Crypto Tax Guide To Uniswap Crypto Exchange

Mar 9, 2020・3 min read

Part 1 (How Uniswap Taxes Work) of this 2 part series, we discussed some of the core functionalities of Uniswap at a high level and how this crypto exchange is different from traditional exchanges. This understanding was essential before diving into the crypto tax implications of Uniswap. Note that there is no one set of tax law that directly governs Uniswap transactions. In the absence of more specific laws, we can infer applicable crypto tax laws based on the general guidance issued by the IRS.

Adding Liquidity & Receiving UNI-V1 Token on Uniswap

There could be two tax positions.

Position 1: Adding liquidity is a taxable event. It could be argued that you are selling your original deposit and receiving a new property, UNI-V1. Crypto to crypto trades are taxable (A15). This position does not make any sense in practical terms. However, since you are highly unlikely to get back the initial ratio deposited in its original form, one could argue that you disposed of it at the time you added liquidity.

Position 2 : Adding liquidity is not a taxable event. You are not disposing of your property; you are only depositing a pair of tokens. UNI-V1 you receive is a mere representation of your original deposit ratio; it is not a new property. This position is taxpayer friendly and makes the most sense in practical terms.

Earning Pool Fees on Uniswap

There is a 0.3% transfer fee that Uniswap charges to the swapper that is then split among all the liquidity providers in that specific pool based on their liquidity offering size. If we apply the staking rules, these fees earned can be either taxed as interest income or rental income as you earn them.

Crypto Trading (Or Swapping) On Uniswap

Without any ambiguity, crypto to crypto exchanges are taxable (A15). Your gain or loss is the difference between the fair market value (FMV) of the property received and the cost basis of the property exchanged.

Changes In Uniswap Liquidity Ratio

Every time your original deposit ratio changes, it means you either have gained access or lost access to one side of your pair. It could be argued that you are selling one side of the pair in exchange for the other side of the pair (a crypto to crypto exchange). Therefore, every time the ratio changes, a taxable event occurs. However, this will be virtually impossible to track because the ratio changes very frequently. One practical alternative is to tax when you remove your deposit.

Removing Liquidity from Uniswap

If changes in the original deposit ratio is not taxed real time as mentioned above, an alternative approach is to tax when you take out your position from the pool. For example, you can compare the cost basis of ETH at the time you entered them into the liquidity pool vs the market value when you retrieve them. The difference can be taxed as capital gains or losses.

2025

Crypto Tax

Guide is here

CoinTracker's definitive guide to Bitcoin & crypto taxes provides everything you need to know to file your 2024 crypto taxes accurately.

UNI Token Airdrop in 2020

On September 16t, 2020, Uniswap airdropped UNI tokens to early adopters of the platform. Nearly 150,000 addresses have claimed UNI tokens so far.

Airdrops are taxed as ordinary income on Schedule 1, line 8, according to the IRS rules.

Gas Fees Come With Tax Benefits

Gas fees can reduce your crypto taxes if tracked and reported correctly.

Gas fees paid on sales reduces your profits leading to lower capital gains taxes. For example, if you sell 1 ether (ETH) for $200 and spend $10 for gas, your total proceeds on the transaction would be $190 ($200 – $10)

Gas fees on transfers can be added back to the cost basis. Suppose you purchase 1 ETH at $10 on Uniswap. In order to transfer this token to Metamask, you incur a $2 gas fee. Once the transfer is complete, the cost basis of your 1 ETH on Metamask will be $12 ($10 + $2). When the cost basis increases, the eventual capital gains will decrease.

In summary, it is quite challenging to apply existing general crypto tax guidance into an innovative platform like Uniswap. Until further guidance is issued by regulators, all we can do is being reasonable and conservative when taking tax positions.

