains” line in the “Taxable Income” card on the tax page.

Binance Options

Binance additionally offer options with the right to buy or sell a cryptocurrency at a specific price on a future date.

Example

Let’s say on January 1, 2020, Martin buys 1 call option for $100. This contract gives him the option to buy 1 BTC at $6,000 (strike price) on March 31, 2020 (expiration date). Then, on March 31, the spot price of 1 BTC is $9,000. Martin is now in a profitable situation (“in the money”) because he gets to buy 1 BTC at a lower price than the current market. If he decides to exercise his option, he only needs to spend $6,000 to buy 1 BTC worth $9,000. Exercising the option is not a taxable event. Martin can also add the $100 he paid for the option contract to his basis for a total of $6,100 ($6,000 + $100). This is now how basis for this bitcoin going forward for his future gains and losses when he subsequently sells the BTC. This example shows how taxes work for physically settled options.

Binance options are almost all cash/crypto settled however. Cash settled options result in either short or long-term capital gains for casual investors and traders with no section 475(f) election. The holding period starts when the investor purchases the contract and ends when the option expires or is exercised.

Example

Continuing with the example above, in a cash settled option, Binance would credit the profit of $3,000 ($9,000 – $6,000) to Martin’s Binance account. In this scenario, $3,000 would be taxed as short-term capital gains because he held the option for less than one year.

That's crypto derivatives in a nutshell! Questions or comments? Reach out to us @CoinTracker

Disclaimer: this post is informational only and is not intended as tax advice. For tax advice, please consult a tax professional.