Crypto Tax Guide for the United Kingdom

Jan 14, 2019・12 min read

On March 30, 2021, His Majesty’s Revenue and Customs (HMRC) issued consolidated tax guidance on crypto assets. This guide breaks down the UK’s cryptocurrency tax rules so you can easily comply with them.

UK crypto tax crackdown

On top of the previously released guidance, the HMRC reached an agreement with Coinbase to disclose information on its users with more €5,000 worth of crypto assets on the platform during the 2019-20 tax year. On October 2, 2020, Coinbase sent out the following notice to its users subject to this crackdown.

Tax authorities all around the world are paying more and more attention to crypto tax-related non-compliance issues. To avoid unnecessary trouble, you must be fully compliant with your crypto tax obligations.

2025

Crypto Tax

Guide is here

CoinTracker's definitive guide to Bitcoin & crypto taxes provides everything you need to know to file your 2024 crypto taxes accurately.

How HMRC Taxes Cryptocurrency

Types of Tokens

HMRC does not treat cryptocurrency as currency or money. According to HMRC, there are four types of cryptocurrencies:

- Exchange tokens — used to make payments (e.g. bitcoin)

- Utility tokens — provide the holder with the right to access to a good or service

- Security tokens — give the holder the right to profit and loss in a business venture

- Stablecoins — coins that are pegged to another asset with a stable value such as fiat currency or precious metals such as gold.

Although these definitions are useful to label different tokens you hold, the tax treatment depends on the use case of each token.

General HMRC rules on crypto taxation

HMRC taxes cryptocurrency depending on how you deal with cryptocurrency. If you hold cryptocurrency as a personal investment, you will be subject to Capital Gains Tax rules. This means that you are taxed on the capital gain at the time the cryptocurrency is disposed of (e.g. sold, traded, used for a purchase, etc.). The capital gain is the difference between the GBP value of the disposed asset at the time of the disposition minus the GBP value of the disposed asset (how much you paid for it) at the time it was acquired.

If you trade cryptocurrency as a business activity, income will be subject to Income Tax rules.

HMRC doesn’t define what constitutes a business activity. Whether you have a business activity or not depends on the facts and circumstances of each case. HMRC encourages you to look into financial trader rules to determine if you have a trading business activity.

Generally, speaking a “disposal” activity triggers taxes according to the HMRC. Disposal is a broad concept and includes:

- selling cryptoassets for money

- exchanging cryptoassets for a different type of cryptoasset

- using cryptoassets to pay for goods or services

- giving away cryptoassets to another person

Allowances

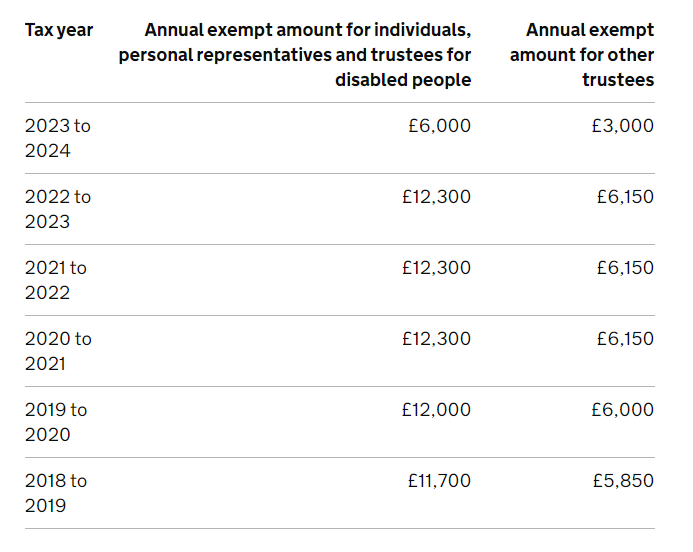

UK residents are allowed an allowance of capital gains that are non-taxed for individuals up to £6,000 in capital gains across all capital assets for the April 6, 2023 — April 5, 2024 tax year (different exemptions apply if you live in Scotland or are domiciled outside the UK).

