Are you confident in accurately reporting cryptocurrency earnings on your tax returns?

A Three-Step Guide to Filing Your Crypto & NFT Taxes

With the US tax deadline quickly approaching, we have prepared a simple three-step guide to filing your crypto & NFT taxes.

March 22, 2022 · 2 min read

With the US tax deadline quickly approaching, we have prepared a simple three-step guide to filing your crypto & NFT taxes.

Step 1: Know the basic crypto tax rules

Cryptocurrencies are taxed as property according to the IRS Notice 2014-21. This tax classification results in taxable events each time you cash out, spend or exchange one cryptocurrency with another. Earning interest, staking rewards, mining income, and receiving airdrops are also taxable events.

(Note: If you only purchased coins & NFTs in USD and/or only hodled assets with no taxable events during 2021, you don’t have any crypto-specific tax filing obligation.)

Crypto investors must pay capital gains taxes based on the difference between the sale price of a coin (or NFT) and the cost basis (how much you paid for it). Interest, staking, mining, and airdrops are subject to ordinary income taxes based on your tax bracket.

Step 2: Connect wallets & exchanges to CoinTracker

Most cryptocurrency exchanges do not provide any tax forms showing your annual crypto capital gains and losses. Even if they do, they tend to be inaccurate and incomplete in most cases because they only have visibility into what you are doing inside that single exchange. Relying on this unreconciled information could result in you needlessly overpaying taxes.

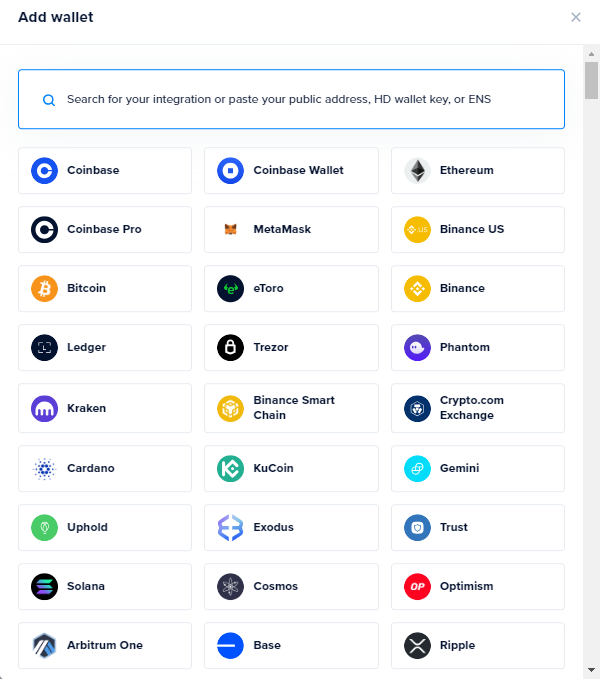

To reconcile your annual cryptocurrency gains and losses, CoinTracker allows you to connect all of your exchanges and wallets. CoinTracker automatically reconciles your activity across all your exchanges and wallets, applies the most up-to-date crypto tax rules, and generates tax forms such as Schedule D, Form 8949, and Schedule 1, which you can file with your individual tax return.

Step 3: File your taxes

Once you have CoinTracker-generated tax forms, you can use either an accountant or a DIY tax filing software like TurboTax or H&R Block to file your taxes and get a refund (if you are eligible).

If you have any questions or comments about crypto taxes let us know on Twitter @CoinTracker.

CoinTracker integrates with 300+ cryptocurrency exchanges, 8,000+ blockchains, and makes crypto tax calculations and portfolio tracking simple.

Disclaimer: This post is informational only and is not intended as tax advice. For tax advice, please consult a tax professional.