Are you confident in accurately reporting cryptocurrency earnings on your tax returns?

Why You Should File Your Crypto Taxes

Crypto tax experts explain why you should start filing your crypto taxes.

September 11, 2020 · 4 min read

Paying taxes (income taxes & capital gains tax) on your crypto gains is not an option: it is a requirement under the IRS tax code. Whether you like it or not, below are several reasons why you should start reporting cryptocurrency on your tax return.

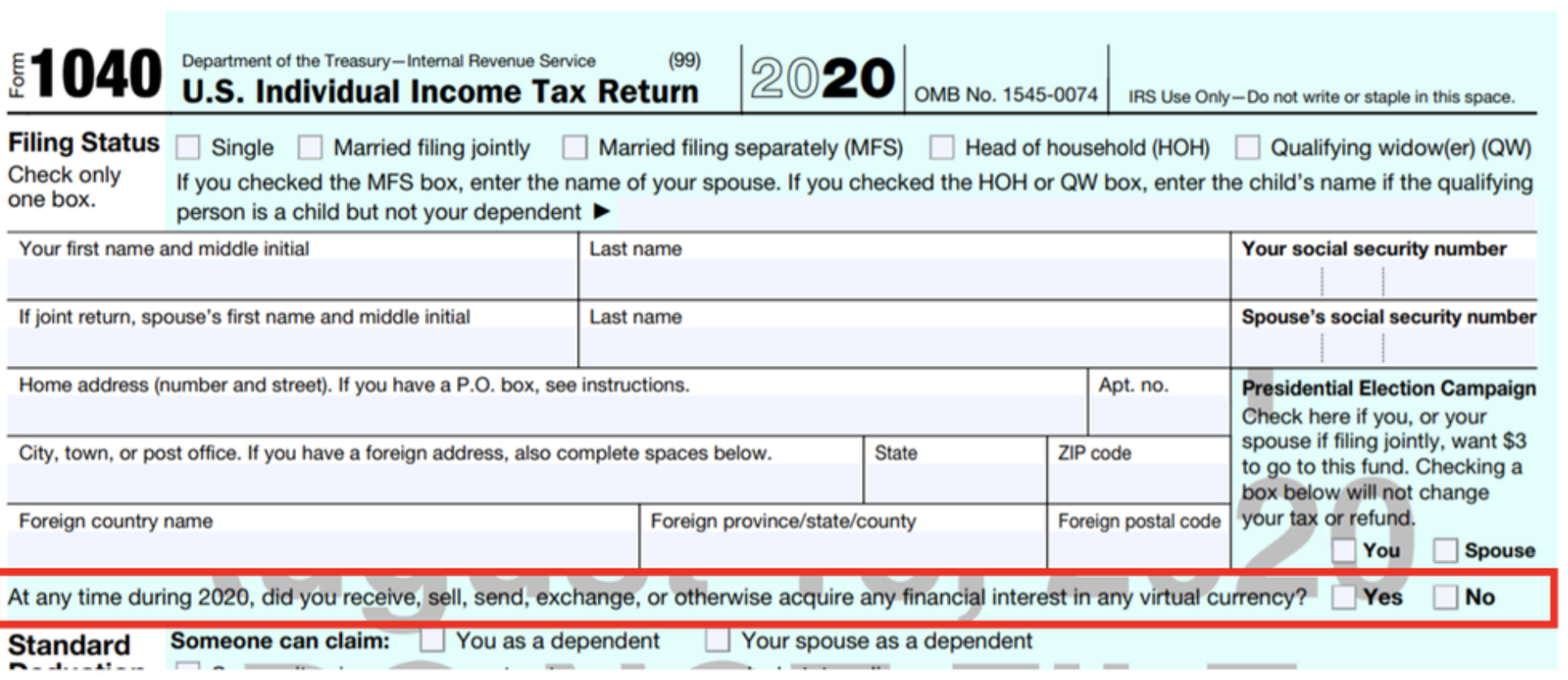

New Crypto Question on Form 1040

Starting this year, the IRS is asking every American taxpayer whether they received, sold, sent, exchanged, or otherwise acquired any financial interest in any virtual currency during 2020. This question was first introduced in the 2019 Schedule 1, and the move to front and center on Form 1040 indicates how serious the IRS is about cryptocurrency given that every single taxpayer is now required to answer this question, going forward, it will be extremely difficult to make an excuse for not knowing about your crypto tax reporting requirements.

