How to Make Money When Your Crypto Portfolio is Losing Money

Sep 30, 2019・3 min read

The price of bitcoin (BTC) has been hovering around $10,000 since July. However, on September 24, 2019 the price dropped to $8,000.

Some pundits predict the price to go as low as $3,000. Declining prices are unfavorable from an investment perspective, however they provide another opportunity. This is a great chance to reduce your tax burden with few quick steps.

Let’s get to know some basic rules before diving into the actual strategy. Per the IRS notice 2014-21, cryptocurrencies are treated as “property.” Therefore, all general tax rules applicable to property are applicable to cryptocurrency related transactions. You should also understand “wash sales.” A wash sale occurs when an individual sells or trades a security at a loss and within 30 days before or after this sale, buys a “substantially identical” security (or acquires a contract or option to do so). The rule is in place to prevent investors from creating artificial losses for tax purposes. Notably, however, IRS §1091 dictates that the wash sale rules are applicable to “stocks and securities”. Since most cryptocurrencies are not treated as “stocks and securities” this rule is not applicable for crypto investors.

NOTE: certain cryptocurrencies may be deemed securities in which case wash sale rules would apply. The SEC has stated that bitcoin is not a security, and ether is also likely not a security.

How to Reduce your Taxes with Crypto Losses

Let’s say you purchased 1 BTC for $10,000 on September 1, 2019. $10,000 is your cost basis for the BTC. Then, on September 15, 2019, the price of 1 BTC drops to $4,000. On this day, you can sell your BTC and harvest a $6,000 capital loss.

Here’s the kicker: immediately after you sell your BTC at $4,000, you buy it back at the same price to hold your position. Let’s assume you re-purchased it at $4,000 (new cost basis). This strategy allows you to claim a $6,000 loss in the 2019 tax year while enabling you to maintain your exact same cryptocurrency portfolio, but with a lower tax bill. If you did not sell, you would have an unrealized loss “on paper” which will not give you any tax benefits in the current year. One note to keep in mind is that, at repurchase, the old holding period clock is reset; a new holding period begins from the date of the repurchase.

In a regular stocks or security transaction, the $6,000 loss would be disallowed as a wash sale.

Many taxpayers have been taking advantage of this loophole since the issuance of IRS notice 2014-21. We believe that the IRS is aware of this loophole and actively working on rectifying it (but hasn’t done so yet). Per AccountingToday, the IRS Small Business/Self-Employed division is currently working on training programs focussed on cryptocurrency examinations. As with any aggressive tax planning strategies, capitalizing on this specific loophole may be scrutinized by the IRS under substance vs. form doctrine.

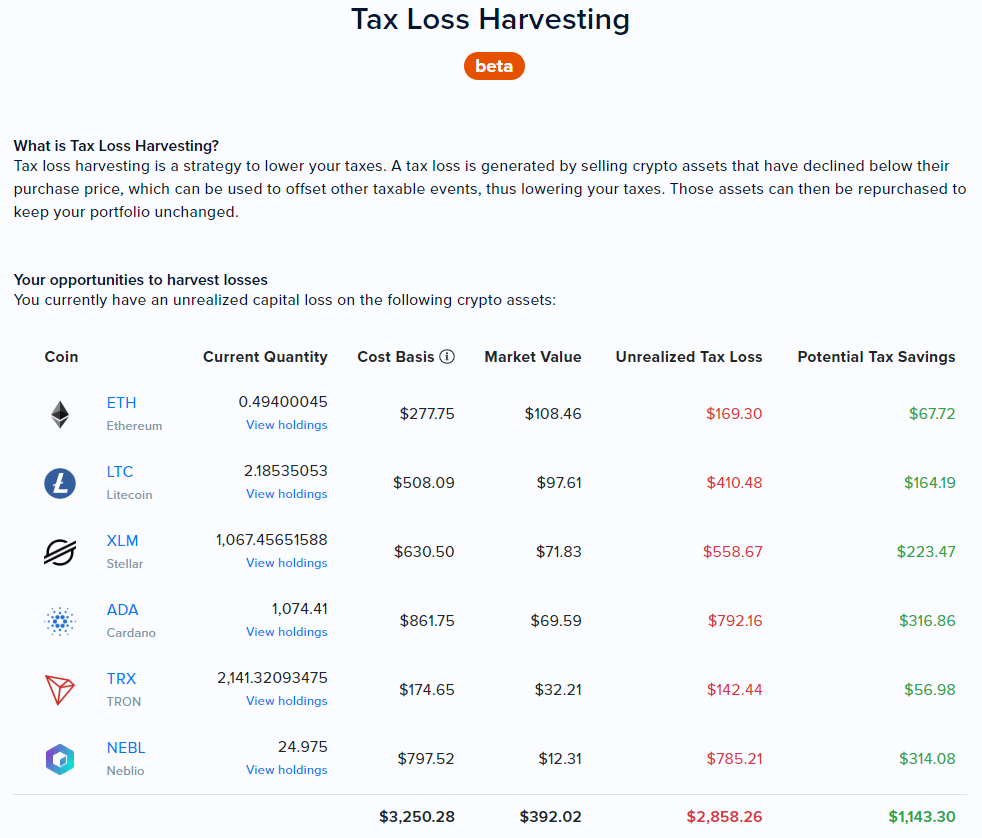

It can be tricky to figure out all the crypto transactions needed to maximize your tax loss harvesting opportunities, especially if you have multiple coins, wallets, or exchanges that you use. That’s where using CoinTracker’s tax loss harvesting dashboard can save you a lot of time and money.

CoinTracker helps you calculate your crypto taxes by seamlessly connecting to your exchanges and wallets. Questions or comments? Reach out to us @CoinTracker.

Disclaimer: this post is informational only and is not intended as tax advice. For tax advice, please consult a tax professional.