Are you confident in accurately reporting cryptocurrency earnings on your tax returns?

How to Choose a Cryptocurrency Wallet

Crypto wallets can be broken down along two axes: hot vs. cold and self custody vs. third-party custody. Here's how to pick the right wallet for your needs.

April 23, 2020 · 4 min read

One of the uniquely differentiating properties of cryptocurrency is the ability to self custody your assets digitally. This means that unlike stocks, dollars, and other common assets — which have to be held physically or in a bank/custodian — you can store your crypto yourself. This is a powerful feature of cryptocurrency, but, with great power comes great responsibility.

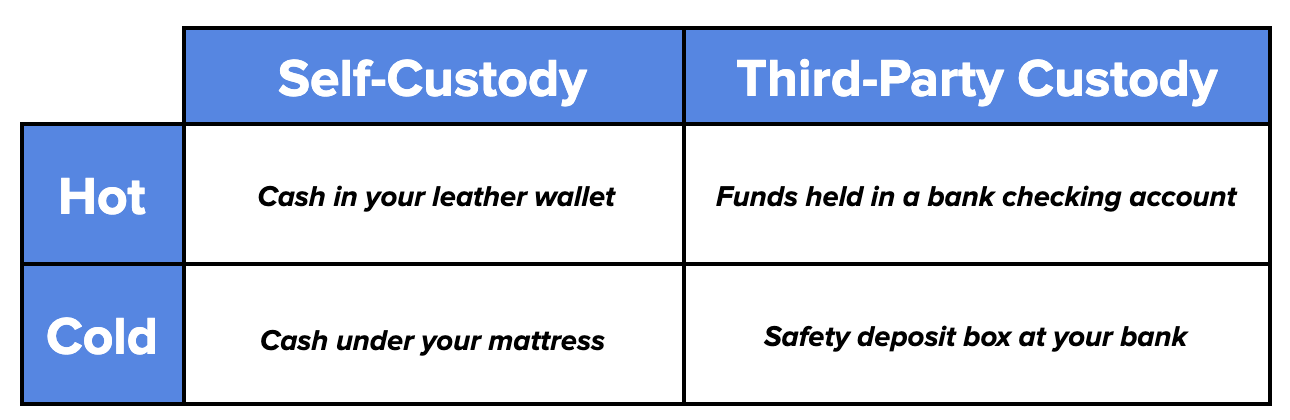

Crypto wallets can be broken down across two axes: online vs. offline (sometimes called hot vs. cold) and self custody vs. third-party custody. It’s worth spending some time to understand each so that you can protect your wealth and make the most out of your crypto assets.

If you remember nothing else, remember that as long as your crypto assets are kept on an exchange or held by a third-party, they are more susceptible to theft, seizure, and other risks, such as the Binance and Cryptopia hacks in 2019. In the first eight months of 2019 alone, crypto theft accounted for more than $4B in losses.

“Not your keys, not your coins”

Hot vs. Cold Wallets

Hot wallets are cryptocurrency wallets that are online and connected to the internet. Given that they are connected to other services, hot wallets make it very easy to use and transfer your cryptocurrency and typically prioritize personal accessibility. The largest downside to this accessibility is that hot wallets are less secure than cold wallets because they can be remotely hacked. The most secure hot wallets tend to compensate for this by including two-factor authentication and require multisignature (multisig) in order to transfer assets.

Your assets held on an exchange can loosely be considered funds in a hot wallet, as they’re ready to be deployed quickly (note: some exchanges also allow you to move your funds into their cold storage). We recommend that you only keep the minimal amount of funds that you need in an exchange or unsecure hot wallet.

Verdict: Hot wallets makes sense for beginners, active traders, and people who need access to their assets quickly

Cold wallets are crypto wallets that are offline (air-gapped from the internet) and either run locally on a computer (without internet access), on an external piece of hardware, or on some other physical storage (e.g. metal, paper, etc.). If you think of a hot wallet as your online bank account, you can think of your cold wallet as your safety deposit box at the bank. Cold wallets are typically more expensive and more difficult to interact with than hot wallets, but provide better security and less dependence on a third party. While cold, hardware wallets can be pricey, you can still create your own cold wallet at home by using a paper key or a dedicated USB drive, although we highly recommend investing in a hardware wallet if you are serious about cryptocurrency.

