January 2024 Product Highlights

Feb 8, 2024・2 min read

Hope your 2024 is off to the races! We are excited to share our latest product updates with you:

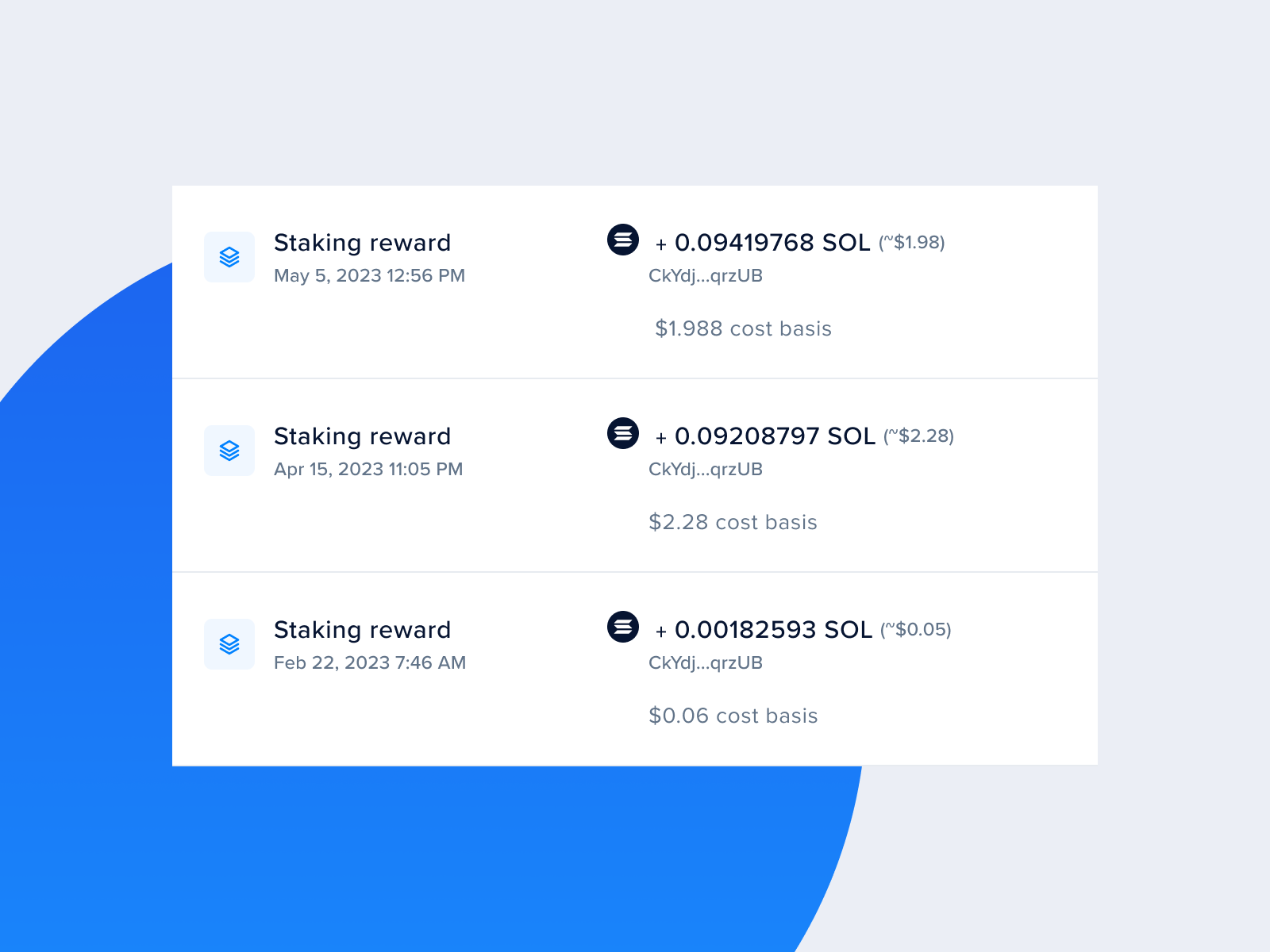

🔌 Native Solana staking support

Tracking staking rewards is easier with CoinTracker. Solana staking rewards received on withdrawing your stake are auto-tagged and included as taxable income in reports.

