How Does the IRS Know If You Owe Bitcoin and Cryptocurrency Taxes?

Feb 10, 2020・4 min read

Form 1099-Ks, subpoenas issued to crypto exchanges and your answer to crypto tax question on tax forms are the three major ways the IRS knows you could potentially owe crypto taxes.

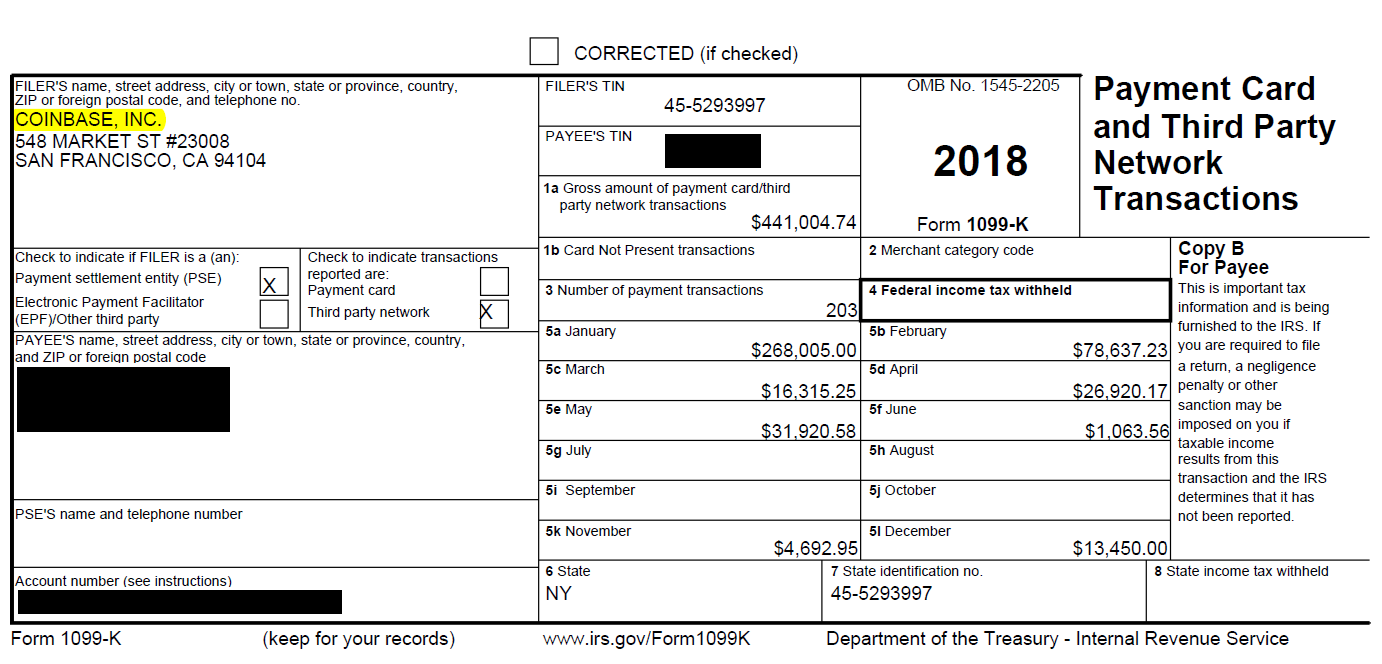

1099-Ks & 1099-Bs Report Crypto Transactions

If you receive a Form 1099-K or Form 1099-B from a crypto exchange, without any doubt, the IRS knows that you have reportable cryptocurrency transactions. This is thanks to the “matching” mechanism embedded in the IRS Information Reporting Program (IRP). Here is how it works. During any tax year, if you have more than $20,000 proceeds and 200 transactions in a crypto exchange, you will get a Form 1099-K indicating proceeds for each month.

The exchanges are required to create these forms for the users who meet the criteria. A copy of this form is provided to the account holder, and another copy goes to the IRS. If you file a tax return and do not include these amounts, the IRS computer system (Automated Underreporter (AUR)) automatically flags those tax returns for under reporting taxes. This is how you get crypto tax notices like CP2000. If you receive a Form 1099-B and do not report it, the same principles apply.

Likewise, Coinbase, Kraken, Binance.us, Gemini, Uphold and other US exchanges do report to the IRS. Therefore, if you receive any tax form from an exchange, the IRS already has a copy of it and you should definitely report it to avoid tax notices and penalties.

Subpoenas Issued to Exchanges

Over the past few years, the IRS has issued subpoenas to several crypto exchanges ordering them to disclose some user accounts. For example, in 2018, Coinbase had to disclose approximately 13,000 user accounts including taxpayer identification number, name, birth date, address, records of account activity, transaction logs and all periodic statements of account or invoices (or the equivalent) pursuant to John Doe summons. On another occasion, the IRS subpoenaed Bitstamp to release more information about a taxpayer who filed an amended return and requested a $15,475 refund.