Cryptocurrency gifts to your spouse are also non-taxed and can effectively allow you to double your tax-free allowance in a given tax year. Gifts to charity are also tax-free (details).

Consider the following scenarios:

Example 1

Purchase 1 bitcoin (BTC) for £100 and then sell it for £5,000. Additional £1,000 in capital gains from stocks. Capital gain is £4,900 from BTC + £1,000 = £5,900. Therefore no capital gains tax filing is needed, and no capital gains taxes are due because the total capital gain is below the allowance.

Example 2

Purchase 1 BTC for £100 and then sell it for £20,000. Capital gain is £19,900. Taxes are due on this amount based on your capital gains tax rate.

Example 3

Purchase 10 BTC for £91,000. Gift half of them to your husband. Then you each sell five BTC for £51,000 (for a total of £102,000). Capital gains are £11,000 but split across two individuals, so below the £6,000 threshold per person. Therefore no capital gains taxes are due. Nonetheless, since the disposition value per person exceeds the allowance (£50,000), a filing still needs to be made.

Note: regardless of the allowance, you are required to file your UK taxes if your proceeds for the 2023–24 tax year were >£50,000 OR your capital gains (before losses , not net capital gains) were >£6,000. There may be additional reasons when you are required to file as well.

Share Matching

HMRC requires share pool accounting when calculating the cost basis of a coin disposition (CoinTracker offers this option in the settings for United Kingdom based users). When you spend/sell/trade cryptocurrency, you will be treated as disposing them in the following order.

- Same Day Rule: coins acquired on the same day as the disposal are consumed first

- Bed and Breakfasting Rule: coins acquired in the 30 days following the day of disposal (provided the person making the disposal was resident in the United Kingdom at the time of the acquisition)

- Crypto-pool (Section 104 Rule): all previous coins purchased, price averaged

Example

Let’s say that you make the following transactions:

- May 1: buy 0.25 BTC @ £1,000/BTC

- June 2: buy 0.25 BTC @ £2,000/BTC

- July 3: buy 0.25 BTC @ £3,000/BTC

- August 4: buy 0.25 BTC @ £4,000/BTC

- December 31: buy 0.25 BTC for £5,000/BTC, and then later the same night sell 0.5 BTC at £5,000/BTC

- Two weeks later, you buy an additional 0.1 BTC for £10,000/BTC

Per share matching rules, your BTC is priced and disposed of as follows:

- Same Day Rule: 0.25 BTC for 0.25 * £5,000 = £1,250 (from #5 above)

- Bed and Breakfasting Rule: 0.1 BTC for 0.1 * £10,000 = £1,000 (per #6 above)

- Crypto-pool Rule: (0.5 BTC – 0.25 BTC – 0.1 BTC) = 0.15 BTC for 0.15 * (0.25 * £1,000 + 0.25 * £2,000 + 0.25 * £3,000 + 0.25 * £4,000) / 1 BTC = £375

So the total cost of the 0.5 BTC sold on December 31 comes to £1,250 + £1,000 + £375 = £2,625.

Note: in the case of multiple purchases at different prices in a given day, average the cost of all transactions into one combined transaction for that day when determining cost basis (TCGA92/S105(1)). In the case of multiple purchases at different prices in a 30-day bed and breakfasting period, apply FIFO (first-in, first-out) logic for calculating the cost basis of the previous sale.

As you can see, share matching and pooling can become quite complicated quite quickly. CoinTracker completely automates these calculations for you and your accountant so you can spend less time worrying about accounting calculations and more time thinking about your portfolio itself.