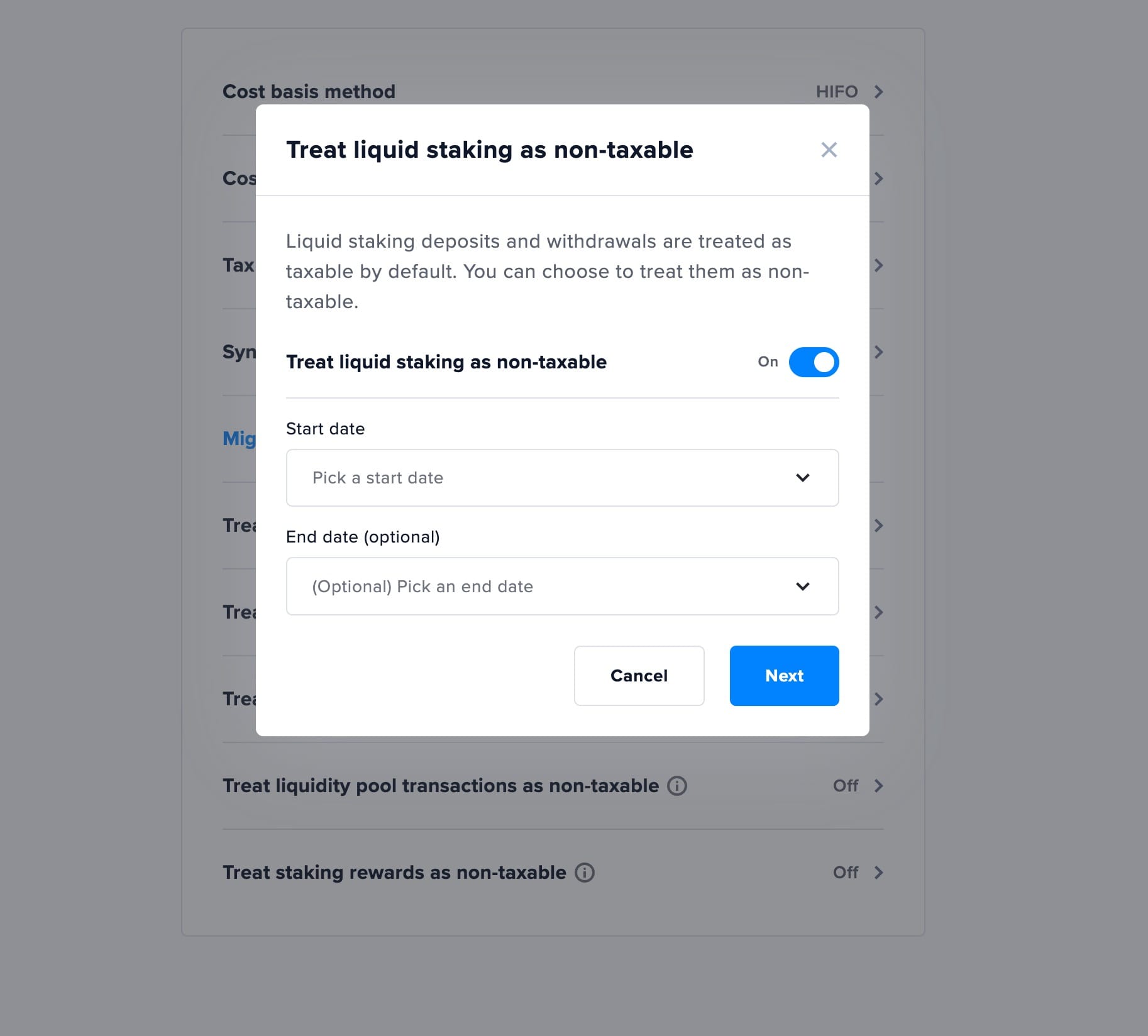

🏦 Set rules for taxability of DeFi transactions

You can set rules to treat wrapping, liquid staking, liquidity pool, and lending transactions as non-taxable (except if you’re in the UK). Regulations on how to tax them are ambiguous and vary by country, so consult your tax professional before changing default tax treatments.

🤯 Add all EVM wallets in one go

Add all EVM wallets associated with the same address in just one click. Wallets with zero transactions are automatically hidden, significantly de-cluttering the wallets page.

🐞 Latest bug fixes and small improvements

- Re-organized tax related settings to make it tidier and easier to find

- Provide more actionable and clearer errors when importing CSVs

- Added haptics in mobile apps for a better user experience

- Fixed bugs causing some Solana transactions to have incorrect amounts

- Fixed Gemini integration to correctly show instant buys

- Tidied up how things look in dark mode and made it more accessible

- Resolved a bug causing tax professionals to pay more for historical tax years

- Shipped an update fixing several small bugs causing NFTs to have incorrect cost basis

For more, follow us on Twitter. If you are enjoying CoinTracker, please leave us a review on Trustpilot, the App store, or the Play store.