2025

Crypto Tax

Guide is here

CoinTracker's definitive guide to Bitcoin & crypto taxes provides everything you need to know to file your 2024 crypto taxes accurately.

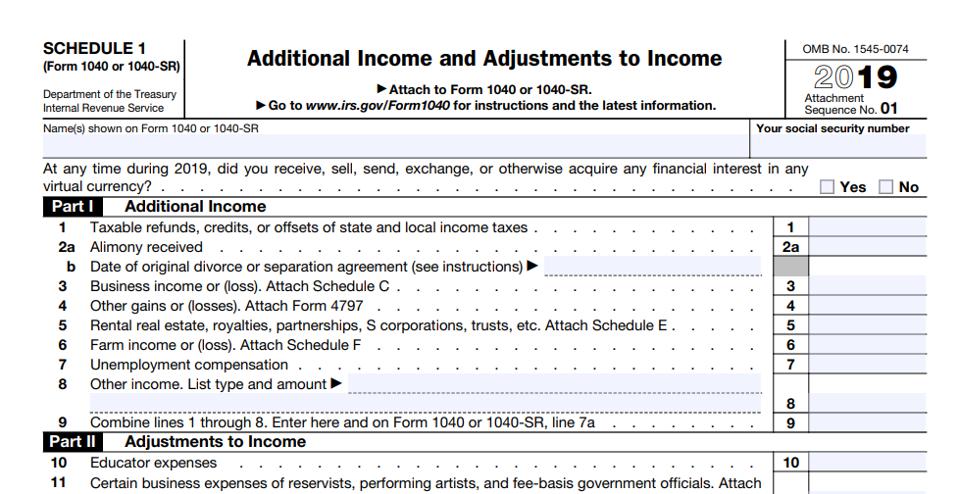

Crypto Tax Question on 2019 Schedule 1

During 2019 tax year, on Schedule 1 filers had to answer the question "at any time did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency?" (Background on crypto tax question).

When you mark “yes”, first & foremost, it would signal the IRS to check various forms & schedules of the return for cryptocurrency gains & losses.

However, everyone who marks “yes” may not have taxable income to report. For example, during 2019, if you just held bitcoin and did not sell, you would not have any taxable amount to report. In these cases, the IRS will use the cryptocurrency question as a way to gather data about US crypto & bitcoin holders and keep an eye on future years for taxable events.

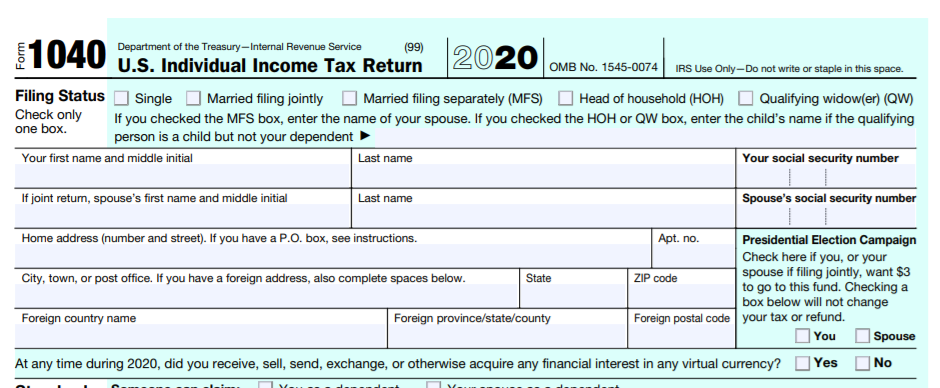

Crypto Tax Question on 2020 Form 1040

For 2020 tax year, the IRS has decided to move the infamous crypto tax question to the front and center of Form 1040. When this question was on Schedule 1 in 2019, you were supposed check "yes or "no" only if you were required to file a Schedule 1. For example, if you just had W-2 income, you wouldn't be required to file this Schedule or answer the question. However, when placed on the first page of the tax return, the crypto tax question becomes a mandatory question roughly 150M taxpayers will have to answer going forward.

Note that the US tax system relies on a voluntary compliance system. This means that the the IRS expects you to report all crypto transactions (whether the IRS knows about those transactions or not) in a given year because it is required by the internal revenue code. Failure to do so may carry hefty penalties.

If you have any questions or comments about how to calculate crypto taxes let us know on Twitter @CoinTracker.

CoinTracker integrates with 300+ cryptocurrency exchanges, 3,000+ blockchains, and makes bitcoin tax calculations and portfolio tracking simple.

Disclaimer: This post is informational only and is not intended as tax advice. For tax advice, please consult a tax professional.