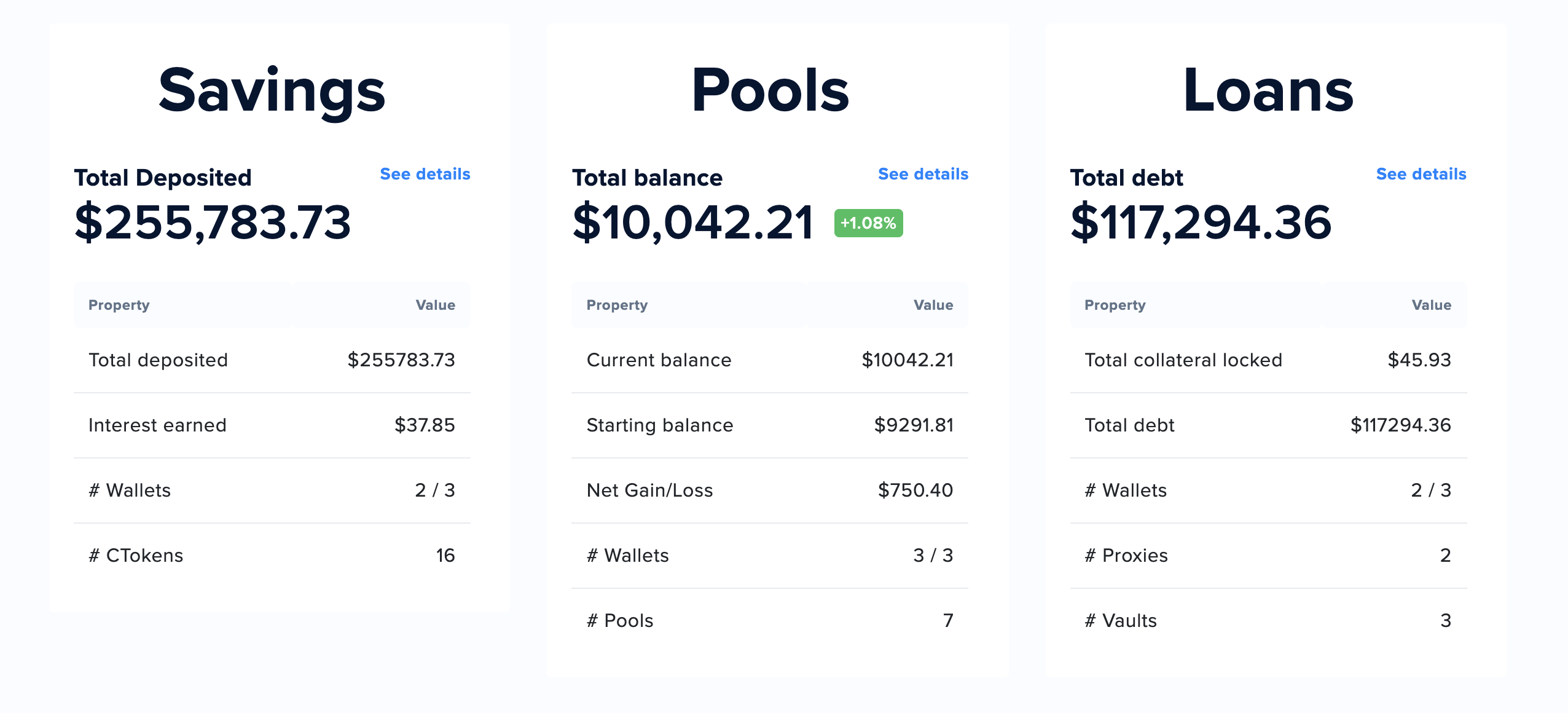

CoinTracker DeFi Center automatically tracks all your Uniswap related transactions and provide all the information you need to prepare your crypto taxes.

If you have any questions or comments about crypto taxes let us know on Twitter @CoinTracker.

CoinTracker integrates with 300+ cryptocurrency exchanges, 3,000+ blockchains, and makes bitcoin tax calculations and portfolio tracking simple.

Disclaimer: This post is informational only and is not intended as tax advice. For tax advice, please consult a tax professional.