Also keep in mind that you sign your return under penalty and perjury, and have an obligation to answer this question as accurately as possible. This also includes other applicable tax forms like Form 8949 and Schedule D as necessary. Luckily, CoinTracker can help you with these forms.

Crypto Tax Rules Have Been in Place Since 2014

Some crypto users believe that guidance on cryptocurrency taxation is unclear. They use this as an excuse for being non-compliant. Unfortunately this is not the case.

In the eyes of the IRS, cryptocurrencies like bitcoin are property (capital assets). Capital assets are subject to capital gains tax. Capital gains taxes have been in existence for decades, well before the invention of bitcoin. In addition, in 2014, the IRS clearly stated that all general tax rules applicable to property apply to crypto. Although there are a handful of unique situations where the legacy tax law and existing generic guidance don’t provide direct authority, there is more than enough tax guidance in place for the vast majority of cryptocurrency users to properly file their taxes.

Crypto Tax Warning Letters

The IRS has started becoming quite aggressive when it comes to sending tax notices to crypto holders who are not reporting crypto holdings. In 2019 alone, the IRS sent out tax notices to over 10,000 taxpayers. The IRS sent another round of these letters in August 2020. These letters came in four variations (Letter 6173, Letter 6174, Letter 6174-A).

It is likely that the crypto users will be getting these letters reminding about their crypto tax obligations every year. Dealing with these letters, especially the letter 6173, can be costly and time consuming. This headache can be entirely avoided by proactively filing your crypto taxes.

Rewards are in Place to Catch Crypto Tax Evaders

If warning letters weren’t enough, the IRS is offering rewards for companies that help them catch crypto tax evaders. For example, the IRS is offering a $625,000 bounty to anyone who can break Monero and Lightning networks. It also offered a $250,000 contract to a crypto tracing software company to help with ongoing crypto tax audits. Further, the IRS has a close ongoing relationship with crypto compliance focused companies like Chainalysis, Coinbase Analytics and Palantir.

Avoid Tax Audits

The statute of limitations legally limits the IRS��’s authority to audit your tax returns. Filing a tax return triggers a stopwatch for the amount of the time the IRS has to audit you. The general statute of limitations for auditing tax returns is three years. For example, this means if you file an accurate tax return for the 2019 tax year on April 15th, 2020, the IRS only has time until April 15, 2023 (three years from the date of filing) to come and audit you, if your return gets picked. After this date, the IRS does not have the authority to audit your 2019 tax return.

With that being said, there are two exceptions to the three year rule. First, if you were to understate your gross income by more than 25%, the statute of limitations is extended to six years. Second, if you don’t file a tax return, the statute of limitations never starts so the IRS can come after you indefinitely.

This is why it is so important to file an accurate tax return — you are starting the three year stopwatch and protecting yourself from an audit. Filing something is always better than filing nothing.Do not skip filing and give the IRS unlimited time to audit your taxes!

Write-off Tax Losses

The tax code allows you to deduct your crypto trading losses. If you are a hobbyist investor, you can deduct up to $3,000 of income using net capital losses every year (unlimited capital gains can be offset by crypto losses in a given year first). If you have net capital losses in excess of this amount, the remainder can be carried forward to future tax years, indefinitely. When you have capital gains in future years, you can use these carried forward losses to offset those gains.

If you are considered a trader for tax purposes, there is no cap on deducting capital losses in any given year. You could even deduct your unrealized losses from cryptocurrency gains if you properly make the §475(f) tax election.

If you have any questions or comments about crypto taxes let us know on Twitter @CoinTracker.

CoinTracker integrates with 300+ cryptocurrency exchanges, 3,000+ blockchains, and makes bitcoin tax calculations and portfolio tracking simple.

Disclaimer: This post is informational only and is not intended as tax advice. For tax advice, please consult a tax professional.