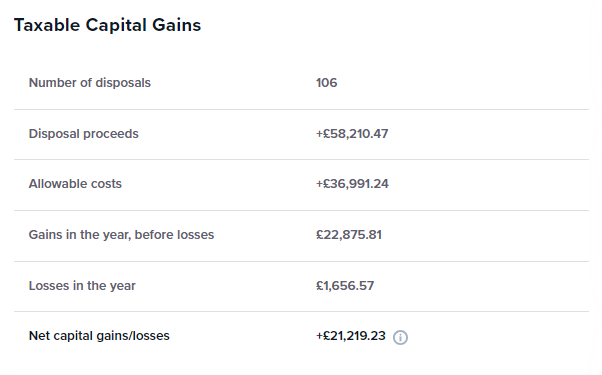

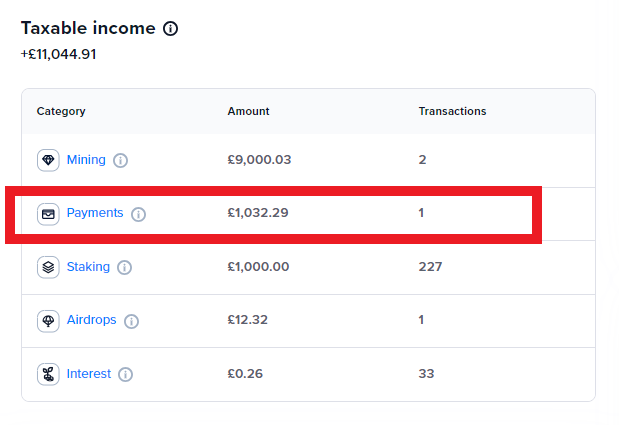

In the CoinTracker Tax Center, your annual capital gains will be shown in the Taxable Income card.

Losses

You can also claim capital losses and use them to offset capital gains in the same tax year or future tax years. The time limit for claiming capital losses is within four years of the end of the tax year in which the capital loss was realised. You claim your losses by including them on your tax return. If you have never made a gain and are not registered for Self Assessment, you can write to HMRC instead.

Forks

A hard fork occurs when you end up with new tokens in addition to your original tokens due to a deviation of the original blockchain. HMRC states that “the value of new crypto assets is derived from the original crypto assets already held by the individual”, but does not prescribe any particular method to figure out the cost basis of the newly received tokens. However, it requires you to pick a reasonable method that complies with the Capital Gains Act of 1992. After the fork, the new crypto assets need to go into their own pool per the share matching rules.

Examples of possible ways to manually edit transactions to split the basis of forked coins include:

- Original coin maintains 100% cost basis, new coin(s) take zero basis

- Pro-rate basis across all coins new and old, based on the price at the time of the split

- Pro-rate basis across all coins new and old, based on the price at the time of gaining control of the coins

Whichever method you choose, make sure to document what you are doing, why, and apply it consistently across all hard forks.

Mining

Hobbyist miner

If you are a hobbyist miner (somebody who mines casually and not as a business), you have to report the fair market value of coins at the time you received as a miscellaneous income. You also get to offset this income by mining-related expenses. You will have to pay capital gains taxes on the mined coins if you later sell them.

Example

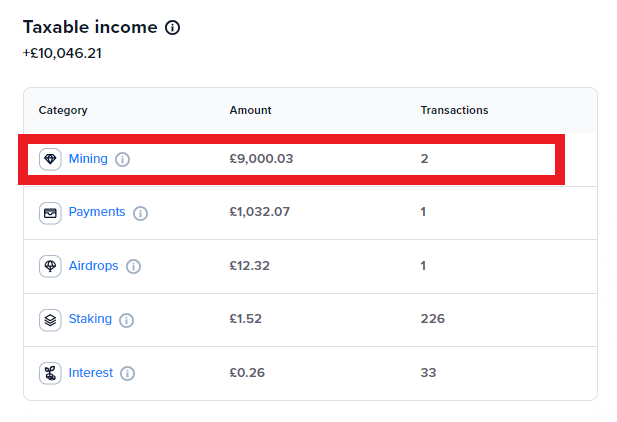

Suppose you mined 1 BTC in 2023. At the time you received this coin in your wallet, it was worth £9,000. You would report £9,000 as miscellaneous income. This also becomes the cost basis of this coin. If you were to sell this coin later for £10,000, you’d have a capital gain of £1,000 (£10,000 – £9,000).

In the CoinTracker Tax Center, your annual mining income will be shown in the Taxable Income card.

Business miner

When you mine coins, the fair market value of the coin at the time you gain possession of the coin will be income incurred and the cost basis for future capital gains/losses. Starting with the 17/18 tax year, the UK allows £1,000 of trading income tax-free. So for example, if your only trading income in the year was £800, then you would not have to report this mining income. If it was £1,200, then you would have to report it and pay income tax on £200.