Verdict: Cold wallets are great for set-it-and-forget-it, long-term investors who do not move their assets frequently

Self-Custody vs. Third-Party Custody

When it comes to custody, another factor to consider is who is holding & monitoring your funds. Self-custody means that your assets & keys are owned by you, whereas third-party custody implies that your funds are held by an intermediary which you have to interact with in order to access your funds. While self-custody limits the number of individuals who can access your funds, it places the entire burden of security and safety on you, the owner. Conversely, third-party custody allows more individuals to access your funds, but typically benefits from the scale effects of pooling users’ funds, such as dedicated security, support, and recovery teams to prevent issues.

You can think about this as whether you want to control your own money or have a bank control your money for you. With fiat currency, it generally makes sense to use a bank because how else are you going to protect your wealth — it’s not practical to cash out all of your money and stuff it under your mattress. With cryptocurrency however, you can self custody all of your coins on a USB drive which changes the game in terms of the practicality of being your own bank.

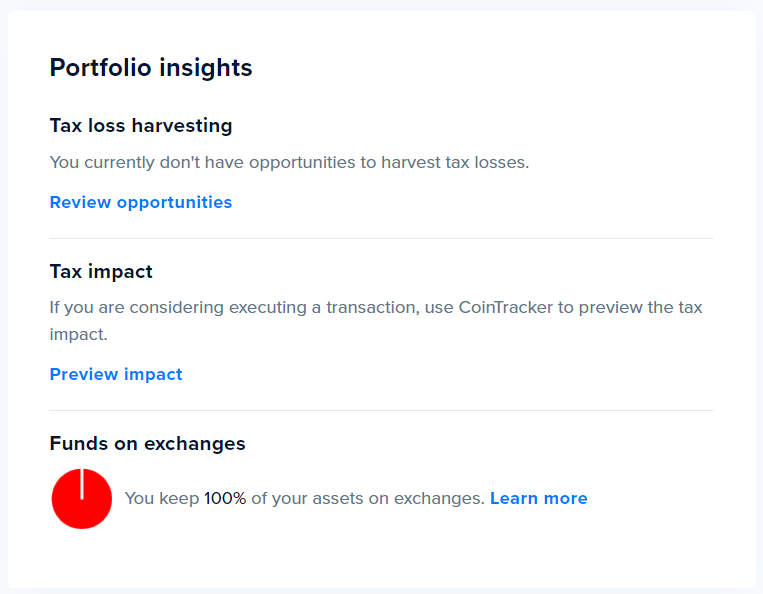

If you have any funds left on an exchange, then those funds are currently third-party custodied, as you have transferred control of your assets to the exchange. In the past, third-party custody in hot wallets, such as most exchange funds, have been repeatedly hacked (billions of dollars of stolen funds). It’s for this reason that we highly recommend you self-custody your cryptocurrency.

Verdict: Avoid hot, third-party custody (such as exchanges) and opt for a self-custody solution.

Wallet Recommendations

There are many cryptocurrency wallets to choose from (do your own research!). Overall, for beginners, it may make sense to use hot, third party wallets such as exchanges to store their funds because they are the easiest to get setup on. A good starting place is Coinbase.

For more advanced users, we recommend self-custodied solutions. Some good options are Exodus (many supported currencies, free), and Coinbase Wallet. We recently joined forces with Coinbase Wallet so you can easily import crypto transactions into Cointracker with just a few clicks. For more secure cold wallets: Trezor & Ledger.

Finally, for high net worth individuals, we recommend Casa — the most secure multisig custody solution.

CoinTracker for Crypto Portfolio Tracking

Regardless of whether you use hot wallets, cold wallets, or just leave your funds on an exchange, CoinTracker can help you monitor your portfolio and notify you any time your funds move.

Once you’ve connected all your accounts to CoinTracker you can generate your tax reports in seconds and make filing your crypto taxes a breeze. Over 100,000 users trust CoinTracker to monitor their cryptocurrency transactions and get their cryptocurrency tax done. Get started today at www.cointracker.io.

Let us know about your thoughts on Twitter @CoinTracker.