Are you confident in accurately reporting cryptocurrency earnings on your tax returns?

2022 Crypto-Exchange Fee Comparison

In the fast-moving world of cryptocurrency, it can be tough to keep up. One area of particular complexity is exchange fees, as many exchanges hide fee structures in the fine print and confuse users with overlapping fee structures and discounts.

July 22, 2022 · 5 min read

In the fast-moving world of cryptocurrency, it can be tough to keep up. One area of particular complexity is exchange fees. Crypto traders have an array of options to choose from when trading, but many exchanges hide fee structures in the fine print and confuse users with overlapping fee structures and discounts. The good news is we built CoinTracker to make it easy for you to track your coins, trades, and fees across multiple wallets and exchanges.

Full list of crypto exchanges supported by CoinTracker.

Types of crypto exchange fees

Cryptocurrency exchanges charge fees on different types of user behavior:

Trading Fees

The primary source of revenue for exchanges. They are typically charged on both fiat-crypto trades as well as crypto-crypto trades.

Deposit/Withdrawal Fees

Some exchanges charge fees for deposits and/or withdrawals. Deposit fees vary based on the type of deposit but are less common than withdrawal fees since exchanges want to incentivize users to fund their account. For cryptocurrency withdrawals, many exchanges limit fees to any blockchain transaction costs (usually a flat fee regardless of the amount withdrawn), but some will take an additional fee based on your country or the type of withdrawal (crypto vs fiat)

Interest/Borrowing/Liquidation Fees

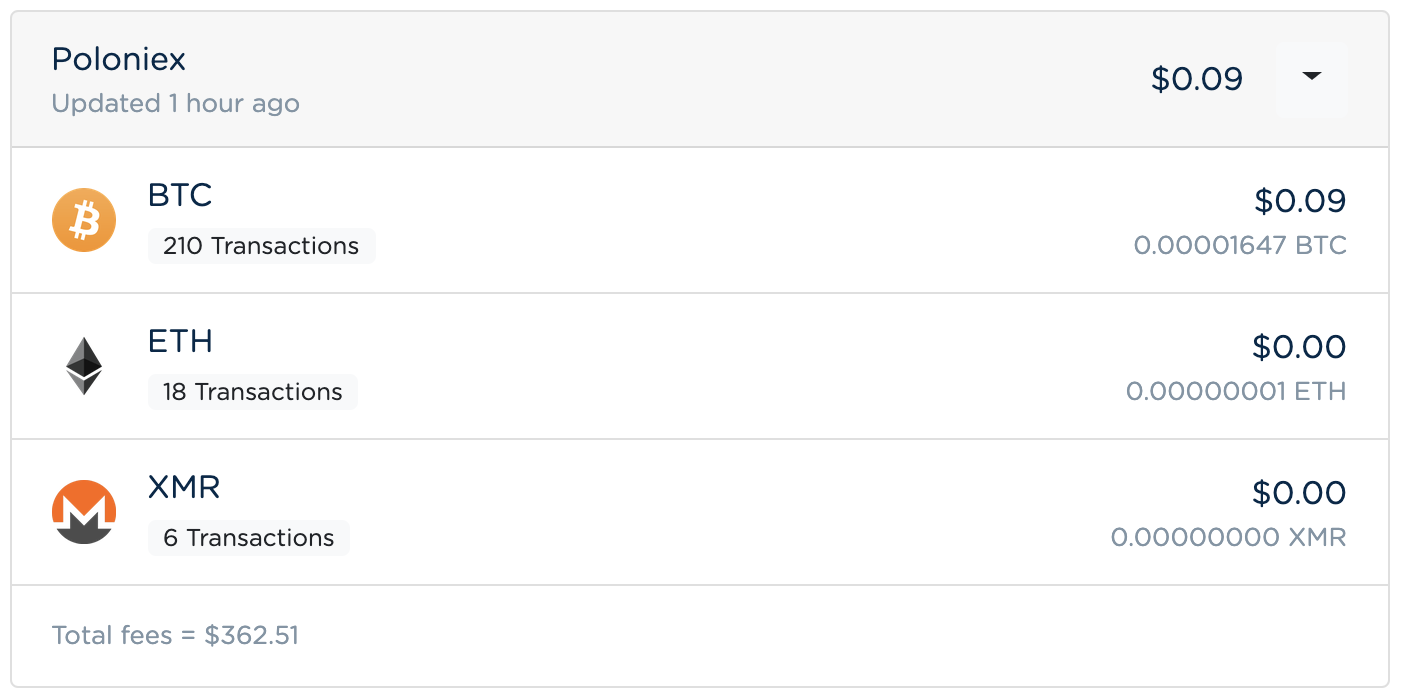

Some exchanges like Kraken, Poloniex, and Bitfinex offer crypto margin trading: the ability to borrow or synthetically borrow additional funds to increase your position and create leverage. These exchanges typically charge additional fees based on the amount borrowed on margin and an interest rate determined by the supply of funds available. Additionally, if your trade goes upside down and the position is liquidated you may be charged an additional fee.

Low Fees & Discounts

Market Makers & Volume Discounts

Many exchanges offer lower trading fees to “market makers”, traders placing limit orders instead of market orders, and high volume traders to incentivize exchange liquidity

Exchange Token Discounts

An increasingly popular approach is to discount exchange fees for users who purchase an exchange’s own cryptocurrency token. Several non-US exchanges such as Binance, Huobi, and Bibox have adopted this system to help incentivize investment into their tokens. These exchanges have elected to decrease the amount of the discount each year until phasing it out entirely in after four to five years

Let’s take a closer look at fees across some of the top crypto exchanges.

Fees by Cryptocurrency Exchange

(assuming no discounts as of January 1, 2021)

A Brief Summary

- Trading fees vary by more than an order of magnitude, from 0.1% to more than 1% on Coinbase and Gemini

- Bibox, Binance, Coinspot, HitBTC, and Kucoin offered the lowest taker fee of the surveyed exchanges at 0.1%. Binance and Bibox offer even lower rates when paying with their exchange tokens

- Most exchanges do not charge fees on deposits made via Bank ACH or direct cryptocurrency deposits, but may typically charge additional fees for purchases/deposits made via wire transfer or credit cards

- Cryptocurrency withdrawal fees are typically limited to blockchain transaction costs, but these can vary considerably depending on the cryptocurrency

In sum, always make sure to review the fee schedule at your preferred exchange and consider any applicable discounts for volume or usage in your calculation. When you are ready to trade, connect your exchange accounts to CoinTracker to track your trades and fees across exchange accounts for free.

Automatically Track Your Portfolio and Taxes with CoinTracker

CoinTracker integrates with 300+ cryptocurrency exchanges, 3,000+ blockchains, and makes bitcoin tax calculations and portfolio tracking simple.

If you have any questions or comments about crypto taxes let us know on Twitter @CoinTracker.

Disclaimer: This post is informational only and is not intended as tax advice. For tax advice, please consult a tax professional.