Staking

Staking as a hobbyist

If you are staking as a hobby (somebody who stakes casually and not as a business), you have to report the fair market value of coins at the time you received as a miscellaneous income.

Example

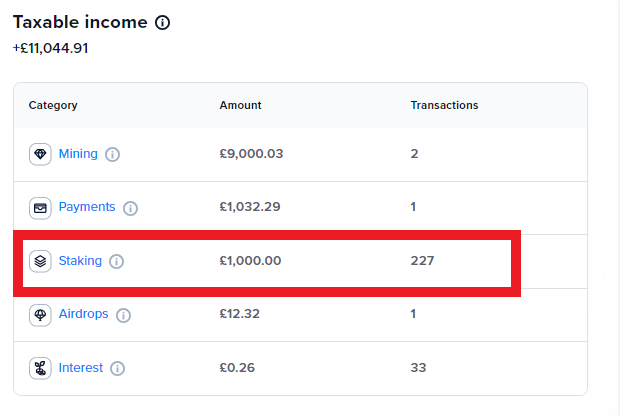

Suppose you staked 1,000 XTZ in 2023. At the time you received these coins in your wallet, each coin was worth £1. You would report £1,000 as miscellaneous income. This also becomes the cost basis of the coins. If you were to sell this lot of coins later for £3,000, you’d have a capital gain of £2,000 (£3,000 – £1,000).

In the CoinTracker Tax Center, your annual staking income will be shown in the Taxable Income card.

Staking as a business

If you stake as a business, staking income must be calculated according to relevant business tax rules. Whether you have a staking hobby or business depends on following criteria set forth by the HMRC:

- Degree of activity

- Organisation

- Risk

- Commerciality

Airdrops

An airdrop occurs when you receive a free token in your wallet. This typically occurs as a part of a marketing or advertising campaign. Taxation of airdrops depends on your tax status ‐ personal investor vs. trader.

Personal Investor

Personal investors are cryptocurrency enthusiasts who are passively involved in investing in cryptocurrency to make profits. Their main source of income is not the profits made from cryptocurrency.

If you are a personal investor and receive an airdrop for doing nothing, you will not be subject to Income Tax. Capital gains tax treatment may still apply when you later sell these coins which have zero cost basis.

If you receive an airdrop in return for performing a service or satisfying some other condition, it will be subject to Income taxes and reported as miscellaneous income.

By default, CoinTracker picks up airdrops to a tracked wallet as capital gains assets, but with the basis set to the fair market value at the time received. You can either mark the airdropped coin as an “Airdrop” using the dropdown next to the receive transaction on the Transactions page which will switch it to Income tax treatment, or you can edit the transaction and set a custom basis for to GBP 0.

Trader

If you run a cryptocurrency trading or a mining business and receive an airdrop, that will be subject to Income Tax at the time of the receipt regardless of you did something to get it or not.

In the CoinTracker Tax Center, your annual airdropped income will be shown on the Taxable Income card.

Crypto donations

Donating cryptocurrency to charitable organizations is not subject to capital gains taxes unless the donation is tainted (i.e individual is getting a kickback from the charity for donating assets) or if it the crypto is sold to the charity at a price greater than the acquisition cost.

Cryptocurrency received as earnings or wages

Cryptoassets received as employment income count as ‘money’s worth’ and are subject to Income Tax and National Insurance contributions on the value of the asset.

In the CoinTracker Tax Center, your annual income received through payments will be shown on the Taxable Income card.

Worthless cryptoassets

You can claim a loss on taxes as a negligible value claim if cryptocurrency you hold becomes worthless.

Your claim will need to state the:

- asset which is the subject of the claim

- amount the asset should be treated as disposed of (which may be £0)

- date that the asset should be treated as disposed of

Losing public and private keys

Generally, if you lose the private keys for your wallet, it does not count as a disposition event. However, if you can prove that there is no prospect of recovery whatsoever, a negligible value claim could be made with the HMRC. If the HMRC accepts this claim you will be able to claim a loss on your taxes.

