Are you confident in accurately reporting cryptocurrency earnings on your tax returns?

How Crypto Gifts and Donations are Taxed

Crypto gifts are tax free for the recipient. Crypto donations can be used to bypass capital gains taxes. Learn more here.

October 10, 2019 · 4 min read

In the US, the IRS originally released cryptocurrency guidance in 2014 and followed it up on October 2019 with additional cryptocurrency tax guidance.

What are Cryptocurrency Gifts?

According to the IRS, “a taxable gift is any property transferred for less than adequate and full consideration.” In simple terms, this means a gift is when you give someone something and didn't receive anything in return and/or you received something in return which is less valuable than the property you gifted.

In the US, generally, receiving cryptocurrency as a gift is a non-taxable event to the recipient (donee). The recipient doesn't have to report this in any tax form. The recipient will have to pay capital gains taxes only if he/she sells the gift in the future.

The gift sender (donor) have no tax obligation if the value of the cryptocurrency gift is less than $15,000 at the time of the gift. If the value of the crypto gift is more than $15,000, the donor will have to file a gift tax return (IRS Form 709)

When you gift crypto, the gift recipient can come across two situations:

Fair market value more than or equal to the donor's adjusted basis at the time of gifting crypto

This is an easy situation to grasp. In this case, the recipient simply takes on donor’s adjusted basis (carryover basis) and holding period of the crypto asset being gifted.

Fair market value of donation is less than donor's adjusted basis at the time of gifting crypto

If the fair market value of the cryptocurrency at the time of the gift is less than the donor's adjusted basis, the recipient's cost basis depends on whether s/he has a gain or a loss when the recipient disposes of that property.

Your basis for figuring gain is the same as the donor's adjusted basis plus or minus any required adjustment to basis while you held the property. Your basis for figuring loss is its fair market value when you received the gift plus or minus any required adjustment to basis while you held the property.

This is very confusing, so here's an example to demonstrate. Let's say that Rashmi buys one bitcoin for $1,000. Two years later she gives it to Jon when the price of bitcoin is $500. Ten days later Jon sells the bitcoin at the following price points:

- $1,100. He takes on Rashmi's original basis of $1,000, and has a long-term capital gain of $100

- $400. Since there is a capital loss using Rashmi's basis, he can't use donor’s original cost basis of $1,000. Instead, he takes on the fair market value at the time of transfer as basis ($500), leaving a long-term capital loss of $100

- $900 (selling price between donor’s cost basis and the fair market value at the time of the gift). Jon will not recognize any capital gains or losses.

This is a counter-intuitive tax scenario, so it may help to think of this treatment as a way to prevent folks from sharing their capital losses with friends. Make sure to keep detailed records any time you send/receive a crypto gift, the donor's original basis, acquisition date (which you always inherit), as well as the fair market value of the coin on the date of the gift

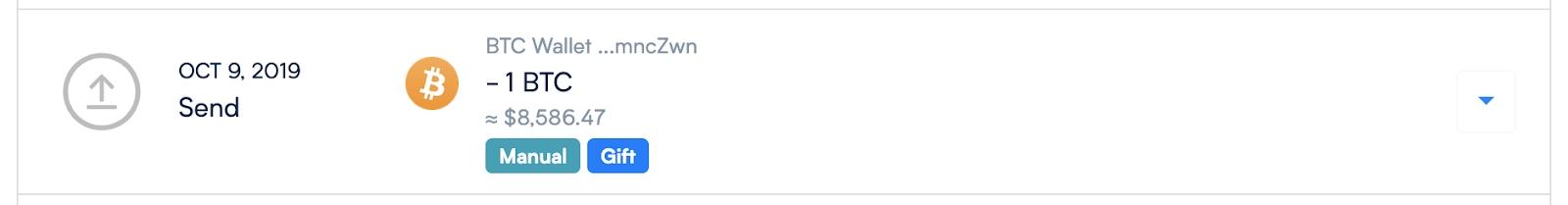

CoinTracker allows you to mark a sent gift transaction (from the Transactions page) as a "Gift" so you can accurately account for those transfers without triggering taxable events.

Note: gift and tipping rules vary from country-to-country. If required to report as taxable income, you would simply convert the cryptocurrency to their fair market value at the time they are received.

Cryptocurrency Donations

Per the updated IRS guidance on cryptocurrency taxation, donating cryptocurrency to a charity will not trigger a capital gain or loss.

If you are donating a crypto asset that you have held for more than one year, you are eligible for a deduction equal to the fair market value of the asset at the date of the donation. If you have held the asset for one year or less, you are still eligible for a deduction. However, it will be the lesser of the fair market value of the asset at the time of the donation and the cost basis of the asset.

Appreciated cryptocurrency can be donated via a platform like Endaoment, which takes in crypto, converts to fiat, and delivers it to any 501(c)(3) nonprofit in good standing. Endaoment accepts over 1,000 tokens and issues a donation receipt upon receiving the asset. They offer direct donations or donor-advised funds (individual charitable checking accounts) for donors looking to streamline their giving.

In essence, this means that you may donate appreciated cryptocurrency assets to charities and bypass capital gains taxes. Crypto donations should be reported on line 12, of Schedule A.

IRS Form 8283

If you’ve donated more than $500 of cryptocurrency to a charity during the tax year, this section is for you! You’ll be required to complete Form 8283 and include it with your tax return. If you’ve donated more than $5,000 of cryptocurrency and would like to claim a deduction, you’ll need an appraisal by a qualified appraiser. The IRS confirmed this requirement on January 13, 2023, with CCA 202302012. This CCA also states that the reasonable cause exception does not apply to cryptocurrencies. That means the deduction will be disallowed if you did not obtain a qualified appraisal and claimed a donation over $5,000 on a previously filed tax return.

Get Started With CoinTracker Today

CoinTracker integrates with 300+ cryptocurrency exchanges, 3,000+ blockchains, and makes crypto tax calculations and portfolio tracking simple.

If you have any questions or comments about crypto taxes let us know on Twitter @CoinTracker.

Disclaimer: This post is informational only and is not intended as tax advice. For tax advice, please consult a tax professional.