Scams

If you become a victim of a crypto scam and losses your funds, HMRC, unfortunately, does not consider that to be a disposal event. This means victims of theft cannot claim a loss for Capital Gains Tax. Those who do not receive cryptoassets they pay for may not be able to claim a capital loss. Those who pay for and receive cryptoassets may be able to make a negligible value claim to HMRC if they turn out to be worthless.

Reporting requirements

You can report in ‘real-time’ using the Capital Gains Tax service or annually in a Self Assessment tax return. If you use the real-time service but need to send a tax return for another reason, you’ll have to report your gains again through Self Assessment. After you have reported your capital gains, HMRC will send you a letter/e-mail with a payment reference number and directions on how you can pay.

In addition to your completed Capital Gains Summary (instructions), the HMRC requires that you keep records of all your transactions for at least a year after the Self Assessment deadline (longer in some cases). Make sure to keep detailed records yourself, or you can use CoinTracker’s tax product and we’ll create a capital gains report with all of this information for you.

You can also get help with your tax return from an accountant or tax adviser.

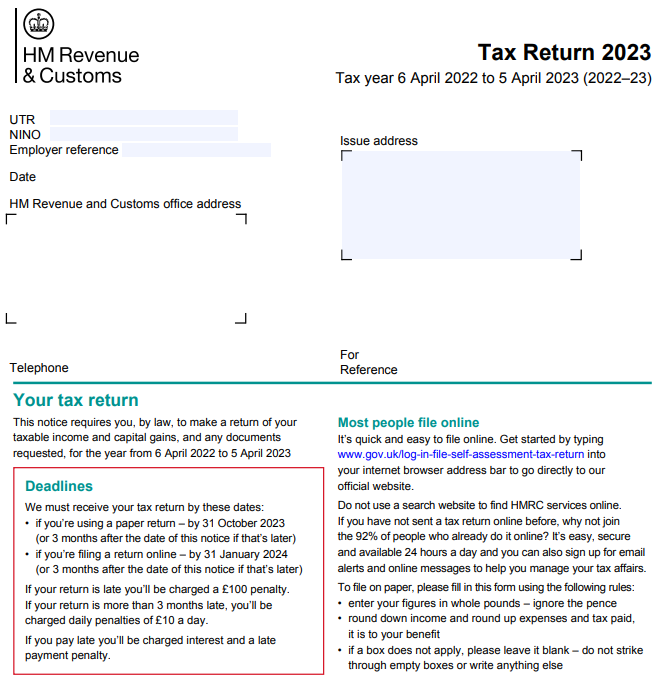

When To Report

The UK tax year is from April 6 — April 5 the following year. Paper returns are due by midnight on October 31 and electronic returns are due by midnight on January 31 the following year. Taxes are also due by midnight on January 31 the following year (more details on UK tax deadlines).

How To Report

You can file your taxes online if you have received your Unique Taxpayer Reference (UTR). If you can’t file online you can use commercial tax software or download the forms and paper file.

Instructions on how to fill out SA100 (2023)

If you don't want to do your Self Assessment yourself, you can hire a certified accountant or a similar service provider to do it for you. We have partnered with TaxScouts, who will connect you to a certified UK accountant to file your tax return for you and answer any tax questions you may have.

How to Pay

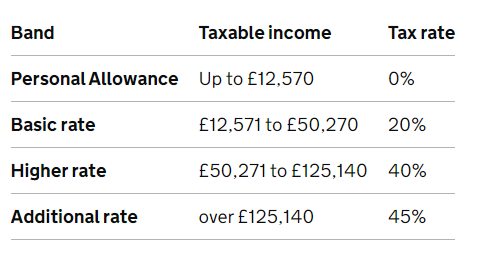

HMRC will tell you how much you owe. The tax you pay depends on your income tax rate.

You’ll have to pay a penalty if you send your tax return late, miss the payment deadline or send an inaccurate return.

CoinTracker helps you calculate your crypto taxes by seamlessly connecting to your exchanges and wallets. Questions or comments? Reach out to us @CoinTracker.

Disclaimer: This post is informational only and is not intended as tax advice. For tax advice, please consult